Al-Qusayr pays a heavy toll for a taste of freedom – photos by Sam Tarling for Executive

Al-Qusayr pays a heavy toll for a taste of freedom – photos by Sam Tarling for Executive

Imagine a world in which a movie search on your phone turns up only the kind of movies you like, and only those playing in your neighborhood; your behavior and interactions on social networks automatically produce lists of recommendations, potential friends, even job offers; searching and browsing the web becomes vastly more interesting and efficient, with results and link suggestions tailored specifically to your interests, and your “virtual representative,” a kind of online personal assistant, keeps working to find you the best information even when you are offline.

This is the world of web 3.0, or what we call the ‘transcendent web’, and it will bring profound changes to people and businesses alike. The benefits it will provide users include the creation of a much more personalized web experience and the automation of many of the services already in use. Businesses too, will benefit from vastly greater amounts of information about consumers and thus the opportunity to market and sell to them much more directly. They will also be able to take advantage of the greater operational efficiencies brought about by technologies that will keep people, processes and products much more tightly connected. The transcendent web will play a critical role in the digitization of industries as wide-ranging as telecommunications, financial services and healthcare.

The transcendent web is still on the horizon, but it is critical that companies understand what is coming, and how it will affect their businesses, if they hope to take full advantage of what it will offer.

Web 3.0 will build on the kinds of applications and services that have proved so popular in the past few years. Recommendation engines will produce much more complete and targeted information, based on a greater knowledge of the habits and preferences of users.

Search engines will become much more precise, taking context and wording into account in generating their results. And services will arise that enable users to create avatars to perform all these functions for them, automatically, depending on highly specific preferences.

These kinds of services will depend on new web technologies that are significantly more intelligent than current standards.

The Social Web: Social networking will continue to be a mainstay of the transcendent web. Indeed, much of the activity on web 3.0 will take place within the context of social media, as the connections among like-minded people become strengthened, reenforced and multiplied.

The Semantic Web: The semantic web will understand on a considerably deeper level the meaning of the search terms people use, and the context in which they are used. This in turn will enable far better results when searching and generating recommendations on the web.

The Internet of Things: More and more things are being made Internet-enabled — houses, cars, appliances, even clothing — allowing them not just to be located through technologies like radio frequency identification but to communicate richer amounts of information about themselves; all of this becomes not just possible but also visible to web users.

Artificial intelligence: Ultimately, the transcendent web will depend on a high level of artificial intelligence underlying many web processes. Using inputs from different sources, including browsing history, user-specified preferences and contextual information such as location, these systems will profile users to better understand both the content and the context of their requests.

The Impact of the Transcendent Web

As web 3.0 comes into being, its effect on both users and businesses will be profound. It will change how people work and play, and how companies use information to market and sell their products, and operate their businesses.

The huge increase in user data, behavior and preferences offers marketeers a great opportunity to attract more consumers to their websites, target their efforts to particular consumers, gather more information about those consumers and use that information more efficiently.

To do so, they must prepare to take advantage of the coming ‘semantic web’, optimizing their websites by embedding them with search engine–friendly, structured, semantic data to increase traffic. When Best Buy embedded semantics into the descriptions of its online products in 2009, describing not just the product, but also accessories, delivery and payment options, and warranty conditions, its site traffic increased by 30 percent.

Advertising too, will be transformed, as businesses come to understand and take advantage of behavioral advertising, in which the kinds of ads placed on websites will depend on highly specific information about who is visiting the site. The result will be a large boost in online sales, as companies learn how to target those consumers most likely to purchase their products.

The impact of the transcendent web will also allow companies to reexamine their entire organizational structures, business and governance processes, supply chains and product innovation efforts. What’s more, they will be able to further automate many processes, promote better communication among employees and enable far more efficient manufacturing, supply chain and inventory management practices, as parts, machines and finished products are linked together in the growing ‘internet of things’.

Enhanced customer feedback will allow companies to boost innovation and continuously improve product quality.

“The impact of the transcendent web will allow companies to reexamine their entire organizational structures, business and governance processes, supply chains and product innovation efforts”

Getting Ready for the Transcendent Web

Many critical elements of the transcendent web have yet to be put in place. We expect, however, that the effort to implement them will accelerate through the coming decade.

The evolution of the transcendent web will take time, but companies should not take that as an excuse to wait and see what it will look like once it is finished. Organizations need to begin now to build the capabilities that will be key to reaping those benefits.

Open up to the Internet world: Ensure that every critical business system is open and ready to interface in a secure way with external systems over Internet protocols.

Move to real time: Convert business systems from today’s often asynchronous data management operating models to real-time analytics and processing.

Structure your data: Move to structure all of your company’s data so that it can be used in different ways both internally and externally by your business partners. This will require the automation of tagging to provide for how data is managed and searched in context.

Develop your people: Create a plan to ensure that your company has the skills needed to take advantage of today’s needs and tomorrow’s opportunities. Keep in mind that the skills required will extend beyond the technology department to encompass the entire organization.

Involve your customers: If you have not done so already, start now to move your customers from a passive, “lean-back” approach to a more active, “lean-forward” attitude. Stimulate an active online dialogue about your products and services, then capture the information produced and use it to further refine your products and services, and to enhance your marketing activities.

Each stage of the journey will bring benefits, and the companies that begin planning now will reap those incremental benefits and be that much better prepared when all the pieces are in place.

KARIM SABBAGH is senior partner and the global leader for the Communications, Media and Technology Practice at Booz & Company; OLAF ACKER is a partner, DANNY KARAM a senior associate and JAD RAHBANI an associate with Booz & Company

In an effort to move from a pure traditional watch brand to a full-on lifestyle brand, the 151-year-old Swiss manufacturer, TAG Heuer, is taking some bold risks. As the world’s fourth largest luxury watch brand and number one worldwide in chronograph pieces, it is also launching its second generation of luxury phones, called “Link”, the first luxury smart phone developed on an android platform. Its expansion plan in the Middle East is no less ambitious. In July the firm opened its 10th boutique in the Middle East, in the Beirut Souks, with the Atamian family as their exclusive agent. Beirut will be one of the first markets in the region to be exposed to the new “1887”, which is an update of the iconic Carrera watch, with a twist. Though originally launched in 1964, the firm is now a chronograph manufacturer, so movements are made for the first time via the firm’s 100 percent in-house department, instead of sourcing from Swiss suppliers of chronograph movements like Zenith and ETA. Executive got in on the details during a cozy bar room chat with General Manager of LVMH Watch & Jewelry, Middle East, Eric Vergnes. [TAG Heuer is one of the 60 brands under LVMH]

It’s a huge investment… We are still at 25 percent of what we are aiming to produce in the future. But the difference in price would be only around 10 percent.

The Zenith is very limited in terms of supplies, quantities. We have a Zenith modified movement “Caliber 36”, it’s on the very high-end, around $12,000, compared to $4,000 for the other ones.

Our targeted customer is the feminine one; we have this very strong image of being a masculine brand, but today, in the region, more than 50 percent of our sales, in value, are done with ladies.

We don’t have diversification in the main families of the watches, which are the Carrera, Monaco 1969 and Grand Carrera. Seven years ago we launched the eyewear, and now, for every two watches we sell one pair of eyewear, and 100,000 units of eyewear are sold every year. We are one of the very few luxury brands making mobile phones. Of course we are very small compared to Vertu. For every 10 Vertu mobile phones sold, we sell one [Link].

There was a survey that [said] that the market of luxury phones will eventually be as big as the market of luxury watches. Nokia has had difficulties, but Vertu is extremely successful in China, the Middle East and Russia. Our main competitors are stuck with their in-house software, but Link has a late generation of androids and the catalog of android applications.

Approximately 5 percent, but we have huge potential for growth in the Middle East. We’re not very big in Saudi yet… Iran and the United Arab Emirates look very promising. We will not double the sales but we can certainly grow by 30, 40, 50 percent.

All partners in the region (in mid 2008) had all of a sudden nearly two years of stock. We didn’t push the selling, instead we did as much advertising as possible and by the end of 2009 they were back to one year of inventory. No partner has dumped product.

