There is no greater form of hospitality than that of welcoming people into your sanctuary, the comfort of your home. This tradition was once embedded in the lives of most Lebanese who would keep their houses’ front doors constantly open to welcome visitors. With the passing of time and the shift in priorities in our increasingly busy lives, our front doors open less frequently. Now, it is only occasionally that we receive guests, let alone host brunches, lunches and dinner parties in the privacy of our houses.

Most people have become hard-working professionals whose leisure time is too precious for them to spend in the kitchen cooking. That is why when they want to treat themselves to a fancy meal, whether alone or in company, they either go to one of the many restaurants that Beirut’s hospitality scene has to offer, or request the services of a catering company renown for delivering succulent food.

Nothing trumps a cozy gathering in one’s humble abode. It not only offers a unique charm but also a certain value. Family feels loved, friends feel appreciated and acquaintances or business relations feel respected. This is why a couple of Lebanese entrepreneurs have decided to implement a business model that would surely encourage people to go back to hosting the good old-fashioned way.

Fadi Kharrat and Jean Fares are initially engineers who specialized respectively in Design & Contracting and Management Consulting. They are also food lovers who really enjoy hosting people and holding get-togethers. When they stumbled upon a video illustrating a concept of chef-at-home, one that they knew to be foreign to the country according to their own experience, they immediately became inspired to customize and apply it within the Lebanese market. Soon after, they were joined by a third partner, Makram Raydan, the man behind the start-up’s web development. Hence the design of ‘BiBayti’, which literally means ‘in my home’ and so perfectly embodies the venture’s primary theme.

Indeed, BiBayti’s chief aim is to turn receptions in one’s home into a hassle-free and enjoyable experience thanks to the services of a talented culinary artist who would be solely responsible for all aspects of the meal served on that occasion. From picking and buying the necessary ingredients beforehand, to preparing and cooking the meal in-house, to crafting the food display and presenting the recipes to the guests; all would be handled by a talented cook, taking the edge off the host in the best possible way.

Indeed, BiBayti’s chief aim is to turn receptions in one’s home into a hassle-free and enjoyable experience thanks to the services of a talented culinary artist who would be solely responsible for all aspects of the meal served on that occasion. From picking and buying the necessary ingredients beforehand, to preparing and cooking the meal in-house, to crafting the food display and presenting the recipes to the guests; all would be handled by a talented cook, taking the edge off the host in the best possible way.

BiBayti.com is an online platform that links individuals who wish to host any type of event in their homes to a wide array of chefs and cooks, whose singular recipes have been personally designed. The soon-to-be launched website is expected to be simple and user friendly. One side of BiBayti.com will be the host’s platform, where hosts are invited to select the type of the event (brunch, lunch, dinner), the preferred date, as well as the area of their home. Once that is confirmed, they will start browsing the different personal menus pertaining to the various professional chefs and amateur cooks. The latter would have also specified their availabilities during a typical week.

The other side will be the chefs’ and cooks’ back end of the website. Each of them presents a description of themself and their specialties (with photos that give the host a good idea of the recipes’ presentation), a copy of one or more of their individually engineered and detailed menus, in addition to the pricing relative to the number of people each recipe can accommodate. Communication between parties starts as soon as the hosts make their selection. Slight modifications to the menu can occur after this selection, both in terms of quantity and specific ingredients.

Finally, an e-payment is made prior to the event so that the assigned chef can start planning their purchases in preparation for D-Day. However, and this is one of the instances where BiBayti management exercises its behind-the-scene control, the e-payment is blocked until 24 to 48 hours following the event, during which the management collects the needed feedback regarding the event. After making sure the host’s expectations are met, the payment is then wired to the relevant chef.

As asserted by the partners, this set-up would guarantee fairness vis-à-vis both parties. The cooks won’t have to worry about shenanigans that could occur in such situations, and the hosts would feel protected from unfortunate surprises. Needless to mention, BiBayti’s cancellation policy allows for a certain period of time for the host to retract and cancel their reservation of the chef in question.

Yet, BiBayti.com management’s mission extends beyond matching people and monitoring the service revolving around its platform. Through their new online venture, the partners want to announce as many of the amateur cooks to the greater public as possible, as well as provide easier access to the professional chefs among them, the direct result of which also being the discovery of many new tastes and flavors.

But most importantly, by introducing that special experience to people’s homes, they are hoping to create a very different type of interaction between culinary artists and the individuals they are serving. Most of the time, people relishing a certain meal do not have the opportunity to meet the chef behind the food they taste, whether in a restaurant or at some venue in which a caterer provides the cuisine.

BiBayti’s principal objective is for hosts to delight in the presence of their appointed chefs and benefit from their presence not only as cooks, but more as enlightening entertainers sharing a passion embodied in the several intricate recipes they are serving.

One cannot be anything but excited about the launch of BiBayti’s website in the coming weeks as it will undoubtedly incite the hospitable ones among us to finally start planning that event they have been continuously postponing!

In the span of less than seven years, Donner Sang Compter (DSC) – a Lebanese non-profit NGO that links potential blood donors to patients in urgent need – has directly contributed to saving around 60,000 lives.

DSC was founded in January 2009 by then 23-year-old Yorgui Teyrouz, who was urged to act when he witnessed how blood shortages in hospitals directly contributed to the deaths of patients whose lives could have otherwise been spared. Teyrouz’s personal endeavor actually began in 2007 as an informal online search for donors among his circle of friends and family. A year later his work had culminated into a database which includes several thousand donors and their respective blood types. In August 2015, five years after the official registration of the NGO, the number of donors had reached 15,000.

Indeed, this small yet exceptionally dynamic organization is helping to cover more than 10 percent of the nationwide demand for blood units today, thanks to both its effective call center that connects patients to donors, as well as the rising number of blood drives it conducts with the aim of eliminating shortages at Lebanese hospitals. Moreover, it is heavily promoting and raising awareness about voluntary blood donation, with the goal of making the experience a rewarding one for participants.

Indeed, this small yet exceptionally dynamic organization is helping to cover more than 10 percent of the nationwide demand for blood units today, thanks to both its effective call center that connects patients to donors, as well as the rising number of blood drives it conducts with the aim of eliminating shortages at Lebanese hospitals. Moreover, it is heavily promoting and raising awareness about voluntary blood donation, with the goal of making the experience a rewarding one for participants.

