It is perhaps an index of globalization’s totalizing embrace that foreign policy communities around the world have been chuckling over the same one-liner all year long: The war in Iraq is over and Iran has won. Well, there’s no doubt that the Islamic Republic of Iran’s (IRI) long and assiduous cultivation of Shiite networks in Iraq reaped dividends once Iraq’s former president Saddam Hussein, the IRI’s most serious threat, was deposed from power. But in truth, nearly everyone with an interest in the region has a lot to be thankful for this New Year’s Eve. But given the disappointments, betrayals and miseries that have befallen the Middle East over the last century, it’s not clear that even younger Arabs are capable of seeing events except as a variation on catastrophe. Or, to put it another way, if the Israelis are still around, we must still be living in the shadow of the nakba.

The fact is that this really was one of the most momentous years in the history of the modern Middle East and most of the news for residents of the region was good, very good. The only clear losers were the Syrian and Iraqi Baath parties, the US taxpayer and the liberal interventionist wing of the Republican Party, otherwise known as the “neo-cons.” Iraq itself, which is in many ways now Ground Zero of the Middle East, is too tough to call. Obviously, ordinary Iraqi citizens are paying with their lives because, one, the US cannot provide security in regions that are not already secure; and two, some Iraqis and their jihadi cohorts take great pleasure in killing other Iraqis and will keep trying to do so come hell or high water. And yet, there are elections, there is the struggle to build democratic institutions, like a constitution, and there are the Iraqi people themselves, many of whom disagree with their neighbors that Iraq was better off under Saddam Hussein. So, it’s going to be many years before anyone knows whether Iraq was a winner or loser this year, and it’s going to be Iraqis who make the call.

As for the rest of the region’s major players, Executive braved the ever-capricious winds of Middle Eastern politics to bring you our year-end round up in the hope that things won’t change too much before we go to press.

Lebanon: a winner (triple plus)

In a region where the word “martyr” is perhaps a little worse for wear, the assassination of former prime minister Rafik Hariri set off a chain of events that effectively liberated his country, and set Lebanon back on the democratic course it was derailed from for thirty years of war and occupation. But the undisputed heroes of the revolution are the Lebanese people, all of them, including those who never took to the streets and those who some believe stood on the wrong side of the street. Pluralism is no doubt a harder ideal than national unity, but it is also sterner building material. As for all the post-March 14 disenchantment, much of it is legitimate – for instance, is there no room in Lebanese politics for the youth who led the uprising outside of the student cadres of General Michel Aoun’s Free Patriotic Movement? Still, it’s important to put this remarkable year into context.

Things are changing so quickly; most local skeptics haven’t had the time to figure out what’s going on. Last year the parliament wasted its time ruminating over Arabism and other ideological niceties; this year the country’s elected officials took up real matters, including the economy, election laws and security. It is the latter that has been on the minds of most Lebanese, especially since the wave of violence left many dead in its wake and did serious damage to the vital leisure and tourism sector. But insofar as the purpose of that terrorism was to set the nation at arms again against itself again, it failed and the Lebanese succeeded. The UN Mehlis report has delayed action on several important issues – especially national security and international investment, both of them tied to disarming the Palestinians and Hizbullah. Hizbullah had a middling year. It became part of the government – except apparently for those uncomfortable moments when Damascus insulted the government’s prime minister – and may indeed be transitioning from armed gang to political party. Premier Fouad Seniora has the attention of a concerned international community but lacks the support of a strong Maronite partner. If that sectarian power struggle sounds to many like politics as usual in Lebanon, it’s not, or at least it hasn’t been for thirty years. This is the real thing, and it was earned.

