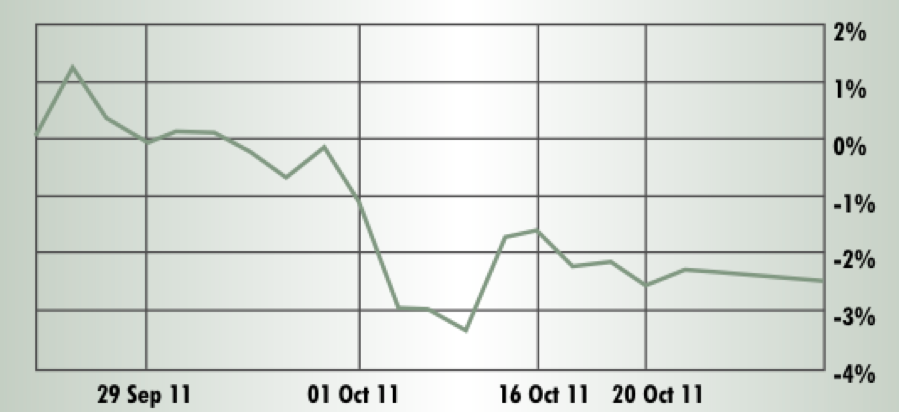

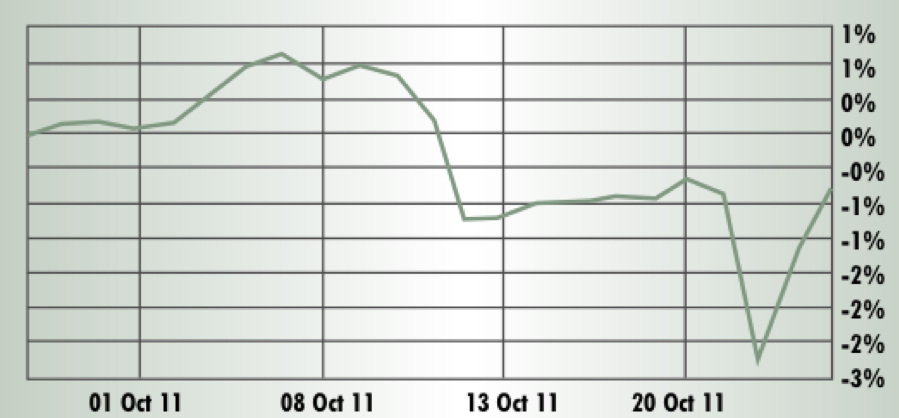

Beirut SE

> Review period: Closed October 24 at 1,212.74 points Period Change: -1.69%

The Beirut Stock Exchange was a ghost town in October as investors hid from uncertainty in Syria and worrying indicators for the outlook of the Lebanese government, economy and banking sector. In the meantime, a raise in the minimum wage united business owners and employee syndicates against the government but did little to attract investors desperate for stability. Class A shares of Solidere, the developer of Downtown Beirut, fell 2.05 percent during the period while Bank Audi, which reported its slowest growth in net profit since 2007, held its ground.

