For an inside view of Lebanon’s top restaurants, check out the the luxury special report in the July edition of Executive Magazine, in stores now.

Underground, down a dark driveway and below a nondescript building in the back streets of the Beirut neighborhood, Tabaris, is a small, unmarked door. Behind this secret portal a bounty of diamonds, sapphires, rubies, gold, platinum, pearls and other precious gems lies in wait. Here, a treasure trove of wishes is carefully and painstakingly molded, filed and polished by the finest expert craftsmen into symbols of luxury and cherished personal items that will eventually adorn fingers, ears, necklines and wrists.

Before it ends up on the velvet pillows of the Mouzannar showroom to be gawked at and drooled over, the giant aquamarine and diamond-encrusted platinum ring passes through many hands. Under the watchful eyes of more than 20 security cameras [1], the jewellers use age-old techniques, with the help of some modern technology, to perform their transformation of raw materials into glorious ostentation.

When the order for the ring comes in to the jeweller, the first step is selecting the stone. Then, using architectural software [2], the cast setting is digitally drawn in three dimensions. At this stage, the ring is moulded in wax [3], before the pure platinum is melted and poured into the setting. Emerging rough and unfinished [4,5], the ring is cleaned and weighed for value before being polished and filed; each tiny precious filing is collected on stainless steel trays for a later date. The giant piece of aquamarine, meanwhile, is weighed and examined in detail for quality, clarity and shape. The same treatment is given to the diamonds that will form the stone’s bed. Dozens of white diamonds pour from plastic zip-lock freezer bags [6] stored in rows in filing cabinets according to size and gem.

Once the gems are selected and prepared, they are ready to be set in the cast. The diamonds are laid out in tiny magnificent rows along the diameter, the aquamarine carefully fitted in its platinum jaw. Now, close to ready, the polishing [7,8] begins again — a process the jeweller explains will file away at least 10 percent of the original weight of the metal. At cleaning stage, the ring is plunged into a bucket of warm soapy water [9] using ordinary dishwashing liquid, then blasted with steam to remove any invisible scratches.

Finally the ring is submerged in salted water and exposed to an electric current to remove any lasting grease before getting a last bath and puff of steam. Still exhibiting golden tones, the ring is lastly dipped in rhodium [10], from which the metal emerges gleaming white. Dried with a hairdryer [11], the ring is ready to leave its humble home [12]. After a process that has taken three days, the ring is taken to the showroom for pricing and exhibition [13].

Dubai’s cedar shoreline

By the fourth quarter of this year, the island of “Lebanon” will be home to the first commercially operating project within The World, the 300-island man-made archipelago off the coast of Dubai developed by Nakheel. The island is fully owned by Indian entrepreneur Wakil Admed Azmi, who has spent approximately $16.3 million [AED 60 million] on the construction of a beach club and facilities, in addition to the initial cost of the island. Reza Sinnen, operations manager at the World Island Beach Club (which is being developed on the island), told the United Arab Emirates (UAE) daily Arabian Business in a June 15 article that another $2.17 million [AED 8 million] would have to be invested to complete the commercial resort, which includes a restaurant, lounge, entertainment venue and cabanas, with facilities that allow yachts of up to 80 feet to be docked. The resort aims to sell club memberships that cost up to AED 40,000 [$10,889] per year. Sinnen said problems with the delivery of water, electricity and on-island services mounted as Nakheel’s credit burdens grew, but that the owner cut construction costs by nearly 70 percent and managed the project himself in order to complete it on time. “We are about four months away. We are tying up with partners, yacht operators, travel agents, the Road and Transport Authority, Sealink…there is a lot to do,” Sinnen said. While 70 percent of the 300 islands are sold, according to Nakheel, none of the other owners have begun construction, except Kleindienst Group, which is developing resorts on the six islands it owns, which together are known as the Heart of Europe Project.

A greener prospect

A new environmental initiative that rates the green credentials of buildings in Lebanon was launched in June. The scheme was announced on the closing day of the 16th Project Lebanon, the international trade exhibition for construction and environmental technology that saw around 500 contractors and construction companies from 26 countries set up shop at Beirut International Exhibition and Leisure Center (BIEL) for the week. The ARZ Building Rating System is the first of its kind in the Middle East to classify the environmental performance of existing commercial buildings. The system takes into account Lebanon’s water and electricity shortages, and includes renovation conditions to reduce greenhouse gases. Building owners can invest between $100,000 and $4.9 million, based on building size and condition, to save between $35,000 and $890,000 in costs per year, according to Lebanese Council for Green Buildings President Samir Traboulsi.

From Damascus to Mayfair

A June 20 article in British daily The Telegraph reported that former Syrian Vice President Rifaat al-Assad bought a 10.3 million pound [$16 million] Mayfair townhouse in 2007 by signing a 110-year lease from the Grosvenor Estate, with funds paid by an offshore company based in the British Virgin Islands. Given the current unrest in Syria and the possibility of several Syrian officials facing international investigation, the properties could be confiscated in the event of a criminal investigation against Rifaat al-Assad for “crimes against humanity,” as he is blamed for ordering the massacre in the Syrian town of Hama in 1982 that killed tens of thousands. The article added that the 73-year-old uncle of current Syrian President Bashar al-Assad did not live in the residence until more than a year ago, but has been residing mostly in France and Spain. In 2008, Hafez al-Assad also bought a lease on the adjacent property, but Land Registry documents did not reveal the amount of the contract. In related news, Rami Makhlouf, the maternal cousin of the president, appeared in a rare televised appearance on state television on June 17 and pledged to relinquish all his real estate in Syria to the state and give up any business ventures that bring him personal gain, such as his stake in Syria’s monopolistic telecommunications company Syriatel.

Tourism takes the cake

Of the 35 business developments launched with the help of the Investment Development Authority of Lebanon (IDAL) between 2003 and 2010, tourism projects accounted for 79 percent ($860 million) of the $1.1 billion total mobilized investment. IDAL indicated that the bulk of tourism projects were the construction of luxury hotels and resorts, generating nearly 3,300 jobs over the same time period. The industrial sector was the second largest recipient of IDAL-supported investment between 2003 and 2010, receiving $131 million. IDAL mobilized investments accounted for some 4,760 new jobs over the seven-year period.

Solidere trumps 2010

Due to a surge in operating profits, Lebanese real estate firm Solidere was able to increase net profits by 7.8 percent in 2010 to reach $196.5 million, according to a June 15 statement by the firm. Sales of land plots and increasing revenues from rental units expanded Solidere’s operating profits to $272.2 million last year, a yearly increase of 16.5 percent. Based on its market capitalization of $3.1 billion at the end of 2010, the company was ranked 61st in Al Iktissad Wal Aamal magazine’s annual survey of the Top 100 publicly-traded Arab firms in the region, down from 45th place in the previous survey. As the largest property developer in Lebanon, its total assets are estimated to be worth around $10 billion today, while unsold property is valued at $7.5 billion.

Noor International’s dodgy dealings exposed

Beirut-based developer Noor International, founded by Mohammed Saleh, has not completed more than 5 percent of its residential projects sold off-plan, according to a June 1 article in Lebanese daily Al Akhbar. It further claims that Saleh fled to Saudi Arabia in May after scamming investors of around $10 million. Noor International first gained notoriety (or infamy, depending on one’s perspective) in 2006 when Saleh sought to raise $1 billion from investors to build “Cedar Island”, a dredging and construction development that would have seen the creation of a 3.3-square-kilometer island off the Lebanese coast in the shape of a cedar tree. To the relief of many, this project was among the 95 percent of Noor’s development ideas never to see the light of day.