From its founding until early 2015, DSC’s method of bridging donors and patients consisted of gathering and sharing information. Those in need of blood to help friends or relatives would contact the NGO with a request for a specific blood type and other details about the situation, including the type of operation required and the quantity of blood units needed as per the hospital’s request. In turn, DSC representatives at the call center would share a limited number of donor names from their database in waves, enabling the patient’s relatives to contact as many potential donors as possible until the demand was met. Once donors confirmed their ability and willingness to donate, DSC would personally follow-up with them.

“DSC’s system was fairly basic, undeniably effective, yet relatively unethical,” confesses DSC’s president Teyrouz. “But it was either that or nothing. We didn’t have the necessary funds to cover the costs that would have been incurred had we done otherwise.” Yet, with people’s increasing reliance on DSC for blood, the NGO’s responsibility towards the community grew. Therefore, as of August 2015, a different system was put in place along with updated technology. “The new method will consist of centralizing the calls. DSC will be handling all communication between parties and its primary tool will be Whatsapp. We found that to be the most effective model in terms of practicality, time effectiveness and cost saving,” states Teyrouz.

“DSC’s system was fairly basic, undeniably effective, yet relatively unethical,” confesses DSC’s president Teyrouz. “But it was either that or nothing. We didn’t have the necessary funds to cover the costs that would have been incurred had we done otherwise.” Yet, with people’s increasing reliance on DSC for blood, the NGO’s responsibility towards the community grew. Therefore, as of August 2015, a different system was put in place along with updated technology. “The new method will consist of centralizing the calls. DSC will be handling all communication between parties and its primary tool will be Whatsapp. We found that to be the most effective model in terms of practicality, time effectiveness and cost saving,” states Teyrouz.

Although the current number of donors registered in DSC appears to be relatively high, Teyrouz says that it should be significantly higher because the growing demand is exceeding supply. DSC found two ways to remedy the situation.

First, it will focus on increasing its personal reserve of blood units through a new strategy of scheduled blood donations. Instead of only responding to emergencies and trying to find blood units according to incoming calls, DSC will establish a method of continuous follow-up with its donors to maximize the number of blood units donated over a shorter period of time in less time. This type of stock monitoring will allow DSC to be better prepared to handle emergencies and be more aware of the amount of blood units it can provide straight away. This way, its call center will function more efficiently.

First, it will focus on increasing its personal reserve of blood units through a new strategy of scheduled blood donations. Instead of only responding to emergencies and trying to find blood units according to incoming calls, DSC will establish a method of continuous follow-up with its donors to maximize the number of blood units donated over a shorter period of time in less time. This type of stock monitoring will allow DSC to be better prepared to handle emergencies and be more aware of the amount of blood units it can provide straight away. This way, its call center will function more efficiently.

Secondly, DSC will keep focusing on its blood drives, which will in turn help hospitals meet their demand. “In 2014 we were able to conduct 125 blood drives from which alone we gathered 6,000 blood units,” says Teyrouz. Since DSC’s representatives are not allowed to perform blood transfusions themselves, the NGO needs to borrow the services of qualified nurses from the hospital for which they are conducting the blood drive. Indeed, each blood drive contributes to filling the stock of each respective hospital for the current demand period, which increases for the next period of time. That time frame can be a maximum of two weeks or only a few days, depending on that hospital’s size and needs.

However, DSC is doing much more than simply filling stocks when it conducts blood drives. One of its chief goals is to change people’s perception, as well as the experience, of giving blood. DSC is doing its utmost to turn the act of donating blood into a rewarding experience rather than a dreadful chore, and one that donors might actually look forward to.

The way it achieves this is by choosing agreeable locations for the drives, and making the process as easy and comfortable as possible. DSC’s members make it a point to explain the procedure to donors and create a positive atmosphere by entertaining and rewarding them with snacks and refreshments when they are finished.

The way it achieves this is by choosing agreeable locations for the drives, and making the process as easy and comfortable as possible. DSC’s members make it a point to explain the procedure to donors and create a positive atmosphere by entertaining and rewarding them with snacks and refreshments when they are finished.

“People are usually reluctant to go to hospitals or blood centers to donate blood, as they perceive them to be sad and austere places. That is why we try to conduct as many of the blood drives either in people’s ‘natural habitat’ such as their office or university, or out in the open in refreshing outdoor spaces,” claims Teyrouz.

DSC, which is run by a team of highly driven and dedicated individuals, always seeks to improve its approach. Its newest project, the ‘Collecte Mobile’, will allow the organization to conduct traveling blood drives. Thanks to the Global Blood Fund’s donation in 2014 (The GBF is an international charitable organization that provides equipment, training, grants and other forms of support to help struggling blood collectors worldwide), DSC will soon be roaming the country with a bus it plans on renovating and fully equipping for the best blood donation experience one could have in Lebanon. Renovating and equipping the bus was made possible after a successful crowd funding initiative, which took place in July-August 2015. Hopefully, it won’t be long before it hits the road!

DSC, which is run by a team of highly driven and dedicated individuals, always seeks to improve its approach. Its newest project, the ‘Collecte Mobile’, will allow the organization to conduct traveling blood drives. Thanks to the Global Blood Fund’s donation in 2014 (The GBF is an international charitable organization that provides equipment, training, grants and other forms of support to help struggling blood collectors worldwide), DSC will soon be roaming the country with a bus it plans on renovating and fully equipping for the best blood donation experience one could have in Lebanon. Renovating and equipping the bus was made possible after a successful crowd funding initiative, which took place in July-August 2015. Hopefully, it won’t be long before it hits the road!

One cannot but respect and admire an organization such as DSC, which is built on a strong desire to serve the community without expecting any form of remuneration, save the humble gratification that comes with helping others.

Donating blood A is irrefutably one of the most significant charitable acts one could ever do and there is nothing more rewarding to a human being than the knowledge that a part of them was shared with another in an attempt to save their life. Yet, that deed has even more substance when the donor does not know the recipient’s identity…That it where true humanity lies.