Saudi Arabia and the Gulf: winners

(double plus)

One of the Bush administration’s more reasonable, and less noted goals in invading Iraq was to boost that country’s oil-production, a potential capacity, it was hoped, that would give the United States some leverage with which to pressure their long-time allies in Saudi Arabia. You see, over the last many years, the American taxpayer has dished out many billions of dollars to float the US Navy’s Fifth Fleet, which protects the free flow of Gulf oil, which in turn ensures that the Saud family stays rich, fat and happy – and in power. But in the aftermath of 9/11 it became apparent that many in the Saudi elite believed those same US citizens were infidel scum who deserved to die. So, the White House wondered how it could get their nice friends to stop saying such bad things in Saudi schools, mosques and the media. They hit upon the idea that if only they could get more oil to market maybe that would help bring the Saudis to heel. But of course, that would’ve meant that the US actually had to protect Iraqi pipelines, and in Iraq the US is mostly only capable of defending Baghdad’s Green Zone.

Thus, the Saudis’ position as keystone of the global economy went unchallenged, and the Kingdom had a bumper year as oil surged to a whopping $70 a barrel. The Bush administration effectively declared major operations against Saudi Arabia over when US Vice President Dick Cheney rolled out the red carpet for the royal family’s brand new Lebanon hand. Saad Hariri may turn out to be a very good leader of his country someday, but it was his Gulf friends who got a young businessman with no political credentials or experience an audience in Texas. This is how a superpower tells a petro-monarchy: “We are not worthy, we are not worthy … ” And now all Washington can do is hope that with King Abdullah finally and firmly in charge, he’s serious about taking on his own domestic terrorists and that he won’t do it by letting them blow off steam in Iraq or Manhattan.

Other Gulf states are investing in a future where oil is not king. Construction, leisure and tourism projects have made Qatar the fastest-growing state in the Gulf, or the new Dubai, but that’s just until Sheikh Muhammad bin Rashid al Maktoum finishes Dubailand, or Dubai’s new Dubai, an enormous theme park that once completed will double the size of the existing Emirate. Look for the Gulf to keep thriving.

France: winner (double plus)

What a bonne annee for La France, the year it became relevant again in the Middle East! Without a large economy or formidable military, Paris has had trouble projecting power in the region since it was flushed out of Algeria. Two years ago, the Chirac government made a lot of noise about the US war on Iraq, which may have won it accolades throughout the region but distanced Paris too much from the US to have any impact in it. Then came Syria and Lebanon. For a host of reasons, French President Jacques Chirac was furious with the young Syrian president he’d effectively taken under his wing, and intimated to US President George W. Bush in the summer of 2004, that he had a project they might both profit from. France led the way with UN Resolution 1559 and the US, with troops in neighboring Iraq, served as a goonish enforcer and voila! France was back in the game.

Egypt: winner

A lot of people did well this year in umm ad-dunya: The Muslim Brotherhood surprised even themselves with the large number of seats they gained in parliament, and the ordinary Egyptian voter got a sense of what real political choice might look like, both in the country’s first contested presidential race and then the parliamentary elections. And since it is a law of nature that anytime the people fare ok, the regime loses big, Egyptian President Hosni Mubarak had something of an off-year, which might be expected after 24 other untouchable seasons. Oh sure, the president managed to keep Washington off his back by sending mukhabarat chief Omar Suleiman to consult with the PA on security issues, but at home 88 people died in an attack in Sharm el-Sheikh, and the regime showed little in the way of intelligence by rounding up thousands of Bedouins in response. (Self-help hint to Hosni Bey: It only gets better if you are honest about your issues. Now, say “Al-Qaeda.”) Still, many people, probably the majority of registered voters, really did re-elect Mubarak for a fifth term and would have done so even without his aggressive TV commercials. But all those slickly produced music videos were meant for Western audiences anyway, and the campaign wasn’t really about the Pharaoh but his son Gamal, a Western-educated, reform-minded man of the future. Sound familiar?