Paying more for the same

Prices of consumer goods in Lebanon continue to rise, with last month’s consumer price index, the major indicator of inflation, showing that the trend of increasing prices since 2000 continues unabated. Even though real estate and communication prices remained steady, the first half of this year witnessed a 6 percent increase in inflation compared to June 2010 levels, according to the Central Administration of Statistics, though many economists fear that actual inflation may be much higher. The rise in prices was mostly attributed to an increase in the price of clothing and footwear (+21.1 percent), electricity, water, gas and other fuels (+13.1 percent), as well as more moderate rises in the price of education, restaurants and hotels. According to the International Monetary Fund the index hit 127.62 in 2009 and is expected to exceed the 150 mark in 2015. Most analysts agree that Lebanon imports around 70 percent of its inflation.

Keeping the country watered

Minister of Energy and Water Gibran Bassil inaugurated last month the Lebanese Center for Water Conservation and Management and announced a strategy aimed at conserving water in the country. According to the minister, unless new measures are taken soon Lebanon will face a water deficit by the year 2020. The project was put together to “promote sustainable water management through both technical and policy-level support”, according to the United Nations Development Program (UNDP) website. It will be conducted with the support of Italy and Spain, through their embassies in Lebanon. According to the UNDP, the strategy has three components: technical capacity building on sustainable water management, the promotion of public awareness on the issue and an assessment and collection of data on groundwater.

Trade deficit hits five-year high

According to Ministry of Finance figures, the period from January to May 2011 registered the highest trade deficit in five years in terms of value. Lebanon’s trade deficit was about $5.95 billion, or 10 percent higher than the trade deficit recorded the same period last year ($5.4 billion). In fact, the economy witnessed a 7 percent increase in imports, which reached $7.66 billion, while exports decreased by 1 percent to $1.71 billion. The main reason was the rise in oil prices. However, an increase in prices of Lebanon’s most important imports was also a key reason (such as a 49 percent rise in the value of unwrought and semi-manufactured gold, precious stones and metals, and a 19 percent rise in pharmaceutical products). Imports from major trading partners Italy and France increased, according to a Byblos Bank report last month, while key export destinations like Switzerland, the United Arab Emirates and Syria fell 17 percent. Lebanon’s main exports include jewelry (33 percent of total exports), base metal (15 percent), machinery and mechanical appliances (13 percent), prepared foodstuff (9 percent) and chemical products (8 percent).

Debt roll over, and over, and…

The government’s strategy of rolling over short-term debt for longer maturity periods looks to continue as reports emerged in July that the finance ministry was seeking to issue Eurobonds this month. The issuance will be the first under the new government and is an indicator of the level of confidence in Lebanese paper. The ministry is looking to make a $950 million issuance that reportedly consists of a $750 million principal and $200 million in interest. According to various reports Citigroup and BLOM Bank will handle the book running for the issuance. The last issuance of Eurobonds occurred in May when $1 billion were issued in two tranches, the first at a rate of 6 percent with a maturity of eight years and a value of $650 million, and a second at a rate of 6.1 percent with an 11-year maturity and a value of $350 million. This month’s issuance will be part of the remaining $2.1 billion in Eurobonds that will mature this year. The public debt maintained its level of $52.7 billion at the end of May, unchanged since the beginning of the year.

Internet penetration on the rise in MENA

According to the International Telecommunications Union (ITU) the United Nations agency for information and communication technology, the rate of Internet penetration in Lebanon rose from 24.7 percent in 2009 to 31 percent in 2010. The figures ranked Lebanon 10th in the Middle East and North Africa in this category, and 100th among 233 countries worldwide — surpassing Egypt and Syria with 26.7 percent and 20.7 percent penetration, respectively. However, Lebanon still has a long way to go to catch up with the leaders in the region. The country is still far behind the United Arab Emirates and Qatar, with 78 percent and 69 percent penetration, respectively. As for fixed-line communications, Lebanon is ranked highest in the Middle East and North Africa region with a 21 percent rate of subscription for fixed lines, compared to a 9.19 percent average in the region; worldwide Lebanon ranks 97th.

Fewer tourists, spending more

An unstable political situation in Lebanon and the region has resulted in a 20 percent decline in tourist arrivals to the country during the first six months of the year, compared to the same period last year — from 964,067 down to 774,214. However, tourist spending grew by 6 percent in the first half of this year, according to duty free agency Global Blue. Arab tourists accounted for 31.9 percent of total arrivals and 54 percent of tourist spending in Lebanon. Among them, tourists from Saudi Arabia took the lead, at 20 percent, followed by the United Arab Emirates (11 percent), Kuwait (9 percent), Syria (8 percent) and Egypt (6 percent). Some analysts say the rise in tourist spending comes on the back of the financial crisis of recent years.

Another growth downgrade for Lebanon

The Institute of International Finance (IIF) has followed other institutional surveys and reduced Lebanon’s real gross domestic product (GDP) growth expectation for 2011 from 4 percent to a range of 1.1 to 3.0 percent. The global bank HSBC made a similar move a few weeks prior, cutting Lebanon’s growth forecast from 3.2 percent to 2.7 percent. Indeed, so far most economic proxy indicators have witnessed a decline, with observers saying that growth will depend on the development of the political situation in Lebanon and the region. In that vein, the IIF has predicted two separate scenarios. The first, with a 70 percent probability of occurrence, assumes that the situation in Lebanon and Syria will remain unchanged, in which case any recovery would be insignificant and GDP growth would not exceed 1.3 percent. With a stable political situation, in other words the return of political calm in Syria and a resolution to strife over the Special Tribunal for Lebanon, the organization would expect 5.1 percent growth in the second half of 2011.

Minimum wage still lagging

As prices rise, wages should follow suit. That was the sentiment last month of Lebanon’s largest labor union, the General Labor Confederation (GLC), when asking that the minimum wage be raised once again. The GLC demanded that the Lebanese government increase the minimum wage in the country by 150 percent, from $333 to $833. However, according to the Association of Lebanese Industrialists and the Federation of Chambers of Commerce, Industry and Agriculture, before being able to do so the government needs to create incentives for companies to increase their level of productivity. Otherwise such a move could lead to the bankruptcy and/or closure of many factories and private companies due to increased wage costs.

Lofty ambitions

New York’s loft-style housing has found a new home on the outskirts of Ashrafieh. Har Properties, headed by Philippe Tabet, launched on July 21 their new residential development U Park, which sits upon a 3,000 square meter (sqm) plot in the Jisr El Wati area, and will boast 63 apartments on nine levels. Tabet told Executive on the sidelines of the launching, “when we bought the plot, we bought it next to another project (Factory by Bear real estate) and their concept was New York style lofts of brick and metallic. We took the same architect of that project [Charles Hadife]… but we added high ceilings and lots of green space and open spaces.” Though Tabet believes Har is “one of the last developers to buy in this area because the price of land is too high,” the group has maximized utilization of the space by including private gardens of 2,500 sqm, encircled by the complex of apartments that range from 110 sqm to 226 sqm, (90 percent are small apartments) while penthouses range from 194 sqm to 350 sqm. In addition to heavy attention to security, with entrance control systems dictated through videophones in every unit, the firm is aiming for high environmental standards, namely a Leadership in Energy and Environmental Design (LEED) certification from the US Green Building Council. Prices start at $3,200 per square meter with construction costs over $1,000 per square meter. Total built-up area is 20,000 square meters, including three underground basements. This is the second residential project for Har, which is also erecting a 20-story building called Aya in Mar Mikhael. Fahd Hariri, son of Lebanon’s late Prime Minister Rafiq Hariri, is a partner in both projects.