“Give Blood. Give Life” is Donner Sang Compter’s slogan, and, as it rightfully states, “Be a hero!”

It comes as little surprise that with the coming of smartphones most people have stripped themselves of those old age address books, notebooks, calendars, recorders and even cameras, since having all those things embedded in a single device undoubtedly makes life much easier.

It comes as little surprise that with the coming of smartphones most people have stripped themselves of those old age address books, notebooks, calendars, recorders and even cameras, since having all those things embedded in a single device undoubtedly makes life much easier.

Even wristwatches have become dispensable – why would anybody need one when the first thing they notice when looking at their phone’s screen is the time of day? Having said that, the watch is one accessory that many are still reluctant to let go of, not out of necessity but out of a desire to make a statement.

One could assume that most people who adorn their wrist with a watch aim to convey a subtle message through their choice, be it in terms of their personal style, interests or status.

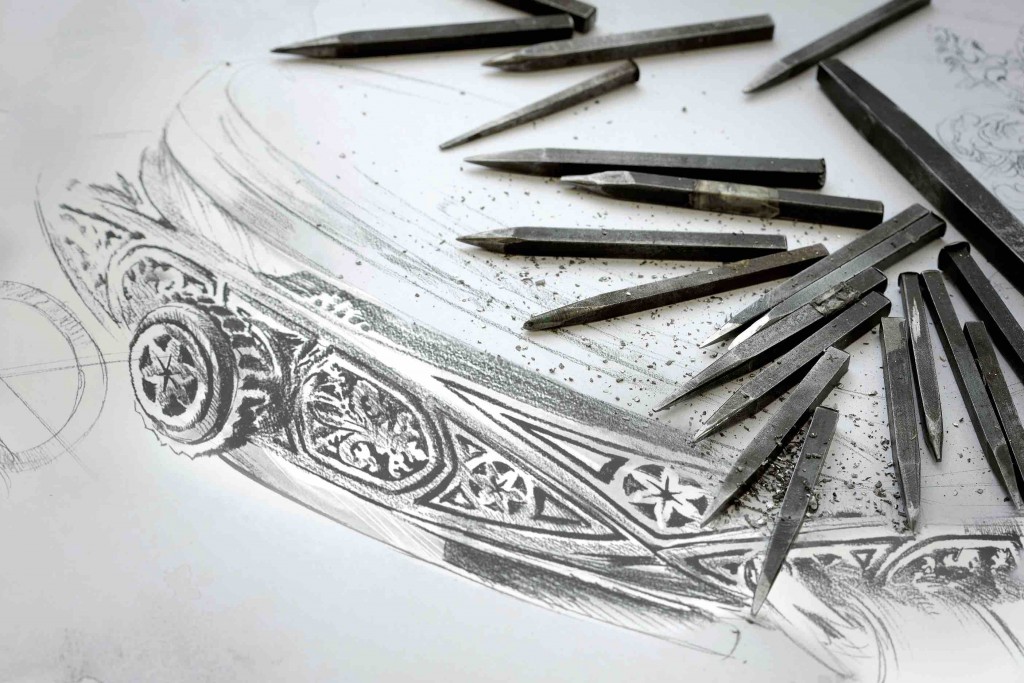

For example, people who choose to wear a Panerai opt for an imposing yet stark look; they have a strong connection to the sea and are clearly willing to spend several thousand dollars on their prized timepieces. Most importantly, Panerai lovers are watch connoisseurs who have been charmed not just by the watch, but by the brand as a whole.

Officine Panerai defines itself as a “natural blend of Italian design, Swiss technology and passion for the sea” according to the company website.

Originally named G.Panerai & Figlio, it was first established in Italy in 1860 when founder Giovanni Panerai opened his watchmaker’s shop (one that also served as the city’s first watchmaking school) on Ponte alle Grazie in Florence. The company was renamed in 1972 to Officine Panerai S.r.l.

Originally named G.Panerai & Figlio, it was first established in Italy in 1860 when founder Giovanni Panerai opened his watchmaker’s shop (one that also served as the city’s first watchmaking school) on Ponte alle Grazie in Florence. The company was renamed in 1972 to Officine Panerai S.r.l.

Since its inception over a century ago, the company dealt mainly with the Royal Italian Navy, and then in 1956 with the Egyptian Navy. That is why it created models that were designed to serve the evolving needs and requirements of navy personnel.

Panerai’s core watch models include Radiomir and Luminor. The Radiomir was first produced in 1938 and then enhanced in 1940. It was characterized by a large steel case and luminescent numerals and marks (thanks to a radium-based powder that gives off brightness) with the aim of providing better visibility underwater.

The Radiomir is a hand-wound mechanical watch that was designed to be waterproof and resistant to extreme tension. In 1950 came the second model Luminor, a different version of the earlier model, principally distinguished by the use of a new glowing powder of the same name.

It wasn’t until 1993 that Panerai introduced the first collection of limited edition watches to the public. The year 1997 was a defining moment for the brand after the Richemont Group (then Vendome Group) acquired and unveiled the company. It has since become a recognizable player in the international fine watchmaking market especially after the opening, in 2002, of its manufacturing plant Panerai Manufacture in Neuchâtel, Switzerland, where it started developing its own calibers and in-house movements as of 2005.

It wasn’t until 1993 that Panerai introduced the first collection of limited edition watches to the public. The year 1997 was a defining moment for the brand after the Richemont Group (then Vendome Group) acquired and unveiled the company. It has since become a recognizable player in the international fine watchmaking market especially after the opening, in 2002, of its manufacturing plant Panerai Manufacture in Neuchâtel, Switzerland, where it started developing its own calibers and in-house movements as of 2005.

As the company’s notoriety and customer base continues to grow, Officine Panerai makes a point of staying faithful to its original designs and prefers to refine its technical features by revisiting the mechanisms of its traditional models. Unlike other brands, it offers a limited number of pieces to the public every year. It is the consistency in the brand’s design, coupled with its exclusive feel, that makes it even more appealing to its clientele.

As the company’s notoriety and customer base continues to grow, Officine Panerai makes a point of staying faithful to its original designs and prefers to refine its technical features by revisiting the mechanisms of its traditional models. Unlike other brands, it offers a limited number of pieces to the public every year. It is the consistency in the brand’s design, coupled with its exclusive feel, that makes it even more appealing to its clientele.

