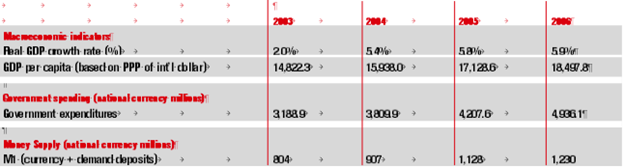

The path of privatization and diversification is the cornerstone of Oman’s economic strategy. From successfully implementing several infrastructure projects, the country is enjoying increased attention from investors and benefiting from high foreign direct investment (FDI) inflows, which, according to Global Investment House, rose from $122.3 million in 2002 to an estimated $705.3 million in 2006.

Increased returns from non-oil activities showed not only the health of the country’s business environment, but also the success of its diversification policy, which began as a hedge against over-dependence on Oman’s natural resource endowments. However, the country’s budget continues to benefit from oil revenues, encouraging public spending, which does not appear to pose a threat to price stability.

Inflation registered smaller than its Gulf neighbors at about 3.2% in 2006. The figure partly reflects “the effects of high growth in the face of capacity constraints, in addition to the sustained influence of imported inflation as a result of the pegged system that the central bank has adopted to the domestic currency,” according Global Investment House.

Inflation is not worrisome

The Gulf trend of imported inflation from currency pegs to the dollar is not unique to Oman, but the government does not seem worried. According to the Oman Daily Observer, Executive President of the Central Bank of Oman Hamoud Sangour al-Zadjali said, “As long as the Omani rial is concerned, there is no plan to change the pegging.”

Leading the drive away from oil dependence is diversification aimed at developing the country’s natural gas reserves. The growth strategy of exporting liquefied natural gas (LNG) and implementation of LNG projects have made the sector the main economic driver with a growth rate of 60.7%, according to Global Investment House.

One LNG plan is by British Petroleum (BP), which successfully bid to develop two large natural gas fields in Central Oman. According to the Oman Daily Observer, BP plans to develop two gas fields in a 2,500 km area close to the existing gas field of Saih Nihayda as part of a government strategy to enhance gas production with the help of multinational firms.

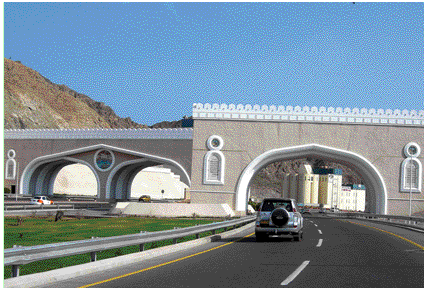

After its gas sector, Oman is witnessing growth in the services sector, which reported a rise of 11.7% in 2006, from 8.5% growth in 2005. Most of the growth in services is led by communication and transport infrastructure growth, which grew by 25.4% in 2006, up from 3.4% in 2005.

oman is witnessing growth in the services

sector, which is reported a rise of 11.7% in 2006

The Sultanate’s banking sector also performed tremendously well. According to Global Investment House, Omani banking sector soundness “was reflected in their strong capital levels, further improvement in asset quality in the face of large expansion in banking assets, and remarkable growth in profits.”

In addition to increased banking performance, Oman’s financial sector remains healthy, despite the downward trend of financial markets in the Gulf. The benchmark Muscat Securities Market (MSM) Index ended 2006 at a yearly gain of 14.5%. MSM’s other figures include a market capitalization in 2006 of $16.19 billion and trading volume growth of 115.9%.

Diversification initiatives

Other diversification plans in the works include the construction of a large sugar refinery at the port of Sohar. According to Oxford Business Group (OBG), Al-Hafri Sugar Refinery signed agreements for constructing a $233 million facility to handle 660,000 tons annually. Al-Hafri’s strategy is aimed at harnessing the strong potential for regional growth, which is estimated at the 5 million tons of sugar gap produced by the shortfall between demand and supply in the Gulf.

Because of Oman’s fiscal health and prospects for industrial sector growth, Standard & Poor’s (S&P) gave Oman a stable rating of “A” on sovereign risk, currency risk, banking sector risk, and economic structure risk.

Research conducted by Jordan Investment Trust also finds Oman in a good situation, noting “Oman is geared up for local and foreign investments after the execution of several infrastructure projects, including the construction of road, water, energy, and communications networks. The economic and political stability the country enjoys and its invest-friendly environment are also value added for investors.”