Tasty hotel space

Beirut hotels Le Gray and Le Vendome will soon host two of the most savory names in Dubai’s restaurant business, both backed by the same Indian owner, Arjun Waney. La Petite Maison, first opened in Nice and later Dubai in August 2010, will open by the end of 2011 on the first floor of Beirut’s Le Vendome Hotel, as told to HotelierMiddleEast.com by the general manager of its Dubai branch, Cedric Toussaint. Though there have been several business advisors who pushed for a faster Middle East expansion, Toussaint told the website, “many restaurants are opening three in Dubai, three in Beirut, it’s too quick… every year we want to do another, but to do each one properly one after the other one.” Japanese restaurant Zuma, which already has a restaurant in London and has been open for three years in Dubai, will open its third installment in downtown’s Le Gray hotel by the beginning of 2012. In June, Director of Operations for Zuma Middle East, Ajaz Sheikh, said, “Beirut is a vibrant city with a unique energy and it seems fitting to open our second property in the heart of its downtown district.”

Cashing in on Iraq

International construction companies will be largely responsible for building nearly 11,000 homes in the Iraqi city of Karbala, for which the total cost is around $850 million. In the first week of July, Karbala’s Investment Commission (KIC) laid the first bricks for the four housing complexes, with construction contracts awarded to Turkish, Canadian and Chinese firms. KIC’s Media Director Raed al-Asali told independent news agency Aswat al-Iraq that infrastructure such as sewerage, water, communications, electricity, internal roads, hospitals, police stations, markets and malls would be built in parallel with the timeline of the four projects.

Land fracas in Lasa

Members of the Maronite church’s land survey team and an MTV news crew were involved in altercations with the mostly Shia residents of the town of Lasa in Jbeil on July 14 and July 19, reported MTV. In the earlier incident, town residents demanded that the land survey team withdraw, as the Maronite church believes many homes in the area are built on land the church owns, an allegation apparently stemming from 1937. On July 15, Father Chamoun Aoun publically stated that 50 homes are built on church-owned land in the town. The residents later told Now Lebanon in a July 22 article that their issue with the Maronite church officials is that they did not ask for permission from the town’s mukhtar (mayor) before arriving. Following the July 19 incident where an MTV crew says they were attacked and had equipment stolen while filming in the town, a meeting took place on July 20 in Bkirki, where Hezbollah officials represented town residents, and met with members of the Maronite church to create a follow-up committee. Minister of Interior Marwan Charbel told Now Lebanon on July 21 that he did not want the simple real estate dispute to turn into sectarian strife, while Al Jamhouriya, in a July 20 article, quoted “informed sources” who said many Jbeil residents consider Lasa to be a convert military base for Hezbollah and accuse the group of setting up a network of shelters and video cameras to record activities and identities of people in the area.

OCI awarded $450 million infrastructure project in KSA

The largest publically traded firm in Egypt, Orascom Construction Industries (OCI) announced on July 7 that its Saudi Arabian subsidiary, Orascom Saudi Limited Company (OSL), would take on infrastructure work in the kingdom for a contract price of $450 million. The subsidiary would undertake civil, mechanical and electrical works that entail 1.4 million cubic meters of excavation and 2.1 million square meters of roads and walkways. The contract also entails the installation of 146 kilometers of pipes for storm water, waste and potable water systems. Within the two-year construction period OSL will also be responsible for installing electrical substations, which require 238 kilometers of copper cables and trays. OCI Chief Operating Officer Osama Bishai commented, “this contract marks a major step forward in establishing OCI in Saudi Arabia and positions us for further opportunities in the future. We are confident that 2011 will see significant growth in our Saudi Arabian business.” The firm had a 77 percent increase in first quarter profits this year. In July, OCI said the International Finance Corporation (IFC), part of the World Bank Group, is considering to provide $300m in loans to OCI companies and invest $50m directly.

Emaar woes

Emaar Properties, the largest developer in Dubai announced on July 26 a 69 percent drop in profits in the second quarter despite diversifying their development business towards hospitality and retail, and expanding regionally to Syria, Egypt and Morocco. The $68 million profit for the quarter was accompanied by a 23 percent drop in total revenue, as sales in their landmark project, Burj Khalifa, slowed to only 244 units, as opposed to sales of 612 units in the second quarter of 2010. The buffer in terms of sales was in the rental and hospitality sector, which includes Dubai Mall, as the company reported a 24 percent rise in revenue from this part of its business.

Beirut SE

Current year high: 1,039.30 Current year low: 842.04

> Review period: Closed July 24 at 886.92 points Period Change: +0.27%

The traditional post-government formation rally failed to materialise. Instead, markets toiled under the weight of local and regional worries as Moody’s changed its outlook on four of the largest Lebanese banks to negative and domestic economic indicators weakened. Indictments issued by the Special Tribunal on Lebanon plus ongoing turbulence in neighboring Syria and in Egypt made the BSE performance look almost Phoenix-like, with Solidere rebounding to neutral territory and Bank Audi reporting a 9.3% increase in second quarter profits.

Amman SE

Current year high: 2,477.99 Current year low: 2,083.56

> Review period: Closed July 25 at 2,090.18 points Period Change: -0.16%

Amman’s financial markets welcomed long-awaited stability following months of losses. The country’s focus shifted to securing energy supplies after the Arab Gas Pipeline bringing cheap Egyptian gas was sabotaged, costing the country millions of dinars in daily losses. While the gas is likely to flow again by early August, tourism revenues are not, as tourist numbers have already fallen 14% YoY in the first six months. Promise comes from ASX heavyweight Arab Bank with a 5.14% return during the review period, a possible sign of better times to come.

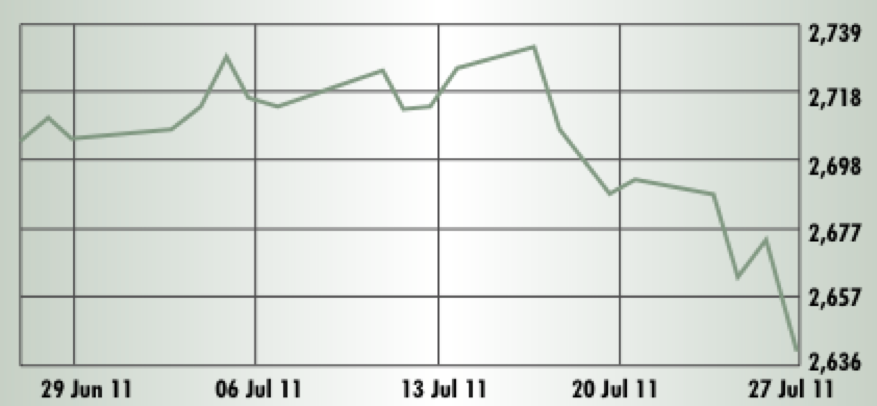

Abu Dhabi Exchange

Current year high: 2,833.09 Current year low: 2,471.70

> Review period: Closed July 25 at 2,663. 13 points Period Change: -1.5%

ADX stocks entered July with some gains but their rally of hope in June petered out. Market heavy Etisalat was resilient even when the company was accused of foreign direct investment violations in India. In banking, NBAD and First Gulf delivered strong 1H earnings growth. Construction and real estate stocks continued their 3-month trend south with little support in sight. Readying themselves for Ramadan, investors were in profit-taking mood and the ADX index weakened at the end of the review period.

Dubai FM

Current year high: 1,781.92 Current year low: 1,352.24

> Review period: Closed July 25 at 1,510.58 points Period Change: -0.42%

DFM investors were more active than their ADX peers in the pre-Ramadan lull, and attention focused on the Greek bailout and forthcoming quarterly earnings. Second quarter profits swelled 85% YoY at Emirates NBD, and investors are bracing for more positive banking results. Tipping the other side of the balance was Emaar Properties, whose Indian operations reported heavy losses, pushing its shares down 4.5% during our review period. Meanwhile, there’s the underlying positive sentiment about the potential MSCI upgrade even if the official decision spills over into 2012.