“Our watches have an identity,” states Officine Panerai’s Managing Director for Middle East, Turkey and India, Mr. Milvin George in an interview with Executive. “We don’t follow the trend; we want to stay close to our roots and our brand DNA”.

“Our watches have an identity,” states Officine Panerai’s Managing Director for Middle East, Turkey and India, Mr. Milvin George in an interview with Executive. “We don’t follow the trend; we want to stay close to our roots and our brand DNA”.

One of Panerai’s boldest traits is its distinguished and well-defined brand identity. Instead of investing in traditional advertising, the brand works on attracting audiences with a similar interest in the sea, art and, last but not least, luxury goods.

Ever since the brand was first introduced to the public in 1993, its connection to the sea was made paramount when the collection was presented aboard the Durand De La Penne Italian Navy cruiser.

From that moment on, Panerai has often participated in events echoing this passion for the sea. For instance, in 2009, it acquired and restored the famous Eilean, a 1936 yacht designed by one of the most legendary yacht builders in the history of sailing, William Fife III. After three years of work, Panerai launched it at the sailing section of the Italian Navy in La Spezia. Panerai has also sponsored one of the biggest events in the world of classic sailing over the past ten years, the Panerai Classic Yachts Challenge.

At the same time as being a brand that offers handmade watches which rely on sturdy craftsmanship, Panerai has also developed an affinity with the art world and is increasingly incorporating artwork association into its brand strategy. Some of Panerai’s most noticeable collaborations include the India Art Fair, with which it has partnered for seven years, as well as the Beirut Art Fair, which it will participate in for the second time in September 2015.

At the same time as being a brand that offers handmade watches which rely on sturdy craftsmanship, Panerai has also developed an affinity with the art world and is increasingly incorporating artwork association into its brand strategy. Some of Panerai’s most noticeable collaborations include the India Art Fair, with which it has partnered for seven years, as well as the Beirut Art Fair, which it will participate in for the second time in September 2015.

For some, seeing only variations of a model that is decades old might seem like a flaw. But for those looking for a timepiece brand that is instantly recognizable by like-minded watch connoisseurs, the value of which will probably appreciate with time, a Panerai is a watch worth considering adding to one’s collection.

The recent garbage crisis has managed to expose a myriad of problems which exist in our political system. Among these is the failure of the government not only to properly deliver a basic service like waste collection, but to decide how to deliver such a service through a transparent, collaborative process. In other words, the problem is not only the outcome but the actual process, which is a key determinant of good and effective service delivery. Often, the more transparent, accountable, and inclusive a decision-making process is, the better the service is in terms of price and quality. The less transparent decision making is, the worse off the result.

With the government’s failure to provide waste collection services—generally considered to be a relatively straightforward exercise—one can only wonder how it will be able to manage a complex sector like oil and gas, which has several stakeholders with varying interests at different stages of the value chain.

Concerns of corruption

Despite being a latecomer to the Levant Basin, Lebanon moved fairly quickly in the process. The parliament passed the offshore law in 2010 and set up the Lebanese Petroleum Administration (LPA), which prepared the bidding-related decrees, only to fall prey to Lebanon’s decision-making quagmire.

The LPA, whose members mirror the sectarian representation of the country, with a one-year presidential rotation for each of its six members, failed to assuage political elites’ fears of losing influence over the sector. In April 2014, the government set up a ministerial committee to advise the government on how to proceed with the oil and gas sector, hence duplicating the role of the LPA. If the committee’s work is to ensure that the LPA is performing well, one wonders why they have only managed to meet twice and have kept the process closed to the public, thereby raising more concerns as opposed to easing public fears of corruption.

Furthermore, the problem does not rest only with the executive body. The illegitimate parliament has also failed to play its role in asking the government where it stands on the development of the sector. In fact, some MPs have shown they have little interest in and knowledge about the sector. This is worrisome as they ought to play a major role in establishing the sector and ensuring that it will be properly managed.

A change in structure

Some have argued that the sector will remain paralyzed in the absence of a president and a new government. Unfortunately, this thinking is flawed. The formation of a new government and swearing in of a president will only give a semblance of normalcy in a country where such a state of affairs generally leads to collusion among the political elite at the expense of citizens’ welfare.

[pullquote]Some MPs have shown they have little interest in and knowledge about the sector[/pullquote]

What Lebanon needs is a different governing structure where state institutions are actually functioning, transparent, inclusive, and accountable. The challenge we face is beyond the LPA. We need a responsible government that is able to put a petroleum policy in place and put it up to debate among the wider public. We need it to actually address the two decrees that are collecting dust. Equally important, we need it to launch a broad consultative process to reach a consensus on how to manage our natural resources. We need a parliament that cares to ask the executive body where it stands and why progress in the sector has been delayed. We need oversight agencies to be equipped to deal with a very complex sector that involves international oil companies, whose resources and capabilities can overwhelm the country’s institutions. We need a judiciary prepared to properly enforce contracts that include service companies as well. We need the LPA to institutionalize the consultation process with the wider public as well as make public its decisions that are relayed to the government.

In the meantime, the Lebanese Center for Policy Studies, as a think tank and part of the civil society community, needs to be ready to engage in the process, inform the public, and monitor the government. We, along with other civil society organisations, must create enough pressure to ensure that the government is held accountable, that the bidding process is transparent, and that contracts are sufficiently disclosed.

The fall in oil prices by half, which makes deep water extraction less profitable, may provide Lebanon with a chance to postpone the development of the sector and reconsider its governing structure. The big question is: Will the political elite have the wisdom to restructure institutions so they become more effective or will they keep undermining institutions so the elite can try to benefit from the mess they are creating? If the latter is more likely than the former, then we must be very aware of the dangers that face us and ready to face the oil tsunami that could very well bury us all.