Jordan: winner

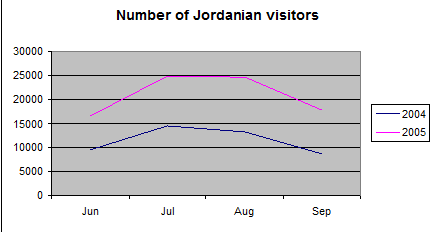

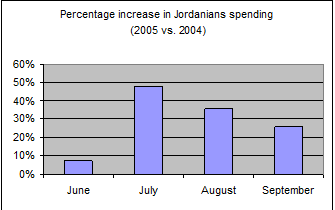

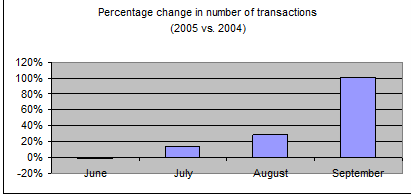

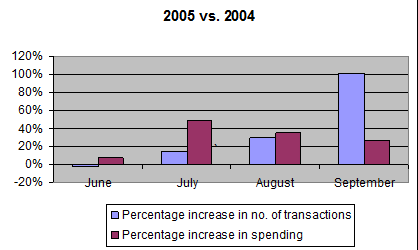

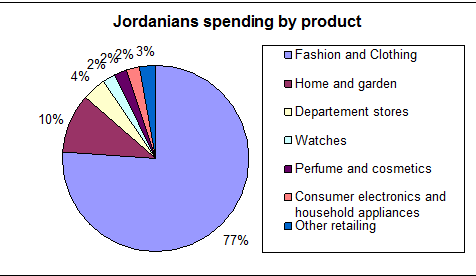

The Hashemites have enjoyed a tremendous financial boom since the onset of the US occupation of Iraq as real estate prices alone have surged some 30% over the last year. Most of that financing has come from money that left Iraq after the fall of Saddam, a trail that will be more closely watched now after 57 people, mostly Jordanians and Palestinians, died in an attack on three hotels engineered by Iraqi colleagues of Abu Musab al-Zarqawi. King Abdullah II replaced his reform-minded prime minister with a former security chief and the diwan’s new mantra is, “political reform plus security,” which means no reform and no matter how much money you bring to town, you’re going to pay dearly if you mess with Jordanian security.

Iran: winner

Compared to the other players in the region, Iran didn’t do as well as many observers suggest. Yes, it consolidated its influence in Iraq, and like the Gulf states it profited greatly from high oil costs. Also, it has managed so far to run circles around the EU 3 (England, France and Germany) that has been “negotiating” with the IRI over its nuclear program. But those talks have taken a few strange turns over the last year, especially after the election of Iran’s tone-deaf new president. Until President Mahmoud Ahmadinejad advocated the destruction of the US and Israel, even the hawks at the Pentagon had no real military option for Iran. Presumably, that is no longer the case, since American officials started to take “death to America” sloganeering pretty seriously after 9/11. And Ahmadinejad’s re-structuring of his foreign service to better suit Iran’s apparent new policy direction has also put a number of Western officials on edge. So the Iranian issue, relegated to the backstage for the last three years, has now moved to front and center and the curtain is rising. In the next few years look for Iran well south of here on the scorecard.

Israel: Winner

It goes without saying that Israel always stands to gain when Arabs lose – but what about when Arabs lose their illusions? If you’ve missed the news from Iraq, Mr. Zarqawi has put paid to the notion of one glorious Arab nation ranged against the outsider. He’s killing Arabs, mostly from a rather largish Muslim sect known as Shiites. As it turns out then, the Middle East is made up of lots of groups, many of whom, especially the smaller communities, will make alliances with others to advance and protect their interests and their lives. In this context, the Zionist imperialist warmongers to the south look less like outsiders and more like a regional minority that’s done well for itself – like Iraq’s Shiites and Kurds. Wow, those Jews win even when Arabs do too!

Ariel Sharon: winner

The Gaza withdrawal earned him international acclaim, including thawing relations with a number of Muslim and Arab states, like Pakistan, Qatar and the UAE. Now Sharon has left Likud to start his own party, Kadima, or Forward. In the last two elections, it was Arabs who elected the prime minister, but it’s unlikely the PA, Hamas, Islamic Jihad or Hizbullah, will have a very large say this time. Sharon has provided Israelis with plenty of security and even if he wanted to withdraw from the West Bank, and he doesn’t, there is no political will in any of the country to do so.