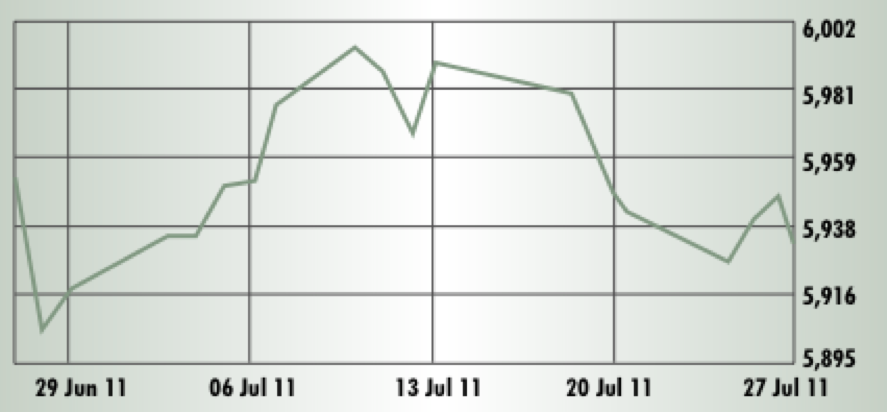

Kuwait SE

Current year high: 7,129.30 Current year low: 5,973.10

> Review period: Closed July 25 at 6,065.3 points Period Change: -2.36%

Solid second quarter results at National Bank of Kuwait (NBK), Boubyan Bank and Kuwait Finance House (KFH) were not enough to jump-start stock prices. Instead, profit takers ruled the charts and pushed the KSE index down to a seven-year low of 5,973.1 points on July 18, as market heavyweights NBK and KFH tumbled 6.9% and 10%, respectively. Kuwaiti investors await further positive earnings results, but the KSE benchmark ended the review period more than 12% down for the year to date.

Saudi Arabia SE

Current year high: 6,788.42 Current year low: 5,323.27

> Review period: Closed July 25 at 6,472.03 points Period Change: -1.58%

Dismal performance of Tadawul stocks in July in fact reflected profit-taking following dozens of strong earnings reports across various sectors. All banks except SABB and Samba posted second quarter profits and major companies such as Savola and Kingdom Holding posted double-digit growth in net income. Investors still snatched some returns from SABIC’s 2.9% gain through July 25, and are looking for more as Jadwa Investment expects global moves to outweigh the cyclical downward Ramadan pattern.

Muscat SM

Current year high: 7,027.32 Current year low: 5,904.68

> Review period: Closed July 25 at 5,939.45 points Period Change: +0.39%

Muscat securities appear to have touched bottom in July following the precipitous dips in February and April. Banking stocks were buoyed by rising profits at National Bank of Oman and Bank Sohar, although legal disputes drove down BankDhofar’s profits in the second quarter. The export-oriented economy was not insulated from the global slowdown, but the outlook remains positive, supported by expectations of a global recovery and increased government spending. Among the greener pastures was Omani Qatari Telecommunications Company which added 1.76% during our review period.

Bahrain Bourse

Current year high: 1,475.10 Current year low: 1,298.35

> Review period: Closed July 25 at 1,298.95 points Period Change: -1.57%

Rolling downwards has become the norm for Bahraini stocks. While the government was announcing plans to dig deeper for natural gas to meet the country’s rising demand, stocks were struggling to dig their way back up, instead giving away 12% from their 2011 peak. Rising profits at Ahli United Bank and National Bank of Bahrain did little to assuage fears of future unrest as the main Shiite opposition party pulled out of national dialogue. Ironically, S&P affirmed the country’s sovereign debt rating after relative stability had returned, but maintained a negative outlook.

Qatar SE

Current year high: 9,242.63 Current year low: 7,004.66

> Review period: Closed July 25 at 8,399.8 points Period Change: +0.46%

Although the Qatar Exchange is down 3.5% for the year to date, trading activity in July was only slightly diminished versus June and reflected the positive mood in the country due to rising oil prices and strong economic prospects, driving up heavyweight Qatar Telecom 1.9% through July 25. Banks and real estate stocks added to the cheer after Qatar National Bank reported strong gains in second quarter profits and a report by Barclays Wealth showed high net worth individuals expect real estate to be a safe short-term investment.

Tunis SE

Current year high: 5,681.39 Current year low: 4,058.53

> Review period: Closed July 22 at 4,399.01 points Period Change: +2.1%

Tunindex stocks aim for the stars and for the second consecutive month hit first place in the MENA region. Despite continued skirmishes between various groups ahead of October elections, the end of oppressive rule is breathing new life into tourism and trade, with the food sector especially benefiting from exports to neighboring war-torn Libya. Tunis Air reported strong increases in bookings and was swiftly rewarded with a 7.2% monthly return through July 22. Uncertainty about election results and post-election democratic processes remain a major source of investor unease.

Casablanca SE

Current year high: 13,397.47 Current year low: 11,213.55

> Review period: Closed July 25 at 11,341.1 points Period Change: -1.48%

The king won a unanimous, and by government accounts, democratic, 98% “yes” vote for a new constitution. Yet investors were not visibly emboldened by the king’s bids for change under his own leadership, which was deemed “inviolable” in the new constitution. The MASI kept sliding in July and slumped to a 17-month low at the end of the review period. Immediately following the constitutional vote, the Moroccan government announced plans to sell parts of its stakes in Maroc Telecom and Royal Air Maroc.

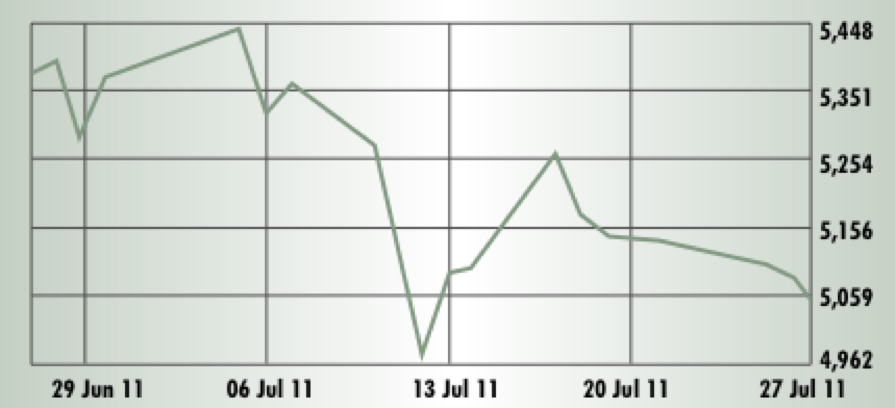

Egypt SE

Current year high: 7,210.00 Current year low: 4,878.00

> Review period: Closed July 25 at 5,104 points Period Change: -5.0%

Investors headed for the trenches as Egyptian protestors roared back into Tahrir Square. Already fragile stocks retreated back into the red in July as Commercial International Bank and Orascom Telecom fell 8.3% and 4.2%, respectively. Escaping the selling pressure was Telecom Egypt, rising 5.6% ahead of an anticipated dividend announcement. Orascom Construction was flat despite securing a major Saudi Infrastructure contract and $350 million in loans from the International Financial Corporation.

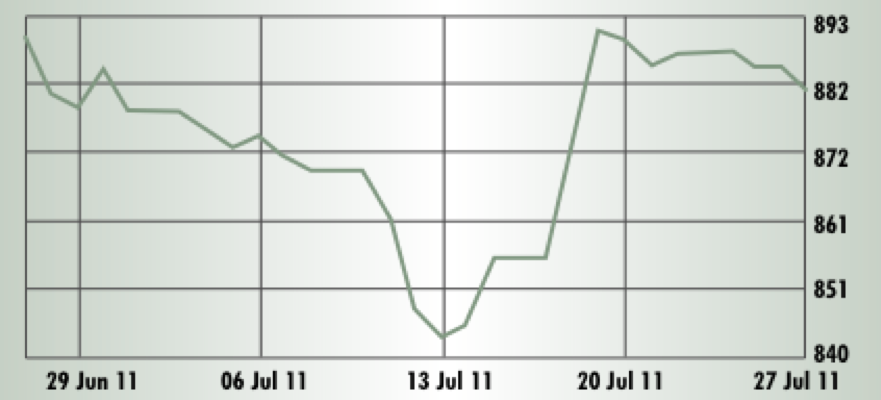

Lebanese equity markets

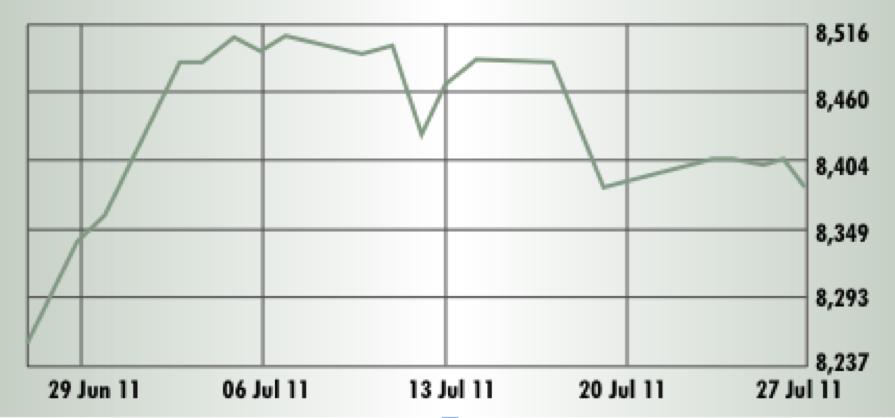

BLOM Stock Index (BSI)