Earlier this year, for-profit Contra International faced a problem with a decidedly not profitable recycling initiative it operates in Lebanon. The company was doing a residential door-to-door pick up of paper, cardboard, aluminum and all types of plastics, losing money in the process. Residential pickups were not in the company’s plans when it started its initiative, Zero Waste Act, in 2011. Salim Barakat explains that, based on opinion surveys Contra conducted, the company started its recycling work in schools as it found that older Lebanese were unwilling to sort their trash at home. The idea was to “focus on the new generation.” It worked well, he says. Kids soon began pestering their parents to sort at home, and those parents brought the idea to work with them, so Contra’s first pick up expansion was to offices. Home pick up followed later, and Contra was collecting free of charge. In May, that changed.

Barakat says that residential clients were calling to have their recyclables picked up when 60-liter capacity garbage bags began overflowing. People wanted to remove what appeared to be massive amounts of waste from their homes. In reality, Barakat explains, that 60-liter bag only actually amounts to a kilogram or two of plastic – which Zero Waste Act then sells on to local industry by the ton – meaning the “valuable” recyclables being picked up don’t cover the cost of retrieving them. He says in four years of collecting, Zero Waste Acts’s revenues from selling recyclables have yet to cover the initiative’s operational expenses. In May, he says, Zero Waste Act began charging a fee for at-home pick up. Barakat says the company was picking up recyclables from more than 800 homes before imposing a fee. The number plummeted afterward. Two months later – after the Naameh landfill was closed and Lebanon plunged into its smelliest crisis yet – he says his phone does not stop ringing as he shows Executive a four-centimeter-thick stack of new Zero Waste Act member applications.

Waste ideology

Bassam Sabbagh, the Ministry of Environment’s solid waste expert, does not believe Lebanese people will sort their trash at home. The ministry has ignored the magazine’s interview requests in the past two months, but in previous conversations, Sabbagh has correctly noted that not even Californian residents sort at source 100 percent, from which he concludes Lebanon is a hopeless case, despite evidence to the contrary supplied by Zero Waste Act and several NGOs with recycling programs. That said, recycling is not a cash cow. Barakat notes that prices paid for some recyclables – particularly plastic and aluminum – are volatile. He admits that, in the past, Zero Waste Act would store these materials in a warehouse to wait for prices to rebound.

Arcenciel, another NGO that has been recycling also since 2011, is also not making money from the operation. “Currently, the revenues we make from selling recyclables,” says Arcenciel’s Olivia Maamari, “do not cover the costs of the services we provide.” The limited economic value of recyclables was a lesson learned in Saida as well. When IBC – a private company with Lebanese and Saudi partners – wanted to build a waste treatment plant in the coastal city, CEO Nabil Zantout tells Executive that initially, the idea was not to charge municipalities for bringing their waste there as profit would come from selling recyclables. Zantout says reality soon set in, and the plant now charges $95 per ton to receive trash.

The known unknown

There is an informal recycling sector in Lebanon as well, but Executive has not found any research on the contribution of scavengers to recycling in the country. Zantout explains that IBC loses some potential revenue to this gray market, but he views it as minimal. Some municipalities have even banned scavengers (Executive saw a sign announcing such a ban in Kfar Aabida, south of Batroun). What their existence indicates, however, is a local market for recyclable materials, even if the size of that market is difficult to estimate. Everyone Executive interviewed for this article says they sell recyclables locally. It is unclear how elastic demand is, but the answer to that question may present itself if and when municipalities start ramping up their own recycling efforts – as envisioned in the latest national waste management plan. What is clear, however, is that recycling will not completely fund municipalities’ trash schemes. An expert who helped write Agriculture Minister Akram Chehayeb’s waste plan notes that recycling revenues are unlikely to cover more than “15 to 20 percent” of municipal garbage bills.

The waste management crisis has been a good awareness campaign for recycling. In the past two months, there have been numerous reports of municipalities demanding residents sort their waste at home. Zero Waste Act — a private-sector recycling initiative reports a deluge of interest from people who want to divert some of their trash from open dumps and parking lots. Ditto Arcenciel, an NGO with a recycling program. Both are also working more with municipalities since the crisis erupted. This is encouraging, but let us not be fooled. Well-intentioned interest will not be enough to get recycling going. To be an effective part of our future waste management, recycling needs an entire infrastructure and the number of local governments and individual people recycling must grow substantially.

The national waste management plan Lebanon may soon begin implementing envisions training municipalities on modern trash treatment practices and giving them funds to implement new projects. They will need legal tools as well. Lebanon does not have a single law for trash, so municipalities will be limited in how they can incentivize behavior change and punish non recyclers. Parliament must take any law it approves seriously, unlike the way littering was treated in the new traffic law. While the legislation banned throwing rubbish from a moving vehicle, it did not punish violators with points on their licenses. If people have not yet learned that their trash is their responsibility, we must have rules in place to force that lesson on them.

The private sector has a role to play too. Local industry buys recyclable materials. The Association of Lebanese Industrialists should do a demand survey and publish the results so the markets for various recyclable materials are clear. Sorting garbage is one thing, selling it is something else. The association and the Ministry of Industry should also encourage more manufacturers to see waste as an economic resource. Workshops would be one way to raise awareness.

Finally, we must all accept the challenge of properly managing waste. The first task municipalities have under the new national waste management plan is joining together to create service areas. This will require coordination and cooperation. Petty disputes must not derail this plan. Next, municipalities must find locations for waste management facilities. For this, we all must be willing to sacrifice. Each one of us must be willing to have a modern waste treatment facility in our backyard. If not, we’ll end up with more open, burning dumps.

It was the waste crisis that ignited the protests around the Lebanese Parliament, across Downtown, on the doorsteps of numerous ministries and on highways and sites around the country. On different occasions, such as August 22 and September 20, protests flared into massive demonstrations. On many other days, protest activities were small manifestations of discontent on a street here or in a town square there. All the while, backdoor planning sessions and meetings have been taking place among protest stakeholders from several civil society groups that comprise a new “protest movement” that for many is an embodiment of hope for changing Lebanon for the better.

In speaking with five of the movement’s groups, Executive encountered an array of activists and took note of several facts. Participants are spirited and united when viewed from afar, but up close cracks and dissonances appear. Groups that drive the movement have yet to institute organizational structures and codes of conduct. Opinions which members of the protest movement convey to Executive are generally strong but some are somewhat underdeveloped when it comes to assessing issues such as the role of the private sector. As of today, the movement brims with good intentions that are seeded with the power of constructive rebelliousness and will for change – which is great. But the ambition to force fundamental change is, by universal human experience, highly combustible.

