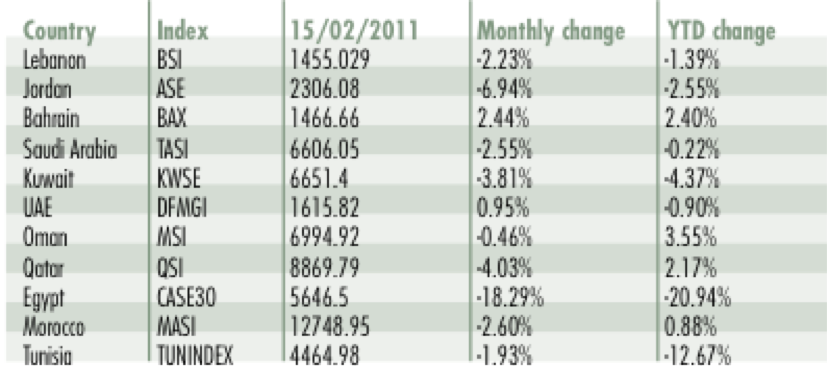

Regional stock market indices

Regional currency rates

UAE developers down at end 2010

Real estate firms in the United Arab Emirates suffered from poor earnings results in the fourth quarter of 2010. Abu Dhabi-based Aldar Properties reported a net loss of $3 billion in the quarter, accounting for its overall $3.07 billion loss for the year. Sorouh Real Estate, Abu Dhabi’s second largest developer by market value, also posted a net loss of $54.18 million compared to a net profit of $7.65 million a year earlier, as its revenues for the last quarter of 2010 fell 51 percent to $58.26 million. Moving to Dubai, Emaar Properties, UAE’s biggest developer by market value, registered a 62 percent decline in net income during the fourth quarter of 2010 to $74.6 million, down from $196.03 million a year earlier. Union Properties’ fourth quarter net loss increased as well, climbing fivefold to $211.8 million compared to a loss of $40.29 million registered in the same period last year, due to losses on property valuations.

Saudi oil production to rise 15.4 percent by 2020

Saudi Arabia’s government stated that local oil production increased significantly during December 2010 to a two–year high of 8.365 million barrels-per-day (bpd), recording a 1.3 percent increase since November. Separately, Business Monitor International (BMI) forecasted a 15.4 percent rise in Saudi oil production between 2010 and 2020, with output reaching 11.4 million bpd by 2020. BMI also expects oil consumption in the Kingdom to increase 40.1 percent during the same period, to 3.91 million bpd. In the near term, BMI believes local oil demand will climb from an estimated 2.79 million bpd in 2010 to 3.38 million per day in 2015, accounting for 38.8 percent of the Middle East’s regional oil demand.

The region’s idiosyncratic unemployment enigma

The number of unemployed in the Arab world is forecasted to reach 19 million by 2020, according to Kuwait-based think tank, Arab Planning Institute (API). The Middle East and North Africa region has been suffering from sluggish labor markets for some time, despite the fact that the workforce is generally young and shows 3.5 percent growth per year, relative to an average 3.1 percent population growth since the 1980s. This favorable employment dynamic has, however, not been used to benefit the region’s development and most MENA countries still lag behind in female employment rates, with less than 40 percent of women eligible for work employed in the labor force. North African countries, however, generally score better in this category, as up to 65 percent of the female population is in the labor force. Another factor contributing to high unemployment in the Arab world is the few job opportunities available for the educated. For instance, up to 50 percent of the unemployed in Tunisia and 44 percent in Morocco have secondary and tertiary degrees, according to API. Under these conditions, a large percentage of people eligible for work become discouraged, excluding themselves from the labor force. Unemployment rates in MENA countries are thus somewhat skewed and expected to remain in the range of 11 to 15 percent over the next decade.