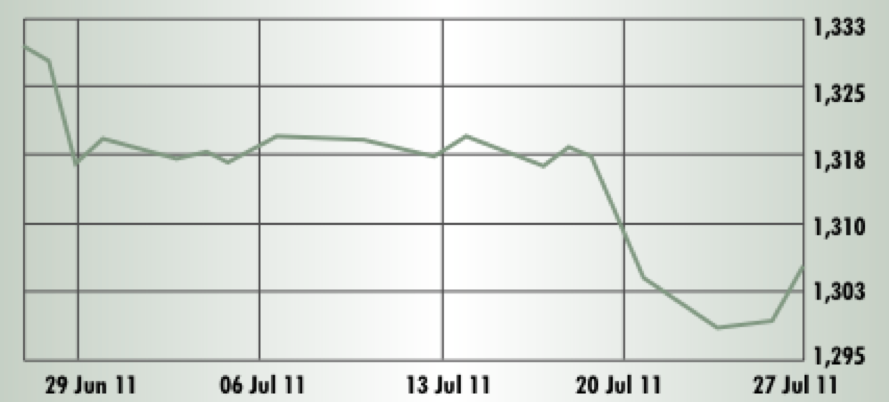

Weighted effective yield of Eurobonds

Equities update

Although political tensions in Lebanon eased following the formation of a new cabinet, investor sentiment remained wary in light of escalating political upheaval throughout the Middle East and North Africa region. This was mainly reflected in low trade volumes on the Beirut Stock Exchange for the four-week period from June 20 to July 15, 2011. The daily average volume for the month reached 120,568 shares compared to 306,829 shares recorded over the preceding four weeks. Furthermore, the corresponding traded values fell by half to $1.56 million. The BLOM Stock Index (BSI), Lebanon’s equity gauge, fell considerably during the aforementioned period, ending at 1,320 points on July 15, 3.05 percent lower than its previous close on June 17, and amounting to a 10.5 percent loss since the start of the year.

Compared to regional and emerging markets, the BSI underperformed both the S&P Pan Arab Composite Large MidCap and the MSCI Emerging indices.

Throughout this period, Solidere’s stocks dominated trades on the BSE, accounting for 65 percent of the total traded value. Nevertheless, the distorted political environment weighed negatively on the performance of the real estate stocks in classes A and B, which fell by more than 7 percent to settle below the $17 mark for the first time in 26 months. It is worth highlighting that BLOMINVEST Bank updated its coverage on Solidere with a ”Hold” recommendation and a fair value classification of $19.40 per share.

The performance of banking stocks also witnessed a downward trend, except for BLC bank’s stock, which rallied 12.6 percent to $1.87. The BLOM Bank Global Depository Receipt (GDR) stock declined 2.8 percent to $8.68 while its listed stock slipped 0.47 percent to $8.46. BLOM Bank preferred shares classes 2004 and 2005 were de-listed from the BSE in preparation for the issuing of $200 million worth of new five-year 2011 preferred shares. Bank Audi stocks followed suit, as its GDR and listed stocks dropped by a respective 4.42 percent and 0.43 percent. Byblos Bank common stock retreated, by 0.57 percent. The preferred stocks for Bank of Beirut classes D and E witnessed a mixed performance. The former lost 2.96 percent while the latter rose 1.78 percent to reach $25.75.

Additionally, manufacturing sector equities closed on a negative note, as Holcim’s stock fell 9 percent to a four-month low of $16 due to the distribution of dividends.

Bond bulletin

With respect to debt instruments, the Lebanese Eurobond market sustained its advance between June 17 and July 15 with demand concentrated on medium and long-term bonds. This pushed the BLOM Bond Index upward 0.58 percent to 110.48 points. Consequently, the weighted yield on holding Eurobonds fell by 20 basis points (bps) to 5 percent and the spread against the US benchmark yield widened by 15 bps to 374 bps. Lebanon’s credit default swap for five years was trading between 340 bps and 367 bps on July 15, compared to 328 bps to 353 bps on June 17. In regional economies, CDS quotes for Dubai stood at 338 bps to 358 bps, with Saudi Arabia between 93 bps to 98 bps.

Lebanon’s newest bank receives BDL approval

Banque du Liban (BDL), Lebanon’s central bank, granted its final approval for the establishment of the country’s newest specialized private bank, Cedrus Invest Bank, after the new enterprise fully covered its $44 million paid-up capital. During Cedrus’s general assembly held in June, Ghassan Ayyash, BDL’s former vice governor, was elected as chairman of the Board Of Directors (BOD), while Fadi Assali and Raed Khoury were appointed general managers of the bank. Other BOD members include Georges Atik, Ghazi Youssef, Ibrahim al-Jammaz and Elias Abou Farhat. Following BDL’s approval, Cedrus Invest Bank’s management issued a statement in which it explained that launching the bank at a time of domestic and regional political and economic distress was a vote of confidence from the bank’s investors and shareholders. The latter include around 30 Lebanese residents and expatriates, as well as investors from the Gulf Cooperation Council countries. Lebanon’s newest bank aims at creating an office for high net-worth individuals and families alongside its other business lines, which include wealth management, capital markets, asset management and private equity. Cedrus Invest Bank will soon raise its paid-up capital to $50 million due to high demand for its shares, the statement added. The bank aims at expanding beyond the Lebanese market in the foreseeable future and will tap into the Levant region, with a focus on Syria and Iraq, as well as into the Gulf.

Lebanon performs well on The Banker’s list

Nine Lebanese banks ranked amongst the top thousand commercial banks in the world, seven of which improved their rankings since 2010, according to a recent survey by magazine The Banker. Taking into account only the core of a bank’s strength — the shareholders’ equity that is readily available to cover actual or potential losses — the survey ranked the banks based on their 2010 end of year tier one capital as per criteria set by the Bank for International Settlements. Bank of Beirut made the biggest leap among Lebanese institutions, rising by 120 places to reach 663rd while recording a 45.3 percent yearly increase in its tier one capital. Byblos Bank followed, ranking at 448th, jumping 58 places from its standing a year earlier and posting an 8.83 percent rise in its tier one capital-to-assets ratio. Recently acquired Lebanese Canadian Bank ranked 912th, a notable jump of 57 spots from the previous year. Meanwhile, both Bank Audi and BankMed saw their positions fall, dropping by 29 and 21 notches to the 355th and 659th spots, respectively. The aggregate tier one capital of the nine Lebanese banks totaled $8.67 billion by the end of 2010, a 15 percent yearly increase, compared to a 10 percent increase in the top thousand banks’ tier one capital, while their profits-to-tier one capital ratio reached 19.9 percent in 2010, also more than the 13 percent ratio for the top thousand banks.

