It may come as a surprise that Palestine has a successful stock exchange, especially given the recent political difficulties that have dislodged the economy. However, with a total market capitalization of $1.9 billion, the Palestinian Securities Exchange (PSE) accounts for only a small portion of the would-be state’s economy and investment opportunities. Inevitably the exchange’s development and economic prospects will be intricately linked to the outcome of the new peace negotiations kicked off by the Annapolis talks in late 2007. Nonetheless, given political stability, it has strong potential for growth, a factor that led Kuwait’s Global Investment House (GIH) to take a 10% stake in the exchange, in February 2007.

Based in Nablus, with offices in Ramallah, the PSE is controlled by the Palestinian Development and Investment Company (PADICO) and was incorporated in 1995, following a period of relative optimism. During this time a significant number of successful and ambitious diaspora Palestinians were returning home with the intent to build what they hoped would become their nation-state. The first shares were traded in February 1997, but since then the economy and investor confidence have often taken a battering, first at the hands of the second intifada and more recently from the infighting between Hamas and Fatah. Although stocks have at times suffered heavily, especially during the last two years, the PSE itself has weathered the storm well. As Talal Samhouri, head of Asset Management in the MENA region for GIH, said, “the exchange is actually in really good shape, with excess capital and equity it has been making money even through the bad times of 2007.”

Politically limited risks

Anybody who has heard the age-old adage “Warning: Prices can go down as well as up!” will be well aware that there can be difficult times but there are also bumper years. In 2005 the total market capitalization reached $4.5 billion and the Al-Quds Index increased by 306%. These were among the highest growths in the world that year, partly as a correction to previous weaker, politically difficult years and partly due to improved performance of listed companies combined with the optimism that Gaza disengagement seemed to hold. As is particularly the case in politically volatile countries, little did they know what lay ahead. By year-end 2006 market capitalization had decreased to $2.7 billion, losing 38% of its value, a trend that continued through 2007, which it ended at $2.35 billion, a 13% drop year-on-year. The services index was the best performing sector of 2007, down a mere -5.42% while the insurance sector slumped -41.13% on the previous year.

Samhouri explained that, “in some ways the nice thing about the PSE is that it has a very high correlation with political improvement.” This is borne out by the recent gains on the exchange: the second half of 2007 saw steady improvement, although not enough to get out of negative territory for the year as a whole. Performance in early 2008 has been strong with 11% gains on the Al-Quds Index in the first three weeks of trading.

In many ways the PSE is ahead of its field compared to local exchanges. It was supposed to have been the first Arabic stock exchange to go public but due to the adverse political situation that has dominated since 2006 the offering was postponed. Although the exchange itself was ready to take the measures, the closure of government departments with many staff not having been paid for months made it impossible to push through the legal and bureaucratic requirements. Since the PSE is owned by PADICO, which is also listed on the exchange, the IPO is seen as an essential step in removing any conflict of interest. In the end, it was the Dubai Financial Market that was the first Arabic stock exchange to list, in November 2006.

All being well politically, the IPO is planned to take place in 2008. GIH, who have board representation on the PSE, see their investment in it as a private equity opportunity and are confident of achieving high returns. Samhouri thinks that “we can see improvements coming in the future and can hold for the next few months or years until the situation stabilizes because then there will definitely be improved market conditions.”

Certainly, the developments since the Annapolis peace talks began seem to indicate that the American administration is prepared to push harder than before to achieve an equitable solution that would eventually allow the conditions to which Samhouri refers to take root. Bush’s use of the word “occupation” and his assurance that Abbas is as much a partner in peace as Olmert are good news to investors in the Palestinian economy, just as they are to Palestinian citizens. However there is still a sense that Annapolis is too little, too late in the presidency and to achieve stability will require, as much as anything else, the next US president to take up the reigns of the peace process at the start of his or her presidency rather than the end.

Stock exchange a winner in volatile market

Although political instability is bad news for the stocks themselves it can actually translate into good business for the exchange. As Samhouri pointed out, “this is the great thing about stock exchanges, they make money whether the market is going up or down.” The last two years of plummeting stocks have led to large and volatile trading volumes, a winner for the stock exchange, which makes its money on commissions. All the same, at times it has been forced to take precautionary actions, closing on three occasions in the last two years following major events and having to restrict price fluctuations to 3%, rather than 5%, following Hamas’ election victory.