Gloom and dividends

Property transactions contracted 21.3 percent year-on-year by the end of April, while the value of the sales dipped 16 percent over the year, according to BLOM Bank. Further indicating a slow-down in construction activity this year, the major supply indicator, cement deliveries, fell 3.5 percent as of the end of April in comparison to the same time last year, according to the Order of Engineers of Beirut and Tripoli, and Byblos Bank. Holcim Liban, one of the major cement producers in Lebanon, will pay $30.25 million in dividends to shareholders starting June 27, at a dividend ratio (dividend payout as a ratio of 2010 net income) of 80.8 percent. Société Libanaise des Ciments Blancs, another major local producer, will also distribute dividends based on last year’s profits on the same day.

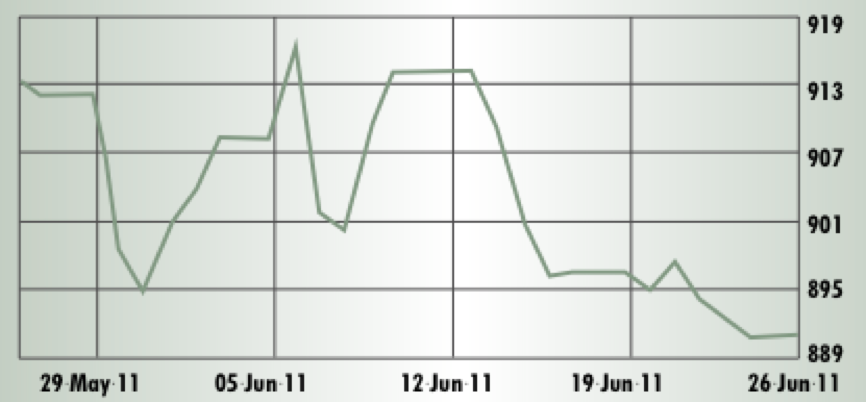

Beirut SE

Current year high: 1,073.93 Current year low: 890.83

> Review period: Closed June 23 at 892.64 points Period Change: -0.25%

Slumping Beirut stocks were not buoyed by the long-awaited emergence of a new, Mikati-led government. Instead, the market seesawed ahead of an anticipated political showdown during the upcoming parliamentary session and on uncertainty about unrest in Syria, leaving stocks down 8.2% in 2011 through June 23. Shares of Solidere hardly budged despite positive news of an 8% increase in 2010 net profits. Political bickering has driven the stock down 4.5% so far in 2011, though it is outperforming Bank Audi and BLOM Bank, which shed 15.6% and 10% respectively.

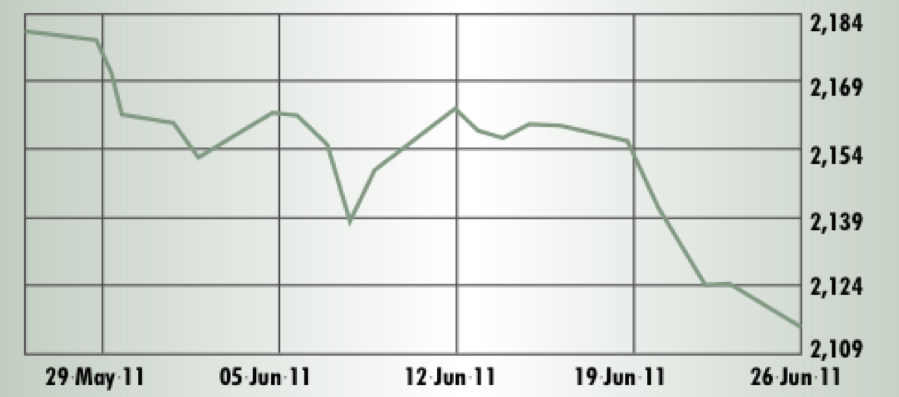

Amman SE

Current year high: 2,477.99 Current year low: 2,113.46

> Review period: Closed June 23 at 2,122.97 points Period Change: -1.7%

For Amman stock prices in June there seemed no end in sight for the slide that started at the onset of 2011. The market index has already given away 10.6% in 2011 through June 23 and stocks are yet to recover from the ‘Arab Spring’- driven declines earlier in the year. Continued political uncertainty, as well as unrest in neighboring Syria pose additional risks for all stocks. However, the banking sector has generally shown considerable resilience with only a 4.7% decline year-to-date, including 1.4% in June.

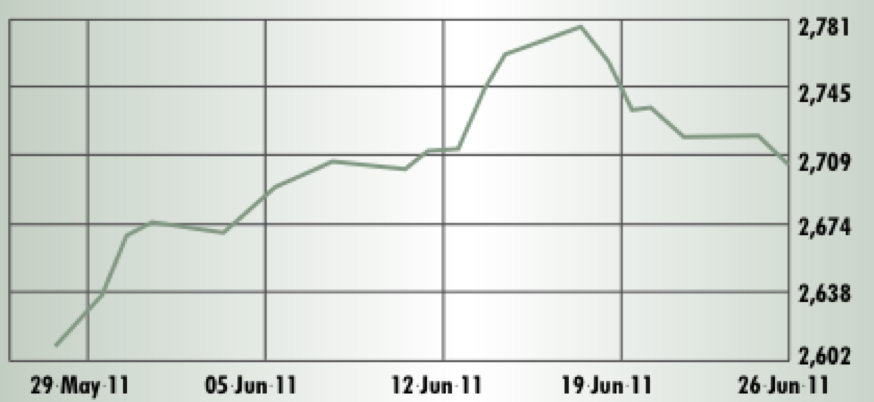

Abu Dhabi Exchange

Current year high: 2,833.09 Current year low: 2,471.70

> Review period: Closed June 23 at 2,716.72 points Period Change: +2.94%

Stocks on the ADX roared in June to a new 2011 high of 2,775 points on investors’ high expectations ahead of a decision by global index provider MSCI to advance the UAE from “Frontier Markets” to “Emerging Markets” status. However, stocks weakened at the end of the review period when MSCI postponed the decision for six months. The ADX benchmark retained a flat record for the year through June 23 and posted solid gains for the month, as Etisalat leapt 7.8%. Year-to-date gains of 6.8% for banking stocks have been the market’s saving grace.

Dubai FM

Current year high: 1,781.92 Current year low: 1,352.24

> Review period: Closed June 23 at 1537.48 points Period Change: -1.44%

Although the DFM index stumbled on MSCI’s decision to delay a possible upgrade to UAE’s bourses, stocks had little to lose. By June 23 the market was already down 5.7% in 2011 on expectations of further losses at real estate and construction companies and despite a year-to-date gain of 5.7% in banking stocks, with a nice top up of 2.4% in June. Market cap leader Emirates NBD booked a handsome gain of 48.6% during the first half of the year, while real estate behemoth Emaar Properties was down 13.2%, including 2.2% in June.

Kuwait SE

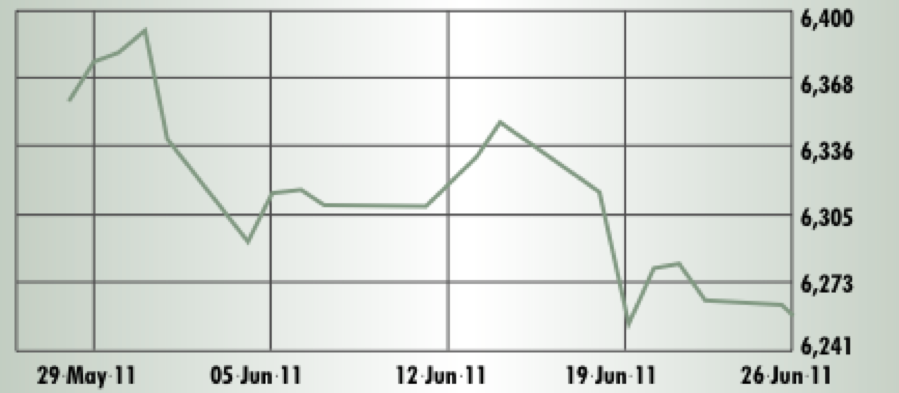

Current year high: 7,129.30 Current year low: 6,134.60

> Review period: Closed June 23 at 6,263.9 points Period Change: -1.8%

Missing positive cues and dropping to thin volumes, Kuwaiti stocks slid further down the May slope at the onset of the summer low trading season. Kuwaitis go on vacation this year with almost 10% of their equity investments scrapped during the first six months. More ominously, the banking sector continued its steady decline, reinforced by Moody’s downgrade of National Bank of Kuwait’s credit ratings on Egypt exposure and real estate risks; the sector is 8% in the red for the year through June 23.