Premiums land high in MENA rankings

Lebanon ranks first in the Middle East and North Africa (MENA) region and 52nd globally in terms of insurance penetration, or total insurance premiums as a share of gross domestic product (GDP), according to global reinsurer Swiss Re’s latest “World Insurance in 2010” report. Compared to 3.1 percent in 2009, Lebanon’s insurance penetration stood at 2.8 percent of GDP in 2010, above the MENA average of 1.3 percent for the same year, but still below the world average of 6.9 percent. Cover premiums in Lebanon totaled $1.1 billion last year, accounting for 0.02 percent, 0.17 percent and 3.2 percent of global, emerging markets and Middle East and Central Asia premiums, respectively. In terms of nominal premiums, Lebanon dropped two spots on the year before to 66th among 147 global markets, and slipped one place, to sixth, in the Arab world. Also included in Swiss Re’s report were estimations of the average amount spent per capita on insurance premiums, or insurance density, which placed the United Arab Emirates first in the MENA region, at $1,248, followed by Qatar at $619, Bahrain at $527, Oman at $261 and Lebanon at $253.

Cypriot banks’ deposit and debt ratings downgraded

A day after it had downgraded Cyprus’ long-term debt rating from A2 to Baa1, just two notches above junk, international ratings agency Moody slashed the deposit and debt ratings of the two main Cypriot banks, Marfin Popular Bank (MPB) and Bank of Cyprus (BoC), from Baa3/Prime-3 and Baa2/Prime-2, to Ba2/Not Prime and Ba1/Not Prime, respectively. Moody’s said the island’s high level of exposure to Greek Government Bonds (GGB) was the primary reason behind its ratings announcement, as it considered all rated Cypriot banks likely to take part in the Greek debt exchange. MPB and BoC exposure to GGB is $4.9 billion and $3.5 billion, respectively, according to the European Banking Authority, constituting 95 percent and 55 percent of their tier one capitals, respectively.

Lebanon still a draw for FDI

Among 18 Arab countries, Lebanon was the fourth major foreign direct investment (FDI) recipient in nominal terms and posted the fifth highest FDI growth rate for the year 2010, according to figures released by the Arab Investment and Export and Guarantee Corporation (AIEGC) last month. Lebanon attracted $4.96 billion of FDI in 2010, a 3.2 percent rise from $4.8 billion a year earlier, making it one of five Arab countries to have witnessed an increase in FDI last year, in contrast with a 23.4 percent yearly decrease in aggregate FDI to Arab economies in 2010. Lebanon ranked highest in the Arab world in terms of FDI inflows as a percentage of gross domestic product (GDP), which stood at 12 percent, followed by Jordan at 6.2 percent, Sudan at 5.4 percent and Qatar at 5.1 percent in 2010. Lebanon’s FDI inflows accounted for 7.7 percent and 8.7 percent of total inflows to Arab countries and to West Asia, respectively, and for 0.44 percent of global FDI in 2010, which increased by 0.7 percent for the same year.

Foreign currency flight from Syria exaggerated

Many an eyebrow was raised at the end of June when The Economist cited that an estimated $20 billion had left Syria since protests began to sweep the country in March. “There is obviously capital flight, but it is impossible that $20 billion left the country,” said Jihad Yazigi, editor of the economic newsletter Syria Report. With the World Bank pegging Syria’s overall economy as worth $52 billion at the end of 2010, and total deposits in private and state banks close to $30 billion, such capital outflows would have disemboweled the country’s finances. “The $20 billion figure is ridiculous, as the deposits of private banks are $11 billion and the deposit base of the whole banking system is $29.8 billion,” Freddie Baz, chief financial officer at Bank Audi, told Executive. “Estimates range between a 15 percent to an 18 percent drop in the deposit base of private banks, so there has been a decline of around $2 billion.” Lebanon’s Bank Audi, which operates Bank Audi Syria, is the second largest private bank in Syria with some 18 branches. However, in an effort to contain foreign currency deposit flight and alleviate pressure on the Syrian pound, the Central Bank of Syria (CBS) issued in early July a set of rules to implement new measures it had announced in May to control foreign currency purchase and withdrawal transactions. The measures include authorizing Syrians to open savings accounts in US dollars and Euros up and equivalent to $120,000, granted the amount is blocked for a minimum of six months, while also allowing foreign currency purchases of up to $60,000 for accounts with a minimum six-month maturity, with the maturity extended by one month for every additional $10,000 purchased. CBS governor, Adib Malayeh, said they had closed about 30 foreign exchange bureaus suspected of conducting illegal operations, with reports of the Syrian pound having been traded at between 10 and 15 percent lower than its official exchange rate. Malayeh said the Syrian pound was still rock solid despite the political unrest, with bank deposits up 4 percent for the second quarter of 2011 relative to the first.

Lebanese banks receive a Moody downgrade

Lebanon’s top four alpha banks, Bank Audi, BLOM Bank, Bank of Beirut and Byblos Bank saw their standalone Bank Financial Strength Ratings (BFSR) and Global-Local Currency (GLC) deposit ratings downgraded by Moody’s Investors Service. On July 19, Moody’s cut all four banks’ BFSRs and GLC deposit ratings to D- and Ba3, respectively, from a previous stable rating. It also reduced Byblos Bank’s B1 subordinated debt to negative. The international ratings agency mentioned the slowdown in the Lebanese economy and political tension, along with instability in neighboring Syria, as factors for increased domestic credit risk and weakened asset quality and profitability for rated banks. Both Bank Audi and BLOM Bank’s extensive operations in Syria suggest a great deal of material exposures to the country, which Moody’s estimated ranged from 70 to 125 percent of the banks’ tier one capital at the end of 2010. Moody’s ratings announcements also raised concerns over the four banks’ exposure to sovereign risk due to their low-rated Lebanese government securities portfolios, which equal several times their tier one capital levels and reflects the banks’ continuous funding of Lebanese public debt. By contrast, Moody’s said the banks’ long-term foreign currency deposit ratings remained unchanged, as those deposits are capped by Lebanon’s B1 ceiling. Lebanese bankers downplayed public concerns in response to the ratings announcement, asserting that Lebanon’s financial institutions have enough liquidity to overcome what is a temporary situation.

Images from Cairo’s Tahrir Square have become iconic symbols of the struggle against oppression and have helped inspire the fight for human rights across the Middle East and beyond; But many goals of the Egyptian Revolution are yet to be fulfilled. Repressive laws remain in place, the military continues to detain its critics and prosecute them in military courts and the torturers of the old regime have gone unpunished, prompting thousands to return to the streets to demand greater reforms. For a look at some of the Egyptians who helped begin the process of change in their country, Executive presents in the following pages portraits of men and women from all walks of life who joined the movement to end Hosni Mubarak’s 30 years of repressive rule. All photos taken by Platon in April 2011, commissioned by Human Rights Watch.

1) April 1, 2011: Egyptians return to Tahrir Square in Cairo for a rally to “save the revolution” and protect their right to demonstrate.

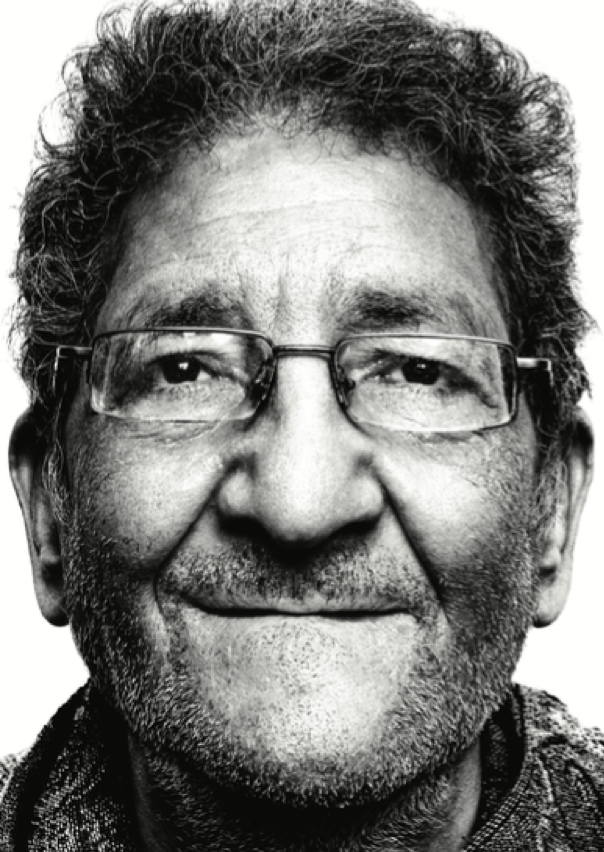

2) Ahmed Seif al-Islam, 60, is a veteran Egyptian lawyer, activist and former political prisoner and founder of the Hisham Mubarak Law Centre, which since 2008 has been the leading Egyptian NGO providing legal assistance to protesters.