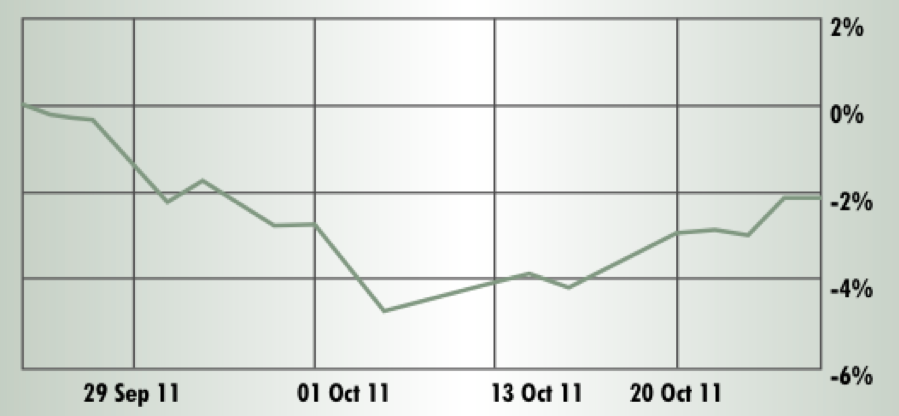

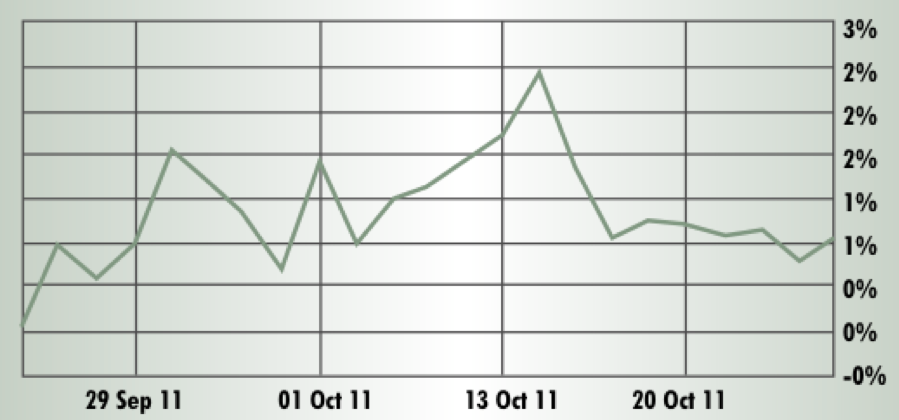

Amman SE

> Review period: Closed October 24 at 1,955.62 points Period Change: -1.81%

A positive mood reigned over Amman stocks in October with a new political leader promising reforms even more feverishly than his predecessor. To investors, however, the ride back looks bumpy at best, but the 1.8 percent rise from the low point on October 10 is a good start. Regional instability is making it tough for the market, given the economy’s dependence on declining tourism. Royal Jordanian shares plummeted 7.8 percent on large full-year loss estimates but management and trading in banks was light, with Arab Bank falling 2.3 percent during the period.