Saudi Arabia SE

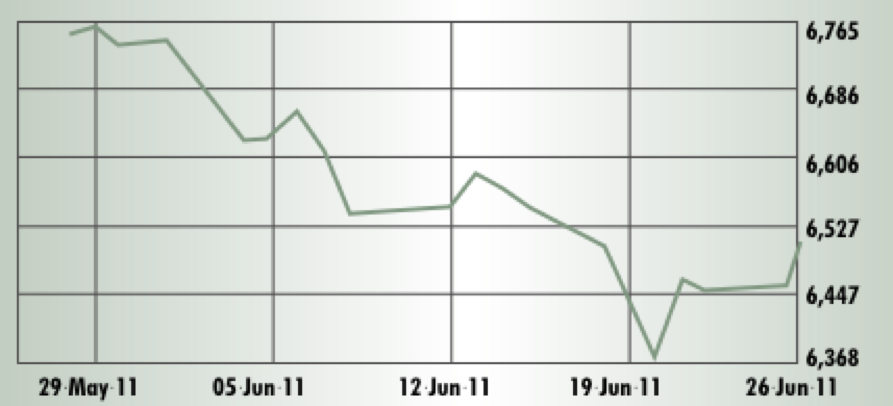

Current year high: 6,788.42 Current year low: 5,323.27

> Review period: Closed June 22 at 6,449.49 points Period Change: -4.26%

Tadawul’s stock activity was vibrant in June, backed by plentiful government loans and corporate Sukuks, including a massive 25-year $13.6 billion soft loan approved by the government for Saudi Electricity Company. However, real estate and banking stocks appeared to be off for an early stint of Red Sea vacationing, diving 8% and 4.9% respectively during our June review period. As a result, Tadawul’s year-to-date performance sank to -2.6% by June, ending Saudi’s earlier MENA exchange leadership.

Muscat SM

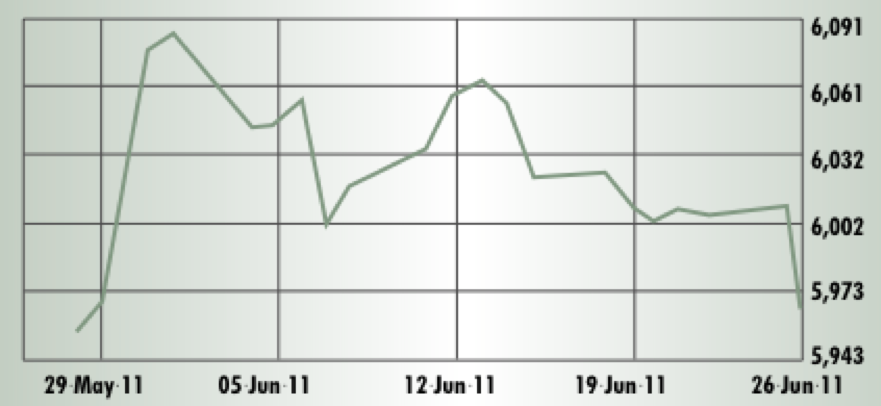

Current year high: 7,027.32 Current year low: 5,952.60

> Review period: Closed June 23 at 6,003.82 points Period Change: -0.07%

June’s mood swings are not unusual on the GCC’s smallest exchange. Following an optimistic Bank of America Merrill Lynch report, foreign investors flooded blue chip stocks hit by significant May declines. However, it appeared domestic investors were either not swayed or had defected to summer activities as the market gave back earlier gains and volumes thinned out. Investors may be saving up for the three IPOs scheduled for the fourth quarter, or are not hurrying into a market down 11.1% for the year and with few positive catalysts on the horizon.

Bahrain Bourse

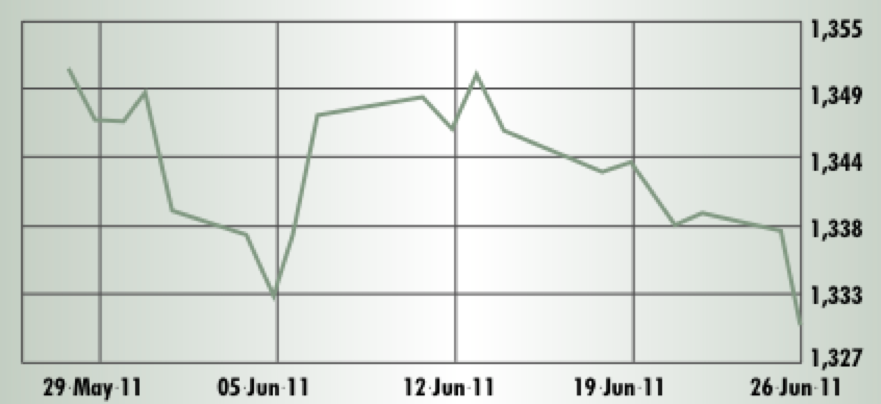

Current year high: 1,475.10 Current year low: 1,330.03

> Review period: Closed June 23 at 1,338.61 points Period Change: -0.6%

As Bahraini courts were inking new life sentences for opposition members in June, the market index was inking a seven-year low, followed by a short-lived uptick. Despite continuing protests and the uncertain outlook for the upcoming national dialogue, the market has held up relatively well given the circumstances, falling 6.5% in 2011 through June 23. The key banking sector only gave up 3.7% during the first six months, with the market’s largest traded stock Ahli United Bank actually adding 1.4% year-to-date, compared to a 12.5% dive at Batelco.

Qatar SE

Current year high: 9,242.63 Current year low: 6,766.80

> Review period: Closed June 23 at 8,214.35 points Period Change: -1.92%

It is telling when Qatar’s central bank’s announcement that real GDP may grow 19% in 2011 does not move markets while MSCI’s decision to delay the decision on Qatar’s upgrade sparks a downturn. But this internationally focused exchange can still cheer foreign activities by Qatari companies, including Diar’s recently-approved multi-billion dollar Chelsea Barracks project in London. The market index on June 23 closed down 5.4% year-to-date, ironically one of the better showings among MENA exchanges.

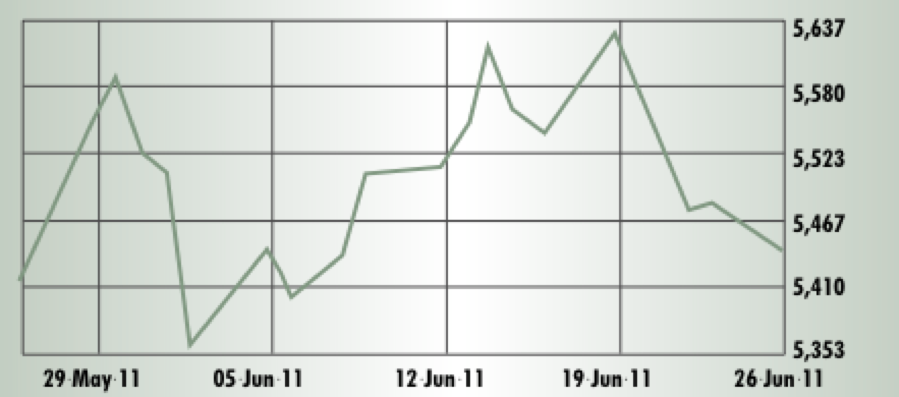

Tunis SE

Current year high: 5,681.39 Current year low: 4,058.53

> Review period: Closed June 23 at 4,254.12 points Period Change: +3.23%

With Ben Ali sentenced in absentia for 35 years, the pre-crisis appeal of Tunisian stocks has returned. Business delegations from across the globe flocked into the country as political parties agreed to postpone elections until October. The market still has a long way to go before it recovers the 16.7% losses in 2011 through June 23, but the upward trend appears to be accelerating; the Tunindex registered the highest June return in the MENA region reviewed here. Meanwhile, Banque de Tunisie remained anchored, declining a relatively modest 5.3% during the first six months.