Can this movement build a sustainable system? This skeptical question obviously begs for an emphatic “no” as answer – but it is an irrelevant question. The true question in the view of Executive editors is, what has the movement already proven? The answer to that is simple and compelling. The movement has proven that the Lebanese will not tolerate the country’s dysfunctional system. Not any longer.

This is dangerous for those people whose welfare depends on the Lebanese status quo. Luckily for Lebanon, these people are but a few – the holders of secto-political ancien regime outposts and their cronies who form less than “one percent” of the population. All the others – the entrepreneurial private sector, the public servants, the retirees, the young and everyone whose economic contributions keep the country alive – have much to lose under a continued status quo. How much? That is innumerable. Think erosion of property rights and economic opportunities but also loss of fundamentals for a modern civilization such as a sound environment, electricity, water, and now health due to the risks of garbage-born epidemics.

Lebanon is in danger because of a system that has grown more dysfunctional with each year for at least a decade and that has been surviving because its beneficiaries could exploit unnatural social dichotomies and economic dependencies. For example, some regions in the south and north of the country have deliberately been denied their rights for development to maintain a poverty hierarchy.

What is needed is a complex development of responsibilities and institutions that must start with a simple premise. We the people must accept that the Lebanese social contract with the state is broken and has to be rewritten.

Why rewrite a social contract?

In the period after the civil war, the social contract was ruled by the Taif Accord that facilitated a return to national order. According to scholar Hassan Krayem, the agreement “tackled many essential points pertaining to the structure of the political system and to the sovereignty of the Lebanese state.” But, as Krayem wrote in 1997, the system established under the Taif Accord failed “to establish a clear and relatively stable formula to rule, govern, and exercise authority” and left the country in unfulfilled need to transcend sectarian identities and “establish a clear conception of the national identity”.

In the context of addressing the ongoing problem of Lebanon’s dysfunctional system of governance, we can identify two salient points from the National Pact and Taif Accord. The first is the observation that the National Pact was produced by a few for the many. As another scholar Farid Khazen wrote in 1991, “this informal agreement was neither restricted to Lebanese parties, nor was it a national one. Rather, it was an arrangement involving Lebanese politicians (mostly Maronite and Sunni), Arab leaders (mainly Syrians and Egyptians), and western powers (the French and the British in particular).” Taif, as Krayem states, “constituted a compromise among the Lebanese deputies, political groups and parties, militias and leaders”. Neither contract was “written by” the Lebanese people.

The second point is that both agreements were smart and fairly workable expressions of “Realpolitik”, and addressed immediate and practical concerns of coexistence. However, neither agreement qualified as a nation building tool. The system governed by the objective of balancing communal interests has served its purpose of maintaining stability, but it has aged to the point of not reflecting the needs of the people who it was designed to serve and protect. In recent years, it has increasingly served the needs of minute, self-styled elites. Twenty years after it was written, Krayem’s final statements seem more relevant than ever: the implementation of systemic reform and creation of a stable modern Lebanese state “needs perhaps the existence of a different vision, different political forces, a different notion of politics, and a new generation.”

The right generation

As evidenced by the protest movement of this summer, the new generation is finally in town and it aspires to its rights. When compared to Lebanon’s previous generations, namely those from the civil war and prior to 1975, the under 30s of today have the advantages of a broader education, fewer experiences of violent external disruptions, and benefit from the millennial tech troika of computing power, connectivity and social networks. What’s more, they are acting in an environment that is ripe for change.

Certainly, not everyone today feels the need to craft a new social contract for Lebanon. However, the vast majority has been waking up to the daily realities of their increasing powerlessness in terms of both political and electrical power, water shortages, inundation with waste and not enough money to get children to college, let alone through it.

These failures of the Lebanese state and of traditional power figures have caused desperation which in turn has destroyed a lot of vertical trust and horizontal social capital. Viewed positively, this is a fertilizer for change. Thus, based on the impulse provided by the protest movement and with buy-in from the important stakeholders – academic, economic, civil societal and even genuine reform-willing political and traditional change makers – the rewriting of our social contract becomes a real possibility.

Although a contract evokes the image of pen and paper, this is seldom the case save for a few declarations made throughout history. The “writing” of a new social contract is a multi-tiered enterprise and done through mutual cooperation. From the perspective of Executive, this would involve mobilizing every available human resource and embarking immediately on an array of projects, of which we emphasize three for starters.

As a polity, Lebanon needs the rule of law and the guarantee of constitutional rights. At the present time, this requires rectifying the disastrous failure of the electoral and representation systems, beginning with the definition of a clear electoral law and implementation of the constitutional mandate to abolish political confessionalism.

As a body social and economic, the Lebanese cannot dispense of knowing who they are, how they live and what they are capable of producing. This requires a complete and detailed census of relevant demographic, social and economic data. Public and private establishments, and all citizens, must have access to comprehensive social and economic information to optimize their ability to plan and perform.

As a community, Lebanon needs to preserve the resources of its historic diversity and at the same time develop its inclusiveness. In regard to the multiple infrastructure emergencies that the country is facing, and especially the waste management crisis, this means that the protest movement and private sector should collaborate with vigor and intensity to produce workable solutions.

The social contract between the state and the people is broken. It had been crumbling for a long time. We’re reminded of the state’s failures every month when we pay two electricity bills and every summer when we pay two water bills. For decades we’ve made concession after concession, the worst being acceptance of the Taif Accord. Beaten down by years of death and destruction, we were so fed up we actually pardoned our warlords and allowed them to become princes in a kingdom of corruption. The system these pardoned criminals oversee will take years to rid of its filth – much like the open garbage dumps our lawbreakers are directly responsible for.

In spite of the many barriers to our competitiveness, Lebanon still has a reputation of being resilient. A phoenix rising from the ashes. This is true only because of our entrepreneurial spirit and the determination of private enterprise. Our social safety net is woven of remittances from our successful sons and daughters abroad. It was not strategically designed by policy makers. For decades now the private sector has held this country together by providing people livelihoods and – all too often – access to basic services. With the region in turmoil and regardless of our central bank’s best efforts our economy is crashing. We’ve finally reached a breaking point. This country is becoming unlivable. We need change, and it must be centered on the rule of law.