3) Heba Morayef, the Cairo-based researcher for Human Rights Watch, covering Egypt. In the middle of the demonstrations and violence during the Tahrir protests, Morayef visited hospitals and morgues to document the civilian death toll from government attacks and sniper fire.

4) Sama Lotfy, 2, Neama el-Sayed, 26, Yassin Lotfy, six months, the children and widow of a protester killed by Egyptian security forces during the Tahrir Square demonstrations.

5) Hossam Bahgat, 31, is the director of the Egyptian Initiative for Personal Rights, which he founded in 2002. He has long played a prominent role in exposing human rights violations in Egypt, including the government’s failure to prosecute sectarian violence against Coptic Christians.

6) Muslim-Christian unity youth organizers, from left to right: Moaz Abdel Kareem, 28, from the youth wing of the Muslim Brotherhood and a participant in the Tahrir Square protests. Sally Moore, 33, psychiatrist, feminist and Coptic Christian youth leader. Mohammed Abbas, 26, a member of the Muslim Brotherhood’s youth movement and a leader in Tahrir Square who worked with secular counterparts and the April 6 movement in planning protests. Mohammad Abbas and Sally Moore drafted a “birth certificate of a free Egypt” shortly after Mubarak’s resignation.

7) Wael Ghonim, 30, the Google regional marketing executive who administered the “We are all Khaled Said” Facebook page after the young Alexandria man’s brutal killing by police. Ghonim’s passionate appearance on Egyptian television after being detained for 12 days by the security police helped energize the protest movement.

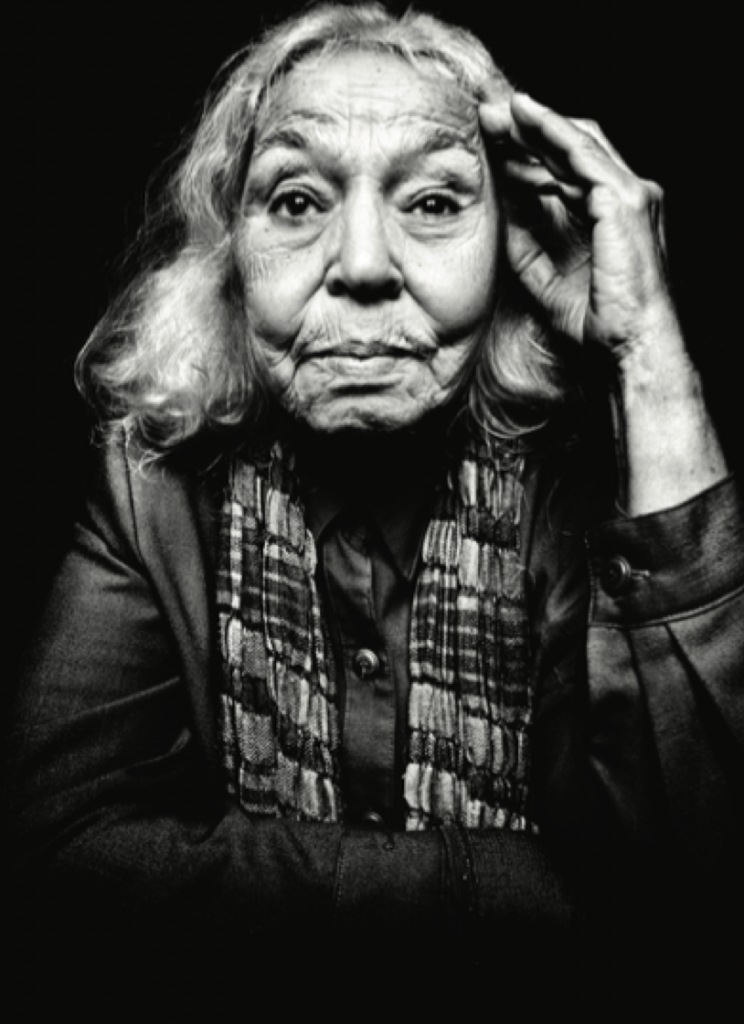

8) Nawal el-Saadawi, 80, an Egyptian writer, veteran women’s rights advocate, psychiatrist and author of more than 40 fiction and non-fiction books, many of which address the persecution of Arab women. Saadawi’s decades-long struggle for women’s rights and against female genital mutilation helped pave the way for the adoption of a historic 2008 law that banned the practice in Egypt.

9) Sondos Shabayek, 25, a writer for independent Egyptian newspapers and magazines and a “citizen journalist” who participated in and tweeted the story of the Tahrir Square protests.

10) Sarrah Abdel Rahman, 23, a social medi activist who reported from Tahrir Square with her popular “sarrahsworld” YouTube commentaries.

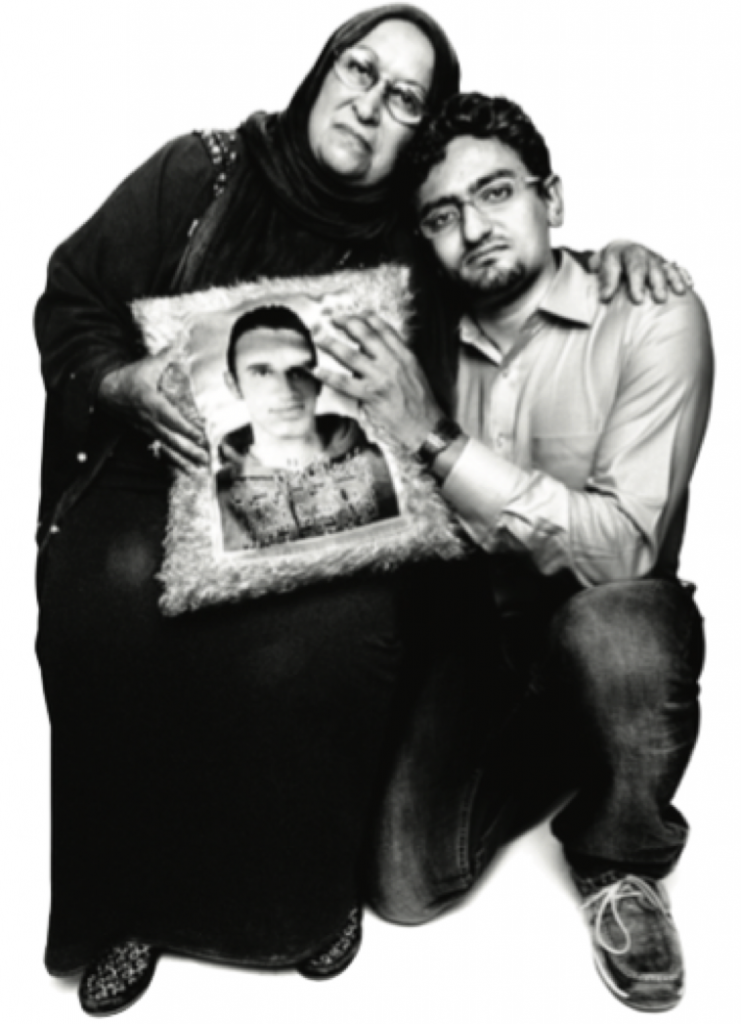

11) Laila Said, the mother of 28-year-old Khaled Said, with influential Egyptian activist Wael Ghonim. Speaking out about the torture and murder of her son by Egyptian police in June 2010, Laila became known as the “Mother of Egypt” and as an emblem of the consequences of endemic police torture and impunity.