Casablanca SE

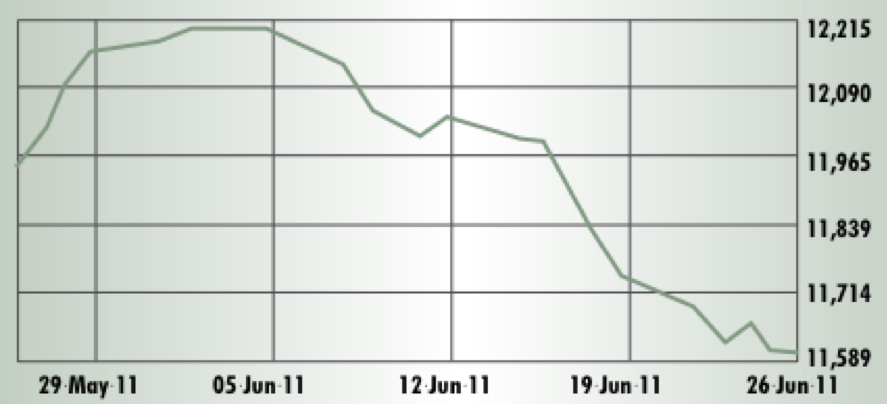

Current year high: 13,397.47 Current year low: 11,499.64

Casablanca stocks witnessed a precipitous decline in June after the youth movement called for a boycott of the king’s July 1 reform referendum. The MENA region’s June laggard has compiled an 8% loss in 2011 through June 23, with market-cap billionaire Maroc Télécom hitting a multi-year low during the month. Banking stocks have tracked the market so far in 2011, with an 8.1% decline, while the largest bank by market cap, Attijariwafa Bank, shed 9.7% during the first six months.

Egypt SE

Current year high: 7,210.00 Current year low: 4,878.00

> Review period: Closed June 23 at 5,479.74 points Period Change: -0.79%

Since touching the year’s low in early May, EGX stocks have gained 12.3% through June 23, reflecting optimism for a recovery in tourism and real estate. Although the market is down 23.3% in 2011 to date, heavyweight Orascom Construction is only 4.5% in the red after post-Mubarak gains of 20%. Commercial International Bank and Telecom Egypt investors have not been as fortunate, with the two stocks losing 17.7% and 5% respectively since trading resumed in March.

After starting out on the Cannes interior design circuit, Prospect Design International’s Managing Director, Fady Chams set up the second branch of the boutique design firm in Dubai in 2005. The firm’s work has been ogled by the eyes of the jet set, with a portfolio that includes the VIP Room in Saint Tropez, to world-famous Movida and Maddox in London, to the iconic art deco Sass Café in Monaco. Closer to home, Prospect left their mark on Beirut’s La Plage beach and Palais nightclub. Though the firm has worked on high-end projects from Casa Blanca to Kazakhstan, the Middle East’s highly hospitable climate remains the focus for their well-secured niche within the interior furnishings market.

- How did you become a high-profile interior design company so quickly, designing interiors of exclusive high-end clubs and restaurants in Monaco, London, France, and the like?

My brother Sami, after having worked with Ralph Lauren Interiors and many other brands in the south of France, set up Prospect Design in Cannes in 1996. Several friends asked him to design restaurant interiors, which became very successful, and we became specialists in that domain of hospitality design. We were thinking to open Prospect Design in Beirut but security and investment-related factors didn’t allow us to do that.

- Do you position yourself as designers in the luxury segment?

Not necessarily. We do high-end and we can provide a mid-end French classical Provence house, which is rich in natural materials, [such as] French antique wood, without having necessarily the highest technology and the expensive marble and so on.

- Wasn’t Palais the biggest budget project in hospitality at the time?

No, not at all. To tell you, it was approximately half a million dollars, which is acceptable when you consider they already had the services, electrical, mechanical, air conditioning and so on. There is big competition in Beirut, especially for [design in] hospitality. Now, we have a lot of private clients for residences… and hope to design a boutique hotel but that is all related to the political and security situation.

- When you compare the market for luxury hospitality design in Beirut with the regional market, do you see major differences?

In Beirut there are no limits compared to the rest of the Middle East. You can open a restaurant and club wherever you want and you are allowed to sell alcohol and open from very early until very late. In Dubai, [if you are a restaurant that sells alcohol] you have to be in a hotel, which affects our design.

- What makes it so demanding to work on a luxury restaurant?

You cannot just design a very nice restaurant [based purely on aesthetics]. When it comes to operations you have a lot of problems with the lighting, the seating or the circulation around the tables. Also, going for a contemporary style or a classical style will definitely last much longer than something futuristic with a lot of LED lighting and changing colors.

- Did the economic downturn impact your business?

Yes and no. Back in 2008, some clients started to freeze their spending. But we do not have a lot of overhead… Before the crisis in Dubai, we were approached by maybe 20 people a week; 90 percent of them were…wasting our time. Now, if we get approached by four clients, three of them are very serious and have the funds.

- What was the most expensive project you ever worked on?

There were some private residences… that included an indoor swimming pool, a nightclub, a basement tennis court, you name it. In hospitality, it is a business with projections and a feasibility study and goals to meet. They don’t care if I put a gold-plated part in the ceiling or something that looks like a gold-plated part. But the private client would want gold-plated.

- How did your strategy develop to combine luxury items with mid-range items in your designs of hospitality spaces?

It comes naturally since in most projects no one has an open budget; we are therefore quite skilled in mixing-and-matching a very expensive sofa with a less expensive table and a chandelier that is not a Swarovski one… to create a unique design. If you want a wall covering, I can find you five similar coverings at very different prices.

Exactly five months to the day that Lebanon’s last cabinet fell, a new one was formed last month on June 12. The abrupt formation after months of impasse took many onlookers by surprise and the reasons for the long-awaited but little-expected conclusion will no doubt continue to be debated for some time to come. Was it the insistence of Hezbollah to come to terms on how to split the pie, Prime Minister Mikati’s realization that he could not wait for the outcome of the Syrian uprising to see which side he would take, or merely that the daily loss of credibility that came with being unable to form a cabinet of supposedly ‘one color’ was no longer acceptable?

In any case, the Lebanese will have to play the cards they dealt themselves the last time they went to the ballot boxes. Let us not forget that we choose the MPs who voted in the last cabinet, and who chose Mikati to form this one; talking about coups is little more than crying over spilt and rotten milk. But, to see this government and its organs for what they are, and what they can realistically achieve, some deep reflection need occur.

The first order of business is a revision of our political definitions.

In 2005, between the assassination of former Prime Minister Rafik Hariri and our Syrian neighbors kindly withdrawing their army from our lands, we divided ourselves into two seemingly equal and persistently fractious parts. What may have been an apt way to represent the diverging points of view that March should not continue to be the basis by which we see this new government; to do so is to fall into the same duplicitous trap appealing to one or the other of two opposing monolithic ideological constructions.

Thanks largely to the ever-capricious Druze leader Walid Joumblatt, political movements March 14 and March 8 are now irrelevant semantic exercises. When you actually study the proposed public policies (where they exist) of the new cabinet’s de facto technical policymaking body, the Free Patriotic Movement, they do not differ greatly from the previous government’s policies.

Both advocate private sector participation in electricity and water; neither have real solutions for, or objections to the cartels they control in almost every sector of the economy — evident in the lack of interest in policies that would encourage entrepreneurship and erode the oligopolistic nepotism that sustains inflated pricing.