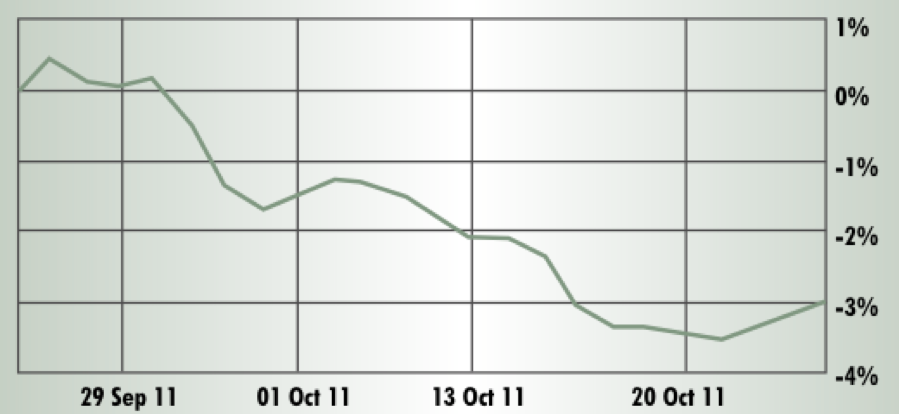

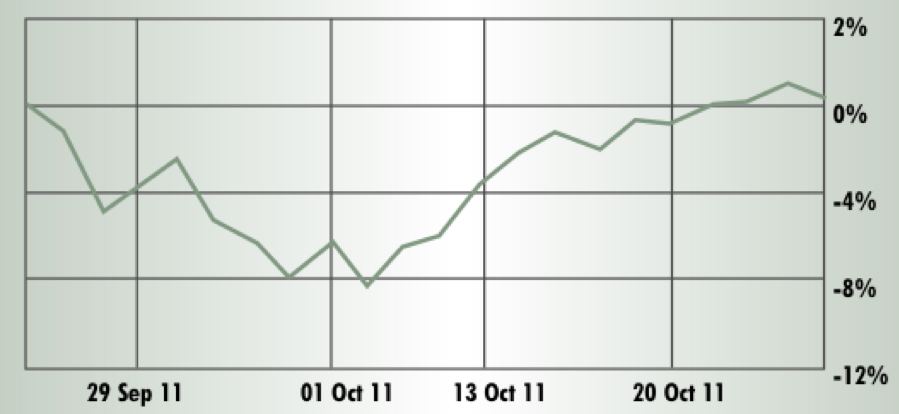

Abu Dhabi Exchange

> Review period: Closed October 24 at 2,446.71 points Period Change: -3.42%

The Abu Dhabi Exchange’s dismal performance in October proved that money can not always buy investor happiness. Abu Dhabi stocks, previously considered safe from the Dubai debt crisis, plummeted to a 30-month low as risk-aversion emanating from Europe left investors watching from the sidelines. Although the National Bank of Abu Dhabi reported strong third quarter earnings, the bank’s shares were met with little cheer at empty exchange hallways, leaving the stock to tumble to 5.2 percent, a minor loss relative to real estate developer Sorouh’s 15.7 percent plummet before reporting results.

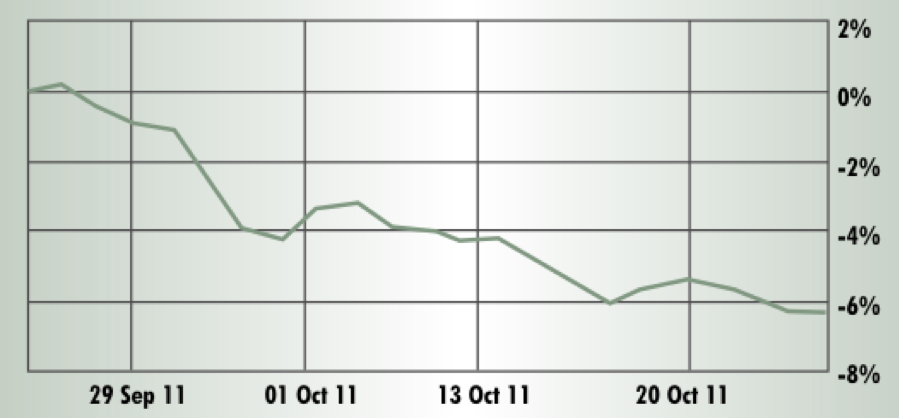

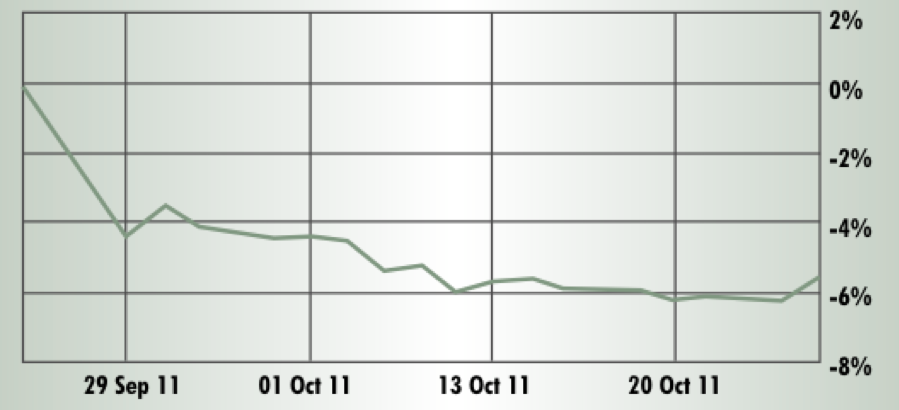

Dubai FM

> Review period: Closed October 24 at 1,359.77 points Period Change: -5%

Dubai may be safe from Arab uprisings but local woes proved enough to upset the markets. The Dubai FM index was the region’s worst performer during the period as rumors surfaced that the exchange would not be upgraded to MSCI Emerging Markets status in December 2011. If that were not enough, Emirates NBD, which was forced to take over fallen Dubai Bank, said profits fell more than half in the third quarter, sending its stock down 8.5 percent. Real estate developer Emaar fared even worse ahead of earnings, down 9.8 percent.