As we note in a special report this month, the threat of potential oil and gas revenues being stolen or mismanaged is real and only ironclad legislation can protect them. Building this industry from scratch with the right laws in place will be an instructive exercise. We need to rebuild the entire Lebanese system to make sure citizens’ rights are protected. A properly functioning legal system must be this country’s backbone. Without the confidence that rights, property and investment are protected, there is no moving forward.

There’s a joke from the classic cult film Pulp Fiction: “Three tomatoes are walking down the street – a papa tomato, a mama tomato, and a little baby tomato. Baby tomato starts lagging behind. Papa tomato gets angry, goes back to the baby tomato, and squishes him…and says, ketchup.”

It’s the champion of condiments, and Dolly’s ketchup evokes nostalgic memories among some Lebanese. Through casual conversations with Executive, they talked of blissful summers past eating hotdogs and homestyle french fries drenched in ketchup piled high atop a red checkered picnic table on a sunny, cloud-free day near the coast. These are wistful Americana summers to remember.

Ketchup does not easily mix with traditional Lebanese cuisine. It is a rare sight to find a bottle of that fine red sauce served with mezze, unless there are also french fries on the table. So it is not wrong to perceive ketchup as uniquely American (even though it isn’t) and boy do the Lebanese seem to love all products red, white and blue.

Dolly’s ketchup too, according to the company’s regional brand manager Saaddine Abou Merhi, is perceived as an American brand. “There is no perception of the brand as a Lebanese one – it’s an American brand with a Lebanese taste. Most of our new customers think Dolly’s is American more than it is Lebanese – because of the name.”

It wasn’t exactly the image the company’s founders were going for but the brand does have strong ties that foster this American perception. For one, Dolly’s ketchup is registered as a trademark in the United States. Moreover, to achieve the desired taste its main ingredient – fresh tomatoes – are an American product. “To get the exact taste we have to import from California and work with a specific farm to source the tomatoes.” Abou Merhi also says Californian tomatoes provide a consistency in quality that defines their ketchup’s texture. Other ingredients such as salt and vinegar are also imported, with water being the only ingredient sourced locally. The taste of Dolly’s ketchup, Abou Merhi suggests, is preferred because of the high level of sweetness, with the precise formula being a closely guarded secret known only to a precious few.

Widriss Holding – the group owning Dolly’s and other local brands, like Idriss Supermarket and Conserves Modernes Chtaura, a cannery – is 80 years old and Dolly’s is nearly 42. Dolly’s started as a ketchup company and has evolved into a condiment brand producing mayonnaise, mustard, pizza and spaghetti sauces, as well as canned corn and canned mushrooms.

Their flagship product remains ketchup, which Abou Merhi says leads the brand’s sales by volume. Mayonnaise leads in sales when measured by value. “Ketchup is the backbone of the company. Mayonnaise is more profitable for the business – it’s mainly oil with egg yolk – but when the prices of oil fluctuate there can be a shift. And there are only two brands in the market that [dominate] in mayonnaise, Dolly’s and Lessieur.” Profit margins tend to be more robust due to the company’s share of the mayonnaise market.

The ketchup market, he says, is more diverse and Dolly’s must compete with Libby’s and Xtra, both owned by Interbrand, Heinz, and producers like Yamama and Maxim’s that have a smaller share of the ketchup market. It is a saturated market, he says, and profit margins for ketchup are driven through bulk sales. To this end, Dolly’s can rely in part on its sister company, Idriss Supermarket, to sell ketchup. The company also has agreements with a number of restaurants to exclusively serve Dolly’s condiments, though Abou Merhi did not give specifics.

Dolly’s, as well as many of the brand’s competitors, passed through a difficult period during Lebanon’s civil war. The war split the country – barriers and checkpoints were erected and no-go zones physically inhibited Dolly’s distribution to areas like the Metn and Keserwan, Abou Merhi explains. De facto distribution monopolies were established, the extent of which can be seen to this day. “Brands established themselves as per the war zones. We have distribution in those areas now, but people prefer their brand because it became like second nature to grab it from the shelf. For us it’s the same – if you go to the south, it’s all Dolly’s, there’s no competition there.”

Syria’s civil war has drastically reduced Dolly’s operations inside Syria. “We had a partner producing Dolly’s brand products and selling them within Syria.” Abou Merhi admits that the Syrian factory now has very minimal production with output at only a fraction of what was produced before the war began. “The factory is there and the machinery is there. If there is a market they will produce more – [but because of the war] the market is now limited to 5 percent. The problem is they cannot sell to Aleppo, Homs, anywhere except for parts of Damascus.”

Syria’s upheaval has also rendered all land transit routes through the country to nearby foreign markets, like Jordan, unusable. “We used Syria as a transit route and what’s happening there has really affected us. We used to ship two trucks per month to Jordan costing some $800 from Beirut to Amman – taking maybe one day. By ship it takes around 12 days and costs maybe 15 percent more.” Abou Merhi also says containers sent by truck have more capacity – they’re 26 feet in length compared to sea containers that are only 20. “You can ship a truck for less cost with more goods, so the cost per product unit was less,” he explains. On top of that he says the market in Jordan has been negatively affected by the region’s instability. “They like ketchup in Jordan but what’s happening in Syria affects the whole region,” and is lowering demand in neighboring countries.

Exporting to Gulf countries, meanwhile, remains a challenge for Dolly’s. “We used to have a presence in Saudi Arabia and the UAE, but now cannot compete in those markets with local producers that receive support from their own governments,” Abou Merhi says, pointing out that production of ketchup in the kingdom is $2 less per box of 24 bottles than Dolly’s.

This disparity he says is derived primarily from the high cost of shipping from Lebanon. Sending a full container by truck from the Dolly’s factory, located in Choueifat, to the Beirut port can cost up to $300. For factories further away from the port, like Dolly’s sister company Conserves Modernes Chtaura, internal shipping can reach as high as $700 per container. Once at the port, Abou Merhi says, additional shipping expenses are incurred. Moving the container from the trucks onto the ships incurs an additional expense of $500. The resulting cost of exporting by sea ranks Lebanon amongst the most expensive in the world, according to Abou Merhi.