We should also be realistic about how much can be achieved when we continue to appoint ministers to our cabinets who have kept our economy at the mercy of cabals, affluent family networks and companies. It is not about how monochromatic your political palate may be, but that the same structure will produce the same results.

However, for the first time in a long time in Lebanon, today we have the semblance of a normal political landscape — a government and an opposition — and that is something we should seek to maintain. What the post-Syrian occupation period has taught us is that national unity governments do not work for two very simple reasons: ties to foreign actors trump nationalism and unity of purpose does not exist.

This time, the cabinet cannot point across the table as easily as it has in the past and say things are not getting done because “they don’t let us.” Even if there is sedition in the ranks — and we should expect some given the amount of bickering we have already seen from those supposedly on the same side — this should not delay the key policy decisions that need to be made from now until the 2013 elections.

The measure of this cabinet will be whether it can make decisions, for good or for ill, rather than crumbling from within. The cabinet’s first achievement — the drafting of a policy statement — should be viewed as little more than a publicity stunt; in practice, policy statements fail to represent anything the population can hold a government accountable for (just look at the last one for a case in point).

The next step will likely be to purge the ministries of opposition supporters in “Grade 1” posts and below. Such action is normal in any democratic society — not a “confrontation” as the opposition paints it — and allows the opposition to criticize and appeal to the population while washing their hands of any blame for stalling the implementation of policies from within. It seems clear at this point that the government will not use the courts to go after members of the opposition, most likely in order to keep their own skeletons safely out of sight. Therefore, the only thing that a true opposition would have to fear is if something were to be accomplished and the government received credit.

This will not be easy to come by. Lebanon’s problems are so deeply engrained in the sectarian and administrative system that resolving them will need to confront the very core of the status quo. We should not kid ourselves into thinking that in the span of roughly two and a half years that will happen. But what we can hope for is that a policy framework is implemented so that reform can begin to take place. Beyond geopolitics and the Special Tribunal for Lebanon, the country’s domestic problems need addressing, regardless of which camp takes them on. The onus is on the new cabinet. In anticipation of the direction this government’s policies may take, Executive lays out the framework for what needs to be done.

Lebanon’s problems are so deeply engrained that resolving them will need to confront the very core of the status quo

The Economy

The first order of business will be to make sure that purchasing power remains intact. The Lebanese lira cannot be allowed to devaluate, and that means confidence must be maintained. Executive does not agree with all the policies of the central bank, nor does it support in principle the idea that government officials should hold their positions for close to two decades. However, Riad Salameh, the current central bank governor, has maintained a stable currency, managed several major crises — including the financial crisis and the Lebanese Canadian Bank debacle — enjoys widespread political support and, whether it is based on reality or perception, symbolizes confidence in the market.

His term needs to be renewed, but it should be done so in accordance with legal norms and not ‘moving decrees’ or other so-called legal instruments that skew the already very blurry lines between the executive and the legislative bodies of government.

If the new government is not sworn in by the time the governor’s term is up, there is a mechanism whereby power can pass to his vice governors until the cabinet gets its act together, drafts its trivial policy statement, receives a vote of confidence and votes him back into office. At that point, and only at that point, should he be reinstated.

Once this occurs, the central bank needs to be clear about its policies and how much of the debt it is holding, and willing to hold. The debt cannot be monetized further, nor can the central bank continue to step in to be a market-maker whenever the commercial banks do not feel like pitching in. The logic of debt markets maintains that there is a price to pay for inefficiency and bad policies. Eventually, the government has to be forced to make tough decisions, like those occurring in Greece. The longer we wait, the worse it will eventually become in the end.

It is time for a New Deal à la Libanaise between the state and the commercial banks. We accept that if not for them we would have no stability in our money markets, and this would have a disastrous effect on our economy. But at this point, the interest the government pays to the banks is just keeping the debt cycle running, making the government even more ineffective, and increasing the risk for everyone further down the line.

A real renegotiation, not a ‘Paris IV’, between the banks and their largest obligator is in order now that there is a government in place that should be able to make decisions and follow on through, and there is no better person to negotiate this deal than Salameh himself. As fewer loans go to the government, more should go to the private sector in order to drive the engine that generates fair tax revenues to fund this debt restructuring.

We are not advocating that our industries be privatized, as is being suggested to our Mediterranean cousins by the International Monetary Fund and the European Union. Doing so would require a clear and transparent strategy and a government elected with a mandate — not one that emerged from political collapse. It would require an adequate amount of competition. The scope of service coverage would also need to be ascertained, and that cannot happen when we do not know how many people need to be served, much less what their consumption is. Any privatization would require faith in the institutions that would oversee it, and this is still far off at best.

In the meantime, liberalizing industries such as electricity, water, air transport and telecommunications without selling the state’s assets needs to occur in order to build the platform needed to grow out of the present slump, and to create enough jobs to keep the population from emigrating.

It is unacceptable that we do not have accurate or timely readings of basic economic and social indicators

Concensus on the census

In order to plan for these reforms we will need to know exactly where we stand. It is no longer acceptable that we do not have accurate or timely readings of basic economic and social indicators such as gross domestic product, inflation, poverty, diseases or even the country’s population. The taboo subject of conducting a simple census must be broached and resolved by this government, with questions of sect removed. An accurate reading of residents’ ages, incomes and other essential population statistics are needed before any government can claim it has a public policy. Once this government knows how many people it will need to serve, it can start planning to do so in a realistic and targeted manner. The starting point will be to use what already exists in terms of public policy plans, then improve and implement them.

Public services, taxes and revenue

The electricity plan passed by the last cabinet should be used as the basis for progress in the sector, which must be unbundled into production, transmission and distribution as planned but without its nepotistic elements. Under the current judiciary and regulatory frameworks, private sector participation in the production and distribution of energy will only result in sectarian overlords exercising more control over local populations through distribution contracts and control over production. That is why the electricity law — which establishes an independent regulator — and others, such as the public private partnership law, need to be enacted and implemented by this government.

The only good thing about the energy shortfall is that there is room to grow in the right direction. Alternative energies such as solar, wind and waste recycling need to be transformed from marketing buzzwords to tangible and transparent industries run by innovators, not sects. If the banks are so keen on ‘going green’, than this is the first energy segment they should fund.

There is no room for waste: all our natural resources must be employed if we are to progress. Our rivers and our seas cannot continue to be dumping grounds for our sewage in a region where water is fast becoming the scarcest resource around. The complications and costs associated with building dams on our perforated geology can only be overcome if we integrate power and water as two industries that are, by force of nature, inextricably linked. Doing so will also allow us to power the plants we need to treat our water so that we do not continue to irrigate our crops with sewage that is creating untold health consequences for the population.

Of course, to build those plants and dams we will need a constant flow of cash and that can only come from one place: the people. Continuing to rely on the debt markets may be an easier and more politically prudent option, but a fair and efficient tax regime is the only way we will ever achieve a just and sustainable solution to our cash flow problem. It is time to wake up to the reality that taxes and fees for public services will need to rise or we will never be able to reform them. This will have to happen gradually for political, technical and social reasons but this government will have to be honest with itself and the people that the days of paying and receiving next to nothing in regards to essential public services are over.

It is simply unfair and unproductive to tax the rich and the poor indirectly through value added tax and excise taxes, while making excuses about a lack of infrastructure to impose or collect progressive and direct income taxes. People need to feel like they are paying for government in order to get angry enough to hold it accountable when it squanders their money. The culture of indirect taxes that has taken hold of this country has separated the people from their government while putting holes in their pockets.

As such, this government cannot continue to view telecommunications as a cash cow for the country. An indirect tax rate of 58 percent on phone bills is not a proper way to fund a government. Instead, the current telecommunications law needs to be applied, in full, and the private sector needs to be allowed to participate on an equal footing with the public sector. If there are parts of the law that need to be amended it can be done through a legal process. The need for such amendments should not be used as an excuse to skirt the obligation of implementing a law that comes from the elected representatives of the people.