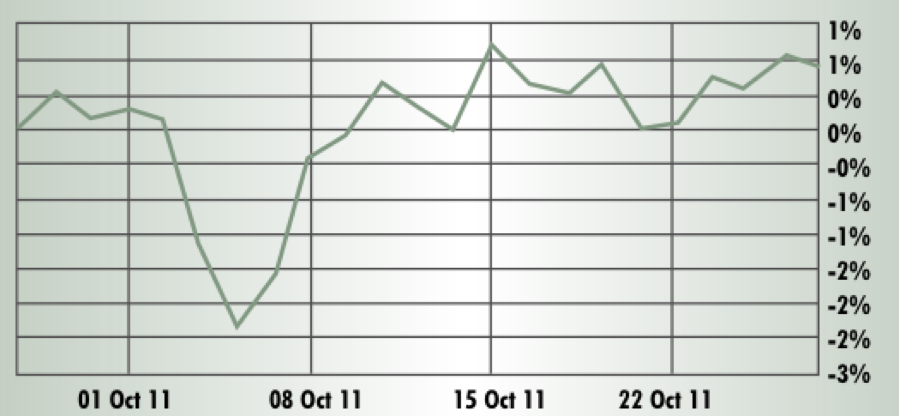

Kuwait SE

> Review period: Closed October 24 at 5,918.5 points Period Change: +1.46%

Kuwait’s market recorded another month of positive growth, as a new wave of optimism came from an increase in real estate transactions: National Real Estate witnessed an outburst of trading that drove the stock up 56.8 percent. Banks suffered the fate of their peers elsewhere in the region as National Bank of Kuwait reported dismally flat third quarter earnings and floated 3.78 percent upwards on low volumes. Ahli United Bank struck down investors with a 10.6 percent scorcher ahead of earnings.

Saudi Arabia SE

> Review period: Closed October 24 at 6,132.25 points Period Change: +0.33%

It appears nothing can shake the Saudi mammoth exchange, including the cancellation of the Zain Saudi Arabia takeover or the 53 percent drop in the company’s third quarter profit. Zain’s shares fell only 9.6 percent but the market remained buoyantly in positive territory. Banking stocks took the rudder, and with tailwinds of double digit growth in net profits in the third quarter, they brought in 2.3 percent from their bottom on October 4.

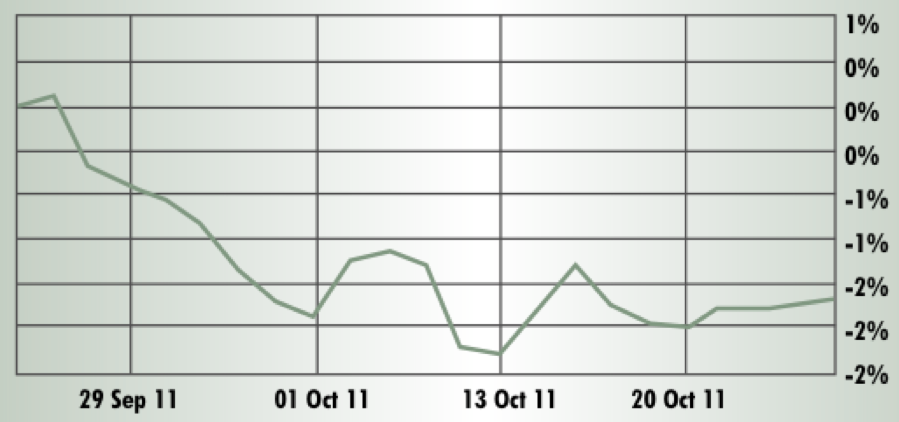

Muscat SM

> Review period: Closed October 24 at 5,538.75 points Period Change: -1.1%

The comeback from the end of September/early October slide was more difficult than expected for Muscat securities. Investors welcomed leaping profits at Bank Muscat, sending the stock up 3.4 percent, but kept National Bank of Oman flat despite increased third quarter earnings. The exchange’s newest comer, SMN Power, also received a warm welcome and a 3.6 percent rise over its subscription price. But the excitement remains limited by downbeat trading volumes, prompting brokerage firms to petition the Capital Markets Authority for more flexibility with margin trading rules.