Palestinians: winner

The Gaza Strip isn’t much, but it’s a place to start – and more to the point, it’s a place where more than half a century’s worth of previous Palestinian leadership has been managed. And now President Mahmoud Abbas is busy trying to cobble together meaningful political institutions while tackling corruption and crime, noble and daunting tasks for any democratically elected leader. He’s got a lot of help from the international community and everyone’s rooting for him – except for his political rival, Hamas. Understandably, Abu Mazen doesn’t want to touch off a civil war, especially one he might not win, but without monopolizing legitimate violence, there will never be a sovereign Palestinian state, not because the US, Israel or the EU won’t allow it, but simply because it won’t be a state. Maybe he is waiting to see how the Seniora government takes away Hizbullah’s arms and gets them fully into the political process.

Syria: loser

Insofar as the goal of any regime is to ensure its continued existence, Syria didn’t do all that bad for an international pariah state. And just when we thought we’d seen the last of Baath party comedy as former Iraqi minister of information Muhammad Said al-Sahaf ran for the hills when US tanks he said didn’t exist were closing in, the Syrians roll out their own investigation into the Hariri assassination. What’s really a gas is that Damascus’ Westernized leader evidently thinks that a German judge goes about his business like a Syrian one. “Yeah, that’s the ticket – Mehlis built his whole case on Hosam Hosam and now he’s got nothing, nothing I tell you! Ha!” It would be really funny if there weren’t so many lives at stake, not that Syria cares as it’s been throwing its insults at its neighbors for several decades now just to keep its own hindquarters dry. Everyone else in the region is furious with the regime, but few wish its demise. Cairo, Riyadh, Amman cannot bear the idea of the Bush administration feeling its oats – What, us next? So, who knows if the family in Damascus will survive, but in the future, God-willing, Syrian high-school students will be hard pressed to believe that at one time their country was run by vicious, buffoonish adolescents.

The US taxpayer: loser

It is a tribute to Middle Eastern hospitality that so many in the region are eager to distinguish between the American people and the policies of their government. Nonetheless, it is useful to remember that government by and for the people means that Americans are their government and are thus endowed with the right to hire and fire their leaders. It’s actually a really good thing, even when voters re-elect a president for a second term, as they did the current inhabitant of the White House. Of course, the many billion dollars the US has spent to give Iraqis a chance to elect their own leaders, is a much smaller percentage of what WW II took out of the US economy, and the military casualties aren’t even as high as civilian deaths on 9/11. But as domestic support for Iraq is waning, the Bush administration has yet to disclose any real new strategy except: Stay the course! Ok, but for how long and what’s the price, in lives and dollars? The real problem is that the one workable solution that doesn’t entail vacating Iraq would demand not less but more from American taxpayers, like higher tariffs, especially on fossil fuels, and most likely a draft to fill the ranks of a military that was not trained for a mission it nonetheless mostly believes in: bringing democracy to Iraq.

The neo-cons: losers

Misunderstood and largely unloved by both those who do and do not understand them, the neo-conservatives are a boutique school of American policymakers, politicians, journalists and intellectuals who have very little in common except their shared belief that US policy in the Middle East over the last 60 years was in error. Given that the attacks on the World Trade Center left thousands of civilians dead in a major US city, they have a point. Once the administration found no WMD in Iraq, the neo-cons were pressed into service – now, the US was in the Middle East to import democracy. As farfetched as that thesis may sound to some, and as mendacious as it may sound to others, without it much of what transpired in the region this year wouldn’t have happened without that idea. For instance, there is a very powerful current in US policymaking circles that still argues that the US needs Syrian help and if that means giving Bashar al-Assad a free hand in Lebanon so be it. The neo-cons won that fight and some others, too. Still, it’s sheer fantasy to imagine that a group of academics and journalists ran the government of the United States while CEO millionaires like George W. Bush, Dick Cheney and Donald Rumsfeld looked on helplessly. No, the neo-cons deserve some credit and as they are not that powerful they’ll take a lot of blame, some if it in Iraq perhaps.