With such reform, taxes in the sector could be shifted from being a burden on the consumer to a cost of doing business for private companies that compete against each other, and in so doing lower prices and provide more far-reaching services. The people, not the politicians and their companies, should get something out of privatization if it occurs. There is nothing wrong with a public share of the telecom industry — the same way there is nothing wrong with a private share — so long as the sector works for the people and their businesses and not for the interests of the zaims.

Once these basic elements of a modern economy are in place, the jobs needed to stem the brain drain will appear. But that will not be enough. The most elemental economic responsibility of any government is to create decent work for all citizens. This cannot be done without a national strategy for job creation from school to the workplace. That strategy must be as realistic as our expectations are for this government. Not everyone can be an employee in a high-value knowledge based industry. Some will need to be employed in vocational and industrial jobs, which are no less meaningful or important to the progress of the country.

The first element of that national strategy will need to involve a break with old habits. The government cannot keep funneling the poor into the army and the security services. It must create viable alternatives.

Similarly, qualified people should no longer be discouraged from working in the public sector. Our ministries and administrations are not tools for this government to practice patronage and a sectarian division of favors for votes. This government must formulate a strategy for civil service reform that is fair to those who have dedicated their lives to serve the nation and those who suffer from the lack of services.

The unqualified need to be trained and the incompetent need to go to make room for those who can do the job and deserve their position. Only then may we rightfully be able to expect a decent level of service from our public institutions.

People need to feel like they are paying for government in order to get angry enough to hold it accountable

The courts and corruption

Without question, these national strategies will mean nothing if they are not implemented and if the government is not held accountable. Despite suggestions to the contrary, it is not up to ministers whether or not they apply the laws.

The vote of confidence they receive from the Parliament obliges them to abide by the will of the people. The reason they have not done so, or have done so selectively, is the judiciary is so inefficient and politicized that we must rely on international tribunals to take up Lebanese affairs.

In order to address the problems of a judiciary that is anything but just, combating corruption must be a priority. The basic institutions for combating corruption have consistently been ignored by every post-civil war government to date, barring the implementation of one now-defunct presidential complaints office and a committee no longer in place.

Basic institutions, such as a national anti-corruption body and an ombudsman office, are essential, but so too is the reform of the current oversight bodies such as the Court of Accounts, the Civil Service Board and the Central Inspection Board. As long as these institutions and their budgets are assigned and overseen by the Prime Minister’s office they remain vulnerable to coercion and manipulation.

Learning to stand

It is naïve to think that all these basic elements of responsible government will be established by a cabinet that is manned and controlled by ex-warlords and businessmen with vested interests. But we should at least expect be moving in the right direction.

What many do not realize is that the larger issues — Hezbollah’s weapons, the Special Tribunal for Lebanon and sectarianism as a whole — are linked to a dysfunctional economy and government. A small country constantly subjected to barrages of local and international interests will struggle to protecting its national interests. But some geographically susceptible countries — like Singapore and Switzerland — have protected themselves by creating a strong and sustainable economy, which they use to shield against outside political manipulation.

Whether we can achieve such a reality will depend on how much the Lebanese are willing to accept the excuses that will, in all likelihood, arise when the tough decisions need to be made. As with the last government, it is entirely possible that this new government will attempt to hide behind concocted alibis and scapegoats to justify the continued ineptitude of the Lebanese state.

But before jumping to criticism, the new government is entitled to an opportunity to prove itself — give them a chance to do their job. And if they do not, at least we now know, without doubt, who to hold accountable, because there are no excuses left.

The larger issues – Hezbollah’s weapons, the STL and sectarianism as a whole – are linked to a dysfunctional economy and government

Economic growth crashing to 1.3 percent

Lebanon’s real gross domestic product growth for 2011 is expected to be just 1.3 percent, according to the Economist Intelligence Unit’s (EIU) latest country report, down from an estimated 7.5 percent in 2010. The EIU attributes the slowdown to national and regional political instability. The report indicates that the country’s economy is subject to shocks in the service sector, which is heavily reliant on political stability. Private consumption is expected to decline when compared to figures from 2007 to 2010 and businesses are predicted to invest less in the growth of their companies. Political instability stunts the government’s contributions to growth, while also hindering the decision-making process with regard to the state’s budget. EIU’s report also predicts average inflation to climb 5.5 percent in both 2011 and 2012, as the prices of oil and food continues to increase.

Israel still hobbling Palestinian workforce

There was little progress related to the condition of workers in Arab territories occupied by Israel, apart from a few improvements on free movement, says the International Labor Organization’s (ILO) annual report. It notes that settlements are the main cause of the amputation of Arab land, the limits on access and movement, territorial disintegration and the depletion of natural resources. Unemployment rates in these areas hit 23.7 percent in 2010, while youth unemployment accounted for 39 percent of that total. According to the report, the sustained blockade of Gaza forces the population to survive on humanitarian aid, while the unofficial “tunnel economy” has become the key driver of the surviving economic activity. According to the report, there are restrictions on Palestinians with residency permits in occupied East Jerusalem, while the destruction of homes and annulment of identification cards persists. Furthermore, the Israeli government extended its subsidized agricultural development in the Jordan Valley while water and land is restricted for Palestinians. Realizing the potential of the Palestinian Fund for Employment and Social Protection, according to the report, must be a priority regarding poverty alleviation, the protection of the unemployed and the securing of practical options for Palestinian workers that depend on work within the settlements. It also urges a review of the wage system and methods of resolving the grievances of Palestinian workers against Israeli employers.

Arabs vote for domestic workers’ rights

The International Labor Organization’s (ILO) convention stipulating that domestic workers have the same essential labor rights as those granted to other workers passed easily last month at the 100th annual ILO conference. The convention was adopted with 396 votes for, 16 against and 63 abstentions. Of the estimated 22 million migrant workers in the Middle East, one third are domestic workers — most of whom are women from Asian and African countries, namely Sri Lanka, the Philippines, Bangladesh, Nepal, Indonesia and Ethiopia. Saudi Arabia alone hosts 1.5 million migrant domestic workers, while Lebanon hosts 225,000 and Jordan 77,000. Workers in the these countries are excluded from national labor legislation and social security, and are attached to their patrons through what is called a restraining protection system. Patrons hold their passports and papers, and workers are often not allowed outside the home on their day off. Abstaining delegations included Britain, Malaysia, Singapore and Thailand. Member states will have to present the new labor standards to their national competent authorities for the convention to be ratified.

EMLED’s impact

Relief International’s (RI) three-year local development program Empowering Municipalities through Local Economic Development (EMLED) — or Baladiyat as it’s known locally — came to a close in June. The program operated in conjunction with Beyond Reform & Development and worked with 130 municipalities, 213 local businesses and more than 3,000 citizens. More than 400 jobs in rural Lebanon were created and RI trained approximately 600 municipal officials on local economic development, strategic planning and public private partnerships. RI also trained more than 1,000 people in business, information technology and other skills.

More Lebanese marriages in Cyprus

The Lebanese have been packing for short trips across the water more than ever lately, according to recent figures published by the Cyprus Tourism Organization (CTO). The CTO stated last month that the number of Lebanese arriving to Cyprus increased by 34 percent in 2010 compared to 2009. A total of 20,650 tourists in 2010 came across the water, compared to 15,450 in 2009. Vassilis Theocharides, director of the CTO, stated that a large part of the influx was due to an increasing number of people coming to conduct a civil marriage, which is not possible in Lebanon. “We have noticed a marked increase in incentive trips to Cyprus from the Middle East and India. We also noticed a growing popular trend for ‘marriage tourism’ from Lebanon, where conducting civil marriages in Cyprus is becoming increasingly popular,” he said. The figures also revealed that the average duration of a vacation is 4.2 days, with average spending at $771.75.