Bahrain Bourse

> Review period: Closed October 24 at 1,144.4 points Period Change: -1.83%

Bahrain investors can take a breather from a marathon year of record losses. Mixed third quarter earnings kept some traders interested, but the cold pause in domestic politics and the rising tensions between Saudi Arabia and Iran do not bode well for the average capitalist. Arcapita’s rating was also downgraded and kept on negative watch by Moody’s as Gulf International Bank saw its profit dwindle 13 percent in the first nine months. Aluminum Bahrain fell 10 percent despite reporting growth in production, on fears of rising production costs and weaker global demand.

Qatar SE

> Review period: Closed October 24 at 8,457.95 points Period Change: +0.76%

It is not all good news for Qatari stock traders, but the worst is probably behind them. After an initial flop following rumors that the Qatar Exchange would not be upgraded to MSCI Emerging Market status in December 2011, stocks took comfort in strong profits at most companies and rallied 3.7 percent from their low point on October 5. Qatar National Bank, Qatar International Islamic Bank, Masraf Al Rayan and Commercial Bank of Qatar all bucked the MENA loss trend and reported healthy earnings, with the latter’s shares inching up 1.5 percent during the period.

Tunis SE

> Review period: Closed October 24 at 4,538.41 points Period Change: -2.74%

The victory of Islamic ‘renaissance’ party Ennahdha in Tunisia’s polls meant anything but a renaissance for Tunisian stocks. Although party leaders promised not to impose Sharia law or retract women’s rights, investors were cautious after several months of optimism. With lower tourist numbers, a crisis in nearby Europe and another round of elections in a year preceded by a re-drafting of the constitution, stocks fell. Tunis Air dropped 2.9 percent and Carthage Cement fell 3.8 percent during our review period through October 24.

Casablanca SE

> Review period: Closed October 24 at 11,333.9 points Period Change: -1.1%

Investors contemplated Moroccan stocks as they watched the forthcoming November 25 parliamentary elections on the horizon. A debate erupted over the construction of the country’s high speed train linking Tangiers to Casablanca. In choppy trading, Attijariwafa Bank, an exchange heavyweight, was off 3.42 percent during the period while Itissalat Al Maghreb held its ground. With the key tourism sector suffering, hopes are high for Gulf support after being promised full GCC membership.

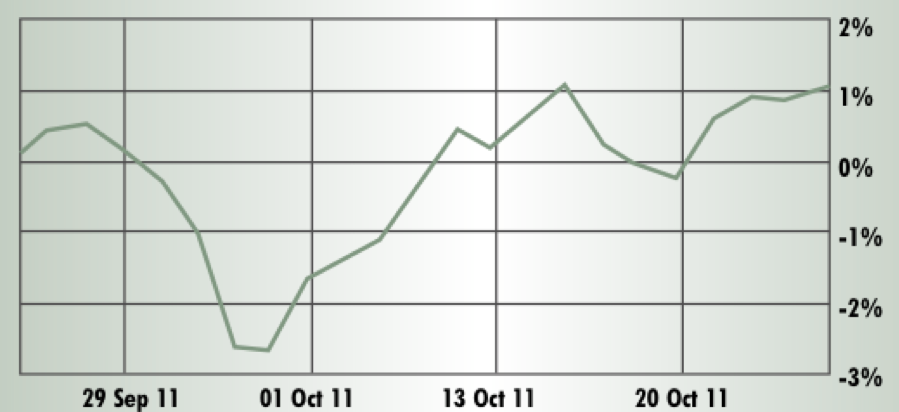

Egypt SE

> Review period: Closed October 24 at 4,311.88 points Period Change: +4.22%

Egyptian stocks are again fertile land for investment. The resumption of negotiations with the IMF and World Bank over a subsidized $3 billion loan and 10 times more in promised funds by the G8 sent Egyptian stocks soaring to the top of MENA exchanges during the review period. The prisoner swap between Egypt and Israel and the recommencement of gas flows at revised prices boded well, and drove Orascom Construction Industries up 5.9 percent and Commercial International Bank up 12 percent.