The PSE has state of the art trading systems, was among the first exchanges in the region to introduce e-trading in April 2007 and as such is well equipped to deal with volatile market trading conditions. However, the PSE’s location in Nablus, much better known for its frequent occurrence in the news as a flash point in the Israeli-Palestinian struggle, may leave doubts with potential investors as to its reliability. Dr. Abu-Libdeh, chairman and CEO of the PSE, has commented on this to the international press, “The challenge for us, as I see it, is not in securing the administrative, logistical and infrastructure conditions for the work, its convincing an investor in Dubai that it is worth investing in Palestine through the stock exchange.”

In his opinion, “the prices in shares are very much undervalued […] and the analysis of the companies shows beyond any shadow of a doubt that these companies are doing very good business; they are really solid in terms of their plans and ability to strike operational profits.”

Perhaps the exchange’s main weakness is its size. With only 35 companies listed, the total market cap of $1.9 billion is only a fraction of the potential and in no way constitutes a liquid secondary market. Nearly two-thirds of this market cap is dominated by just three companies, namely; the Palestinian Telecommunications Company (PAL TEL) accounting for about one-third; PADICO for a fifth and the Bank of Palestine for a tenth.

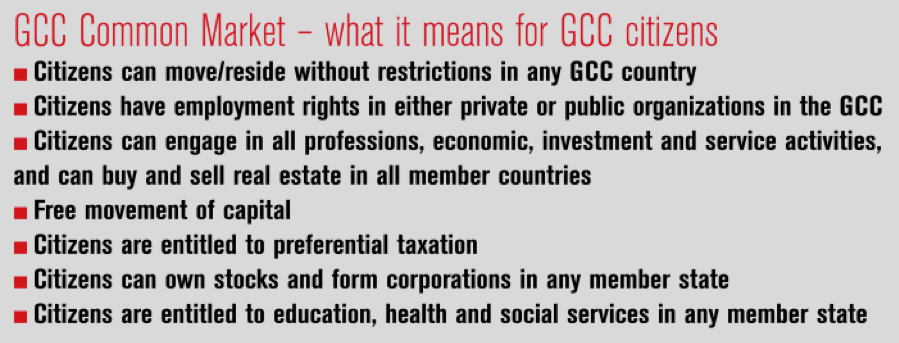

In coming years the exchange hopes to develop stronger relationships with other regional bourses. To date it already has a memorandum of understanding with the Cairo and Alexandra Stock Exchange and is in negotiations with other regional exchanges, including Oman, Jordan, Qatar, Bahrain and the Dubai Financial Market to set up closer relationships. A pan-Arab platform is also in discussion, over which exchanges would be able to swap blocks of shares. The board of directors hopes that measures such as these, together with the investment and board participation of GIH, will improve their visibility to other nations, particularly the cash heavy GCC.

Resumption of aid will help

Improvements to the broader Palestinian economy, or that of the West Bank at any rate, can be expected following the resumption of international aid and the pledge of $7.4 billion from over 70 countries and 20 organizations at the Paris donors conference. The sum was significantly more than the $5.7 billion that the Palestinian Authority requested and will translate to improved financials for companies listed on the exchange as the money filters through the economy. With this in mind though, according to the World Bank, the single biggest obstacle to improving the Palestinian economy are the restrictions on the movement of people and goods. Improvements on these fronts would lead to far greater trade and significant gains on the Al-Quds exchange.

No matter what happens, the PSE seems set to stay put but the degree of its success will depend on the peace talks and their outcome. As Abu-Libdeh has commented, “We are entertaining a lot of options for the future, but it all hinges on what happens to the political process, if it doesn’t give us the breathing room we need it will be difficult to generate the necessary interest to continue growing.” That said, if prospects continue to improve (at least in the West Bank) then the PSE could buck the trend of decreasing world stocks caused by fears of a US recession. The London Stock Exchange recently saw its largest decrease in value since 9/11, while elsewhere bear markets are emerging in many of the world’s leading economies. Should the peace talks gain momentum then the Palestinian Stock Exchange could be one of the biggest beneficiaries of Annapolis.