Gaza nears 50 percent unemployment

Following Israel’s land, air and sea blockade on the Gaza Strip, unemployment in the besieged area has hit 45.2 percent, according to a United Nations aid agency report released last month. The UN Relief and Works Agency for Palestine Refugees (UNRWA) uncovered that by the second half of 2010 real salaries had decreased 34.5 percent since the blockade began in June 2006. The apparent change in policy by Cairo to partially open the Rafah crossing on the Egypt-Gaza border last month has done little to alleviated the suffering of Gaza’s 1.5 million residents, given that only a pittance of the tens of thousands of Palestinians applying for a permit to enter Egypt have been granted one, and no commercial traffic has been allowed to cross the border in either direction. UNRWA also reported that Gaza’s working-age population grew by 2 percent in the second half of 2010, thus increasing the urgency for job creation.

Tunisia’s post-revolutionary economic mire

Tunisia’s economic growth rate will hit 1.5 percent in 2011, according to the World Bank’s (WB) “Global Economic Prospects” report released last month. The World Bank’s report indicated that the country’s industrial production dropped by 9 percent during the first quarter of 2011. Moreover, tourist arrivals dropped 45 percent in the first quarter of 2011 compared to the previous year. Making matters worse, Tunisia’s remittance inflows may drop by 2.5 percent during 2011. The report also stated that the interim government took measures to encourage businesses with a $1 billion multi-donor package aimed at helping the economic situation of the country after the revolution. Relatively, however, 1.5 percent growth isn’t bad for a country fresh from a revolution.

Tax-free shopping edges up

Lebanon’s tax-free spending increased 3 percent compared to the same period last year, according to a report on the first five months of 2011 by tax refund service Global Blue. Tax-free spending by United Arab Emirates (UAE) nationals increased 9 percent year-on-year. However, spending by Egyptian and Jordanian visitors dropped 27 percent and 16 percent, respectively, over the covered period. Spending by Saudi Arabian tourists comprised the bulk of the total, constituting one-fifth of all tourist spending, followed by the UAE (12 percent), Kuwait (9 percent) and Syria (8 percent). Of total refunds, 70 percent were in the fashion and clothing sector, while watches accounted for 10 percent and perfume and cosmetics 5 percent. The report also stated that Beirut is still by far the leading city in the country with respect to measurable spending activities, accounting for approximately 85 percent of the total, followed by Metn (11 percent), Keserwan (2 percent) and Baabda (1 percent).

BLOM Stock Index (BSI)

Weighted effective yield of eurobonds

Exchange update

Activity on the Beirut Stock Exchange (BSE) continued its downward trend during the period between May 16 and June 17, 2011, as local and foreign investors remained cautious amid the delay in the formation of a new cabinet. This was aggravated by the adverse political developments in the region. The BLOM Stock Index (BSI), a gauge of Lebanon’s equity activity, hit its lowest level in two years at 1,357 points on June 8, before bouncing back over the next two days in the positive political climate surrounding the formation of a new government. Nevertheless, the trend was reversed on June 13, as investors were skeptical about the nature of the cabinet.

The BSI retreated on a monthly basis by 2.49 percent to reach 1,362 points by June 17, 2011, its year-to-date performance trending downwards at -7.7 percent. Cross trades of Solidere and BLOM listed stocks lifted the daily average volume per month to 306,829 shares, with a value of $3.22 million, compared to 213,320 shares worth $1.19 million during the prior period. On the regional front, the BSI outperformed the MSCI Emerging index, which declined by a monthly 3.25 percent to 1,107, while the S&P Pan Arab Composite LargeMidCap index fell by 2.26 percent to 115 points.

Banking stocks captured the bulk of trades during the aforementioned period, accounting for 54 percent of the total value traded. BLOM’s Global Depositary Receipts (GDR) and common stocks retreated from their previous close on May 13 by 5 percent and 3.4 percent, respectively, to settle at $8.93 and $8.50 on June 17. Byblos’ common stock also lost 4.37 percent, falling to $1.75. As for BEMO Bank, its common stock slid by 0.36 percent to close at $2.76, while its preferred stock 2006 dropped by 8.3 percent to close at $100.

Regarding Bank Audi, its GDR rose 2.4 percent to $7.69, while its common stock remained flat at $7. It is worth highlighting that Bank Audi converted 4,893,576 shares of “Audi Listed” to “Audi GDR” on May 19. With respect to Bank of Beirut, its common and preferred “D” stocks advanced, with the former rising 0.53 percent to $19.1 and the latter adding 4.27 percent to $26.38. Also of note, on May 23 BLC Bank listed 133,333 additional new shares on the BSE.

The performance of the real estate stock, Solidere, was strongly affected by the unstable local and regional political situation. As a result, Solidere A and B stocks lost 5.6 percent and 5 percent, respectively, from their previous close on May 13 to settle at $17.80 and $17.70.

Manufacturing stocks, on the other hand, closed on a positive note, as Holcim, Ciment Blancs “B” and Ciment Blancs “N” advanced 0.86 percent, 1.66 percent and 34.78 percent, respectively, to $17.6, $3.07 and $1.55.

Bond bulletin

With respect to debt instruments, the Lebanese Eurobond market maintained its uptrend between May 16 and June 17, 2011, as investor confidence in the Lebanese fixed-income market increased following the successful rollover of $1 billion worth of bonds in May 2011. Demand was mainly observed on the medium and long-term bonds, pushing the BLOM Bond Index (BBI) up 0.38 percent to 109.84 points. Consequently, the weighted yield on holding Eurobonds fell by 30 basis points (bps) to 5.20 percent, and the spread against the United States benchmark yield widened by 20bps to 389bps. Lebanon’s five-year credit default swap was trading between 328bps and 353bps on June 17, 2011, compared to Dubai’s 325bps to 345bps and Saudi Arabia’s 103bps to 107bps.

The very wealthy are generally understood to be natural stakeholders in luxury. With Capgemini and Merrill Lynch presenting their 15th World Wealth Report last month, Executive sat down with Tamer Rashad, head of Middle East at Merrill Lynch Wealth Management, to inquire about the luxury and ‘passion’ investments of high net worth individuals (HNWIs).

- The World Wealth Report analyzes buying and investments related to luxury as a specific area covered separately from financial investments. What distinguishes the Middle East from other world regions in these investments of passion?

Let me start by defining and describing what’s included in investments of passion. We have luxury collectibles, like automobiles, boats, jets, etcetera. We have art across different categories. We have jewelry, gems and watches, as well as other collectibles, such as coins, wine, antiques, etc. Then there is sports investment, which is basically investing in sports teams, sailing, racehorses, etcetera. There are other investments which we fit under miscellaneous [passion investments].

- As it analyzes the relative allocations of funds to these categories, what does the 2011 report say about the preferences of regional HNWIs?

If you look at how high net worth individuals around the world invest in these categories, you’ll find that luxury collectibles [account for] about 29 percent globally. In the Middle East, it’s the same (29 percent). Art at a global level is 22 percent, while Middle Eastern investors put in only 17 percent; very similar to North America, which is 18 percent, while investment in art in Latin America, with 28 percent, is significantly higher.

If you look specifically at jewelry, watches and gems, the Middle East seems to invest the most across the whole world in these assets, with 29 percent. The global average is about 22 percent. Europe has the lowest, 17 percent. And in terms of other collectibles — coins, wine, antiques and so forth — you will find that the Middle East is the lowest region, at only 8 percent; in Japan it’s 18 percent and North America 16 percent. The other key factor is when it comes to sports investment. The Middle East has the highest percentage, with 13 percent relative to the global average of 8 percent.

- Last year’s report said that “other collectibles were favored by HNWIs in the Middle East, second only to art, because of their potential to return financial gain.” Did you observe that Middle Eastern collectors differ from other HNWIs in having a higher attention to the value-storage and resale potential of the collectibles?

Well, I think that individuals invested in investments of passion are seeking return, but they are also investing in things that they personally care about. But there is also a cultural influence in this. For example, you find with sports investment, the highest in the world is in the Middle East, while wine investment in the Middle East is the lowest in the world, for obvious reasons.