As a whole, Abou Merhi says that Dolly’s exports more ketchup both by volume and value than it sells in the Lebanese market, and he says sales in the West African market – Nigeria, Togo, and Mali, to name a few – are strong. With no end in sight for Syria’s civil war and an impotent Lebanese government, the brand will continue to look to the African market as a driver of potential new business.

Private equity investment in the GCC appears to be experiencing a “rebirth”. This is a very positive development as it may be paving the way for less oil dependency and an innovative business environment. The private equity industry in the GCC has had a shorter life cycle than other markets and has faced alternating fortunes since its inception in the 1990s. According to data by the Emerging Markets Private Equity Association, funds had raised more than $6.2 billion in the Middle East and North Africa region, but the advent of the financial market crisis caused an earthquake of such magnitude that the prevalent view of some experts was that GCC private equity would never fully recover.

Arguably, that was the end of one cycle and the beginning of a new mature one. Evidencing this, private equity fundraising in MENA reached roughly $1.1 billion in 2014 according to the EMPEA Special Report on Private Equity in the Middle East and Africa, published in April 2015. The mood has clearly shifted. Opportunities are emerging and dynamism and growth are recurrent themes which may lay a brighter future for the region as a whole. As Shailesh Dash, CEO of Al Masah Capital Limited stated in the EMPEA report, it is now a “matter of timing the wave”.

A transformed market

The next question posed is what has caused this change in perspective? The external factors remain difficult and the wars in Syria, Iraq and Yemen have not and cannot disappear overnight. However, the region as a whole has reached a new level of maturity somehow, aided by the constant turmoil that fortunately has been restricted to confined areas. Politically there is a drive towards regional integration. Significantly, the International Monetary Fund expects the region to be one of the world’s fastest growing in the years 2015 – 17, anticipating in the 2014 World Economic Outlook that its GDP will expand at an annual average of 4.1 percent. Investors that were looking skeptically at this part of the world have undergone a transformation in outlook as a result of multiple factors. The main theme revolves around a maturing market, strong fundamentals combined with in-depth “generational changes” all across the Middle East.

An important player in the market has confirmed to me that in the past it was very uncommon to agree to sell part of ownership for financing. It was seen as a taboo and associated with failure. The new generation does not regard the selling of ownership for expansion purposes as detrimental. This is seen as a positive change in mentality.

Currently, the focus of businesses is regional expansion and the building of scales, which as a result open up opportunities for private equity. Also, one of the effects of the financial crisis was the eradication of the smaller private equity businesses. Evolutionary theory worked its magic and those that survived are very well equipped to navigate in the current environment. Overall, there is greater expertise and maturity and the operational infrastructure has also been strengthened. There is also greater diversification and there are more established businesses that require expansion capital and management inputs.

The up factors

The International Monetary Fund has forecast in its 2014 World Economic Outlook that that Middle East and North Africa region will be the third fastest growing region in the next 5 years and data cited by EMPEA indicates that MENA as a bloc constitutes a $3.3 trillion economy. From a demographic angle, the region has a very young population with 162 million people between the ages of 5 and 24 with great consumption power.

In the past, sovereign wealth funds were looking outward for investments but now there are significant investments taking place inwards. Experts are saying that the exit environments for businesses have also been improving gradually as businesses become more structured aided by these inward investments. The drive for regional integration, high incomes and greater trading collaboration amongst Middle Eastern countries is opening opportunities for deals across the GCC markets. These are investors’ dreams and catalysts for yet more investment – none wants to lose a share of the pie at a time when the European debt crisis has shifted the balance of power from the old world to the emerging world.

Short term vulnerabilities

Smaller businesses and owners continue having issues in raising capital and there is a general perception that reaching the next level of corporate growth can be daunting. There are apparent vulnerabilities in the MENA region. The value of the dollar has increased, the price of oil has declined, and US interest rates are likely to increase in 2016 which could weaken the GCC’s economic prospects. Yet, the general view is that these factors are short-term variables that are only likely to frighten the less seasoned investor. It is important to take note of these aspects, but the long-term fundamentals appear solid – there are huge fiscal reserves in the Middle East in addition to strength of consumption. What about oil dependency one might ask? This dependency appears to be decreasing – there is a push for greater economic diversification supported by an increase in trading with Asia and Africa. There is also a strong push in sectors such as real estate, construction and manufacturing, professional services and technology.

Lawyers’ outlook on private equity in the GCC

The legislative outlook for private equity investment appears relatively stable. Investor protection mechanisms and contractual enforceability measures have been consolidated. Parties’ freedom of contract is generally recognized in GCC jurisdictions. The shariah law risks are more prominent in some jurisdictions than others, but strong mitigants can be put in place contractually. Dispute resolution solutions have also been strengthened and the DIFC arbitration centre is now recognized as a leader in its field.

Foreign ownerships restrictions have also been relaxed, although certain GCC countries can be seen as more conservative than others. Saudi Arabia for example has implemented restrictions and protectionism in industries like petroleum, media and transportation services. In the United Arab Emirates limitations to foreign ownership exist on the main UAE territory but the free zones are exempted, which makes the Emirates’ investment environment more flexible.

There is a drive for international standard alignment, transparency and governance. The UAE can possibly be seen as leading the way in this respect. Yet, in most GCC countries the enforcement of contractual rights is not always as predictable as one might wish, specifically in relation to shareholders agreements. This means that greater certainty is required although parties tend to mitigate this risk in most cases by ensuring the contract provides for arbitration provisions.

Future trends

Private equity in the GCC is shifting towards majority buyouts, the creation of value, and well defined exit strategies. The star industries appear to be food and beverages, healthcare technology and education. Some commentators are of the view that business valuations are still not realistically aligned and this needs to happen soon. Another significant development for the region is the renewed accessibility of Iran, which might open the door to even greater opportunities for investors. As Taimoor Labib, the regional head of MENA private equity and the head of global private equity portfolio management at Standard Chartered Bank, says, “The tremendous growth we are set for in private equity investment in MENA over the next few years should act as a source for good, creating values in companies, which will in return reduce unemployment and improve living standards”.