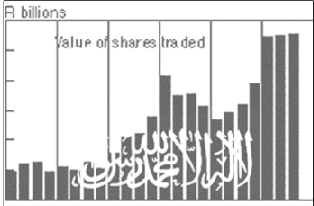

largely thanks to the legacy of the elder Assad, Syria has very limited opportunities for private investment and the vast majority of interests are publicly owned. The absence of a stock exchange means that many larger Syrian investors often choose real estate as an investment destination—which partly explains why real estate is disproportionately expensive in Damascus compared to most other commodities.

Despite the fact that Syria is generally considered to be a poor economy, there are a large number of wealthy expatriates, many of who fled after or during the Baathist revolution. According to one estimate, expatriate Syrian wealth is thought to be larger than that of the Lebanese and, one source says, reaches over $70 billion. There is, therefore, significant potential for greater private investment both from inside and outside the country. This helps to explain why the recent IPOs in Syria have been so hugely oversubscribed by Syrian nationals.

In the late 1980s and early 1990s, when Hafez al-Assad was still in power, a number of IPOs were attempted, but failed, as they did not generate sufficient investor interest. This discouraged other public/private companies from opening their equity for a number of years until 2003, when the government’s re-licensing of privately-owned banks (under a 2001 law) signaled a new era of IPOs, as reformist elements in the new Assad regime began to introduce a gradual economic liberalization plan.

In March 2006, with a view towards establishing a stock exchange in Damascus, the government created the Syrian Securities and Exchange Commission (SSEC). Syrian companies now wishing to open their capital to the market have to apply through the SSEC, which will ensure the company satisfies requirements in terms of its finances, credit history, prospects and valuation. This is a very new process, however, and as yet there are no case studies to judge by.

With the establishment of this commission, which is considered to be professionally-staffed and foreign-aided, analysts in Syria expect to see many more IPOs in Syria—or rather many more companies wishing to broaden their ownership base and open their capital. The stock exchange is expected to open in late 2007, although delays would not be surprising.

With the arrival of the SSEC, the likelihood of another Daaboul-style mishap has been reduced, although it should be remembered that both private and public sector companies in Syria are financially opaque, have an untraceable credit history and are not experienced in sophisticated styles of corporate governance. They also tend to be family-owned.

Furthermore, those companies which have opened their capital are generally high-profile companies with excellent prospects (banks and a mobile phone company). Whether other types of companies could have as successful IPOs is as yet untested, although there is undoubtedly a great deal of private investment potential given the 40-year absence of opportunities.

Banking IPOs in Syria

International Bank of Trade and Finance (IBTF)

This was the first IPO of the new wave and, as such, was seen as a landmark transaction. IBTF, the first of the privately-owned banks to open after the legislation of 2001 made them possible, ran the IPO in October 2003 and opened $14.7 million of its capital—the first time a bank made an open equity offer in Syria. It was open to Syrian nationals only and totalled 49% of its capital, with a 5% limit per investor. The majority shareholder (49%) is Jordan’s Housing Bank for Trade and Finance.

Arab Bank Syria

Arab Bank, a subsidiary of the Arab Bank Group of Jordan, was established in Syria in January 2005 with a capital of $30 million. It offered 24.3% to Syrian investors.

Bank Audi Syria

Audi’s IPO took place in 2005 and was hugely oversubscribed—it attracted subscriptions of over $115 million compared to needs of only $11.7 million. This represented 25% of the bank’s capital and it was open only to Syrian investors.

Byblos Bank Syria

The Byblos IPO took place in July 2006 and represented $6.7 million or 15% of the bank’s capital. The bank began full operations in August 2006, although it had been licensed some time before this.

Bank of Syria and Overseas (BSOM)

Blom Bank has a 35% stake in BSOM, the IFC has a 10% stake, 13% is held by Syrian businessmen and the rest was opened as an IPO in 2004.

Banque Bemo Saudi Fransi (BBSF)

BEMO bank and larger Syrian investors have the majority shares in BBSF, with the third party being Bank Al Saudi Al Fransi of Saudi Arabia. 48% of the bank’s equity was sold as an IPO to Syrian nationals in October 2003.

Syria Gulf Bank

A joint venture between Syrian and Gulf investors (the bank is part of the giant Kuwait-based KIPCO group). The IPO took place between Sept. 4-21, 2006, and was 250% oversubscribed. It raised $7.8 million, or 26% of the total capital. It was sold to Syrian nationals within Syria itself and also in the Gulf, where there are a large number of wealthy Syrian expatriates.

Al-Sham Islamic Bank

This was the first Islamic bank to launch an IPO in Syria. The IPO took place between Nov. 18 and Dec. 8, 2006, and was oversubscribed. There is rising interest in Islamic finance in Syria, as very little Islamic banking or finance is currently available.