- Do you see a level of correlation between the number of high net worth individuals and their increases in wealth and the luxury market?

Absolutely. The report is important for people who operate in wealth management but also for anyone in a sector or industry that serves high net worth individuals or ultra high net worth individuals.

- Is advising on investment in luxury pretty much the same game as advising on financial investment?

It varies from one client to another but we look at the overall financial situation of the individual. There is wealth preservation, wealth creation, wealth transformation from generation to generation, and that’s all in consideration of investment for passion as a component of the bigger picture and the overall asset allocation.

Capital inflows to MENA to slump

Net capital inflows to the Middle East and North Africa (MENA) region are forecast to drop 28 percent in 2011, from $80.6 billion in 2010 to $60.3 billion, according to an Institute of International Finance (IIF) report entitled “Capital Flows to Emerging Market Economies” issued earlier last month. Meanwhile, net capital outflows from the region are expected to rise to $221.5 billion for 2011 against the backdrop of political turmoil, a 74.55 percent increase from $126.9 billion in outflows a year earlier. The report said foreign direct investment (FDI) in the MENA region would rise by $8.2 billion this year, which would compensate for portfolio investment losses and the drop in inflows from banks and private creditors. While account surpluses have more than doubled for the United Arab Emirates and Saudi Arabia, buoyed by increases in oil prices, the report highlighted that some countries have suffered from large capital outflows and account deterioration, namely Egypt. Estimates for the country’s total outflows reached $16 billion, largely due to a slump in tourism activity, an $8 billion drop in reserves and a sharp fall in FDI. For Lebanon, the IIF projected the current account deficit to widen from 15.9 percent of gross domestic product in 2010 to 17.7 percent for 2011, and net private capital inflows to decline by 49.35 percent in 2011 to $3.9 billion, compared to $7.7 billion a year earlier, due to the country’s political situation.

BDL regulates money dealers

In an effort to deter money laundering and terrorism financing, Banque du Liban (BDL), Lebanon’s central bank, issued a set of circulars to regulate the operations of money dealers in the country. The directive includes mandatory training courses on anti- money laundering and terrorism financing for all persons involved in the direct or indirect management of money dealer institutions. The circular also prohibits them from opening accounts at any bank at which their partners, owners, shareholders, managers and members of the board of directors hold personal accounts and from depositing cash directly into their clients’ accounts or accepting to represent third parties. It also requires that money dealers notify the Banking Control Commission (BCC) of any bank with which they work. The circular also stipulates that money dealers appoint a compliance officer and exchange bureaus an internal auditor to make sure their operations are aligned with the regulations of BDL, BCC, and Lebanese central bank’s Special Investigation Commission (SIC). One of the circulars sets a minimum capital of 5 billion Lebanese lira [$3,333,333] for money dealing institutions, adding that the latter’s accounting transactions must segregate shipment of cash and precious metals from those of other operations. Per the new regulations, money exchange institutions and banks that ship bank notes or precious metals between Lebanon and abroad must notify the BCC and BDL’s Directorate of the Financial Markets of the detailed number and volume of such shipments through monthly financial statements. And lastly, money dealers will be required to send monthly, quarterly, semi-annual and annual financial statements to the BCC and BDL’s Directorate of Financial Markets.

Cost of sending remittances to Lebanon drops

According to figures released by the World Bank, the cost of sending remittances to Lebanon dropped in the first quarter of 2011. A $200 transfer from the United States to Lebanon costs $25.10 in nominal terms, almost 12.6 percent of the total amount, a decline from 13.2 percent for the same period the year before. Likewise, the cost of sending $500 amounts to $27.70, 5.53 percent of the transfer and a decrease from 5.74 percent for the first quarter of 2010. The survey was conducted on 24 countries, among which 11 were in South and Central America, seven in East and Southeast Asia, three in the Caribbean and two in Africa. Lebanon ranked as the most expensive destination for $200, and sixth for $500 US transfers. Including a transaction fee and an exchange rate margin, the cost represents the average charges for transferring money through commercial banks and money transfer operators, which amounted to 17.2 percent and 6.2 percent for the first three months of 2011. On a side note, the World Bank also revised 2010 expatriates’ remittance inflows to Lebanon upwards to $8.4 billion, compared to an $8.2 billion forecast in November 2010.

Lebanon’s NACB bank freezes Libyan assets

In compliance with United Nations Security Council resolutions 1970 and 1973, Lebanon’s North African Commercial Bank (NACB) froze an undisclosed amount of assets belonging to the Libyan regime in June. Both resolutions mandate that member states freeze any economic or financial resources owned or controlled by the Libyan regime, whether directly or indirectly. A spokesman for NACB, which is 99.54 percent owned by the Tripoli-based Libyan Foreign Bank and formerly known as The Arab Libyan Tunisian Bank, dismissed news reports that the bank had ceased its commercial activities since February 2011. Further tightening the financial sanctions on the Libyan government, the United States Department of the Treasury (DoT) released a statement on June 21 blacklisting and prohibiting U.S. transactions with nine companies controlled or owned by Muammar Qadhafi’s regime, including NACB, the Arab Turkish Bank and Tunisia-based North African International Bank. The DoT exempted other financial institutions based in foreign countries and overseen by the Libyan government from these sanctions, provided their operations do not benefit the Qadhafi regime, or any Libyan entities and individuals who have previously had their assets frozen.

And the rich get richer

The worth and number of global high net worth individuals (HNWI) have surpassed 2008 pre-crisis levels, growing by 8.3 and 9.7 percent in 2010 respectively, according to Merrill Lynch and Capgemini’s 2011 “World Wealth report”. The number of HNWIs in the Middle East reached 40,0000 in 2010, an annual increase of 10.4 percent, while the region’s wealth was estimated at $1.7 trillion, up by 12.5 percent from a year earlier. At 32 percent, fixed-income assets made up the bulk of total financial assets held by Middle Eastern HNWIs, followed by equities at 28 percent, real estate at 18 percent, cash and deposits at 16 percent and alternative investments at 6 percent. The report also shed light on ‘passion’ investments — such as art, luxury collectibles, jewelry, jems and watches. The majority of Middle Eastern HNWIs biggest ‘passion’ appears to be luxury collectibles, which stood at 29 percent of their total investments of passion in 2010; their allocation to jewelry, gems and watches was reduced from 35 percent in 2009 to 29 percent in 2010. Meanwhile, art and sports investments took away 17 percent and 13 percent of Middle Eastern HNWI wealth dedicated to passion in 2010, respectively.

On a local level, the report said the key drivers of HNWI wealth in Lebanon for 2010 included a real gross domestic product growth of 7.2 percent, an increase in real private and government consumption, a continuous rise in property prices, large capital inflows, rapid de-dollarization and containment of inflation at around 4.5 percent. The main inhibitor to growth in Lebanese wealth in 2010, according to the report, was the country’s fiscal policy as its government debt, which stood at 148 percent of gross domestic product by end of 2009, was still among the highest in the world. The report showed that globally, HNWIs’ greatest concern was the impact of the economy while some 69 percent of HNWIs were concerned that future generations would not adequately manage their inheritance.

BDL foreign reserves see slight dip

In its May 2011 balance sheet, Banque du Liban (BDL), Lebanon’s central bank, recorded a 0.74 percent decline in its foreign currency reserves for the second half of the month, a depreciation of $224.15 million to $29.95 billion, down from $30.18 billion for the first two weeks of May 2011. This would be the first time BDL’s foreign reserves slip below the $30 billion mark since March 2010, a decrease mainly attributed to weakened investor sentiment in Lebanon amid political instability in the country and the neighboring region. Meanwhile, BDL’s gold reserves appreciated by a bi-weekly total of 1.61 percent to $14.18 billion for the second half of May 2011, following the surge in prices of precious metals.