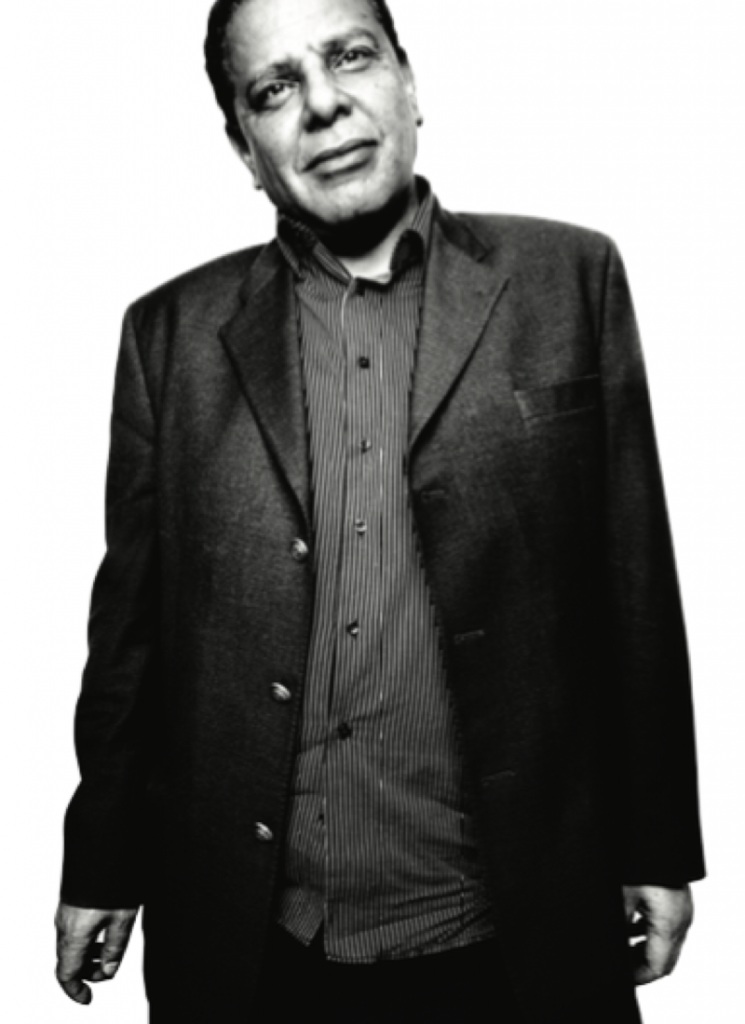

12) Alaa al-Aswany, an Egyptian writer born in 1957 and author of acclaimed novel The Yacoubian Building. He was a founding member of the political opposition movement Kefaya (“Enough”).

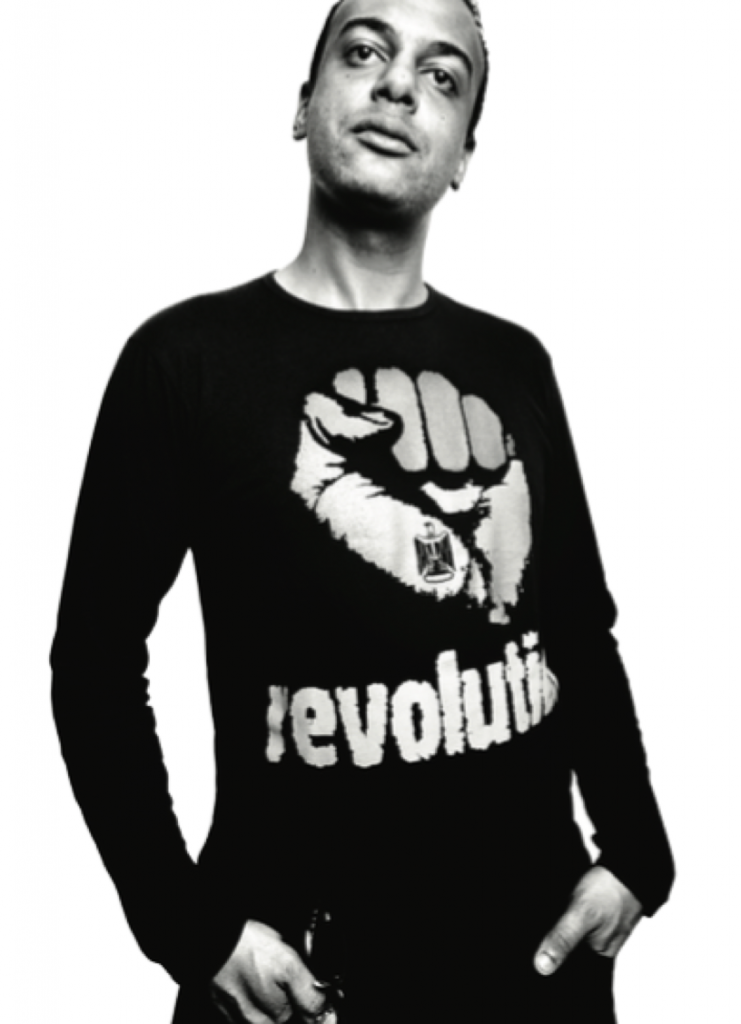

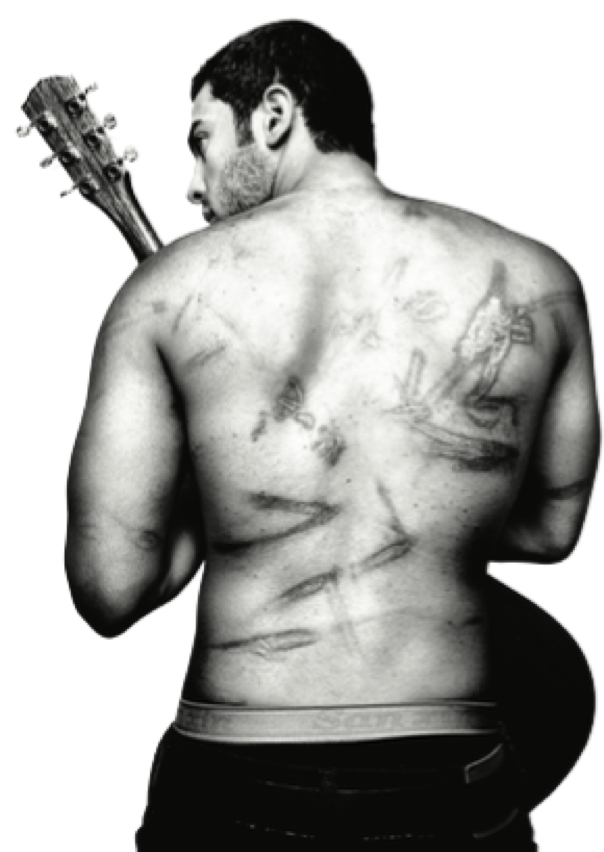

13) Ramy Essam, 23, a charismatic singer, guitarist and songwriter who became famous during the Tahrir Square protests as “The Singer of the Square”, was detained and tortured by the Egyptian military after President Hosni Mubarak fell.

If Riad Salameh were no longer driving the bus that is Lebanon’s economy, many of us would feel differently about being on it. Faith in the lira, confidence in the sanctity of our savings and a belief, if fragile, that Lebanon can withstand internal and external economic shocks are thanks to him. But as we breathe a sigh of relief at his re-appointment to a fourth term as governor of the Banque du Liban (BDL), Lebanon’s central bank, we must also look at the precedent being set: It is true that through times of siege from without and sabotage from within he has kept us from tumbling off the road to prosperity… But nothing gold can stay.

It is no coincidence that the banks have kept Lebanon’s economy (relatively) on course during Salameh’s tenure. In fact it is no less than obvious; a well-tended garden makes for better flowers. If other ministries took their cue from the BDL, they too might discover the wondrous results diligence, conservatism and foresight can produce.

Manufacturing, industry, agriculture — long neglected by the state as unviable oddities in Lebanon’s gross domestic product — are precisely the sectors in need of investment to help broaden the foundation upon which our prosperity is based.

As it takes many pillars to support a temple, the government must give the Lebanese a reason to believe that this varied and vibrant country can have a varied and